- Product

- Solution for

For Your Industry

- Plans & Pricing

- About us

- Resources

For Your Industry

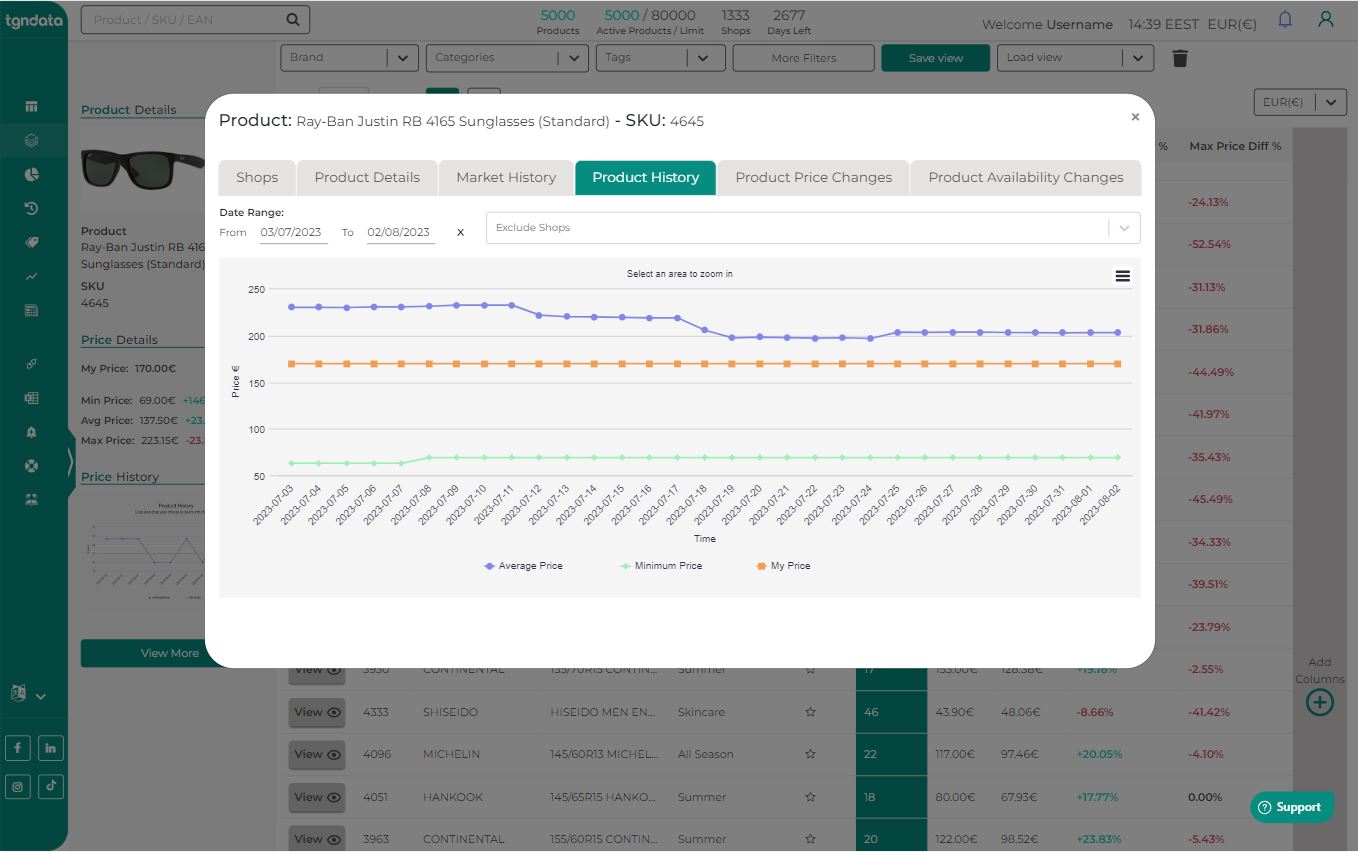

Historical pricing data is a treasure trove of information that can be used to make informed business decisions. By analyzing past price trends, businesses can gain valuable insights into market dynamics, consumer behavior, and competitive landscapes.

Example 1: Seasonal Pricing for a Retail Store

A clothing retailer analyzes historical sales data to identify seasonal trends in demand for specific products. They discover that sales of winter coats peak in November and December, while summer dresses sell best in June and July. Based on this analysis, the retailer can adjust their pricing strategy to offer discounts on seasonal items during off-peak periods and increase prices during peak seasons.

Example 2: Competitive Pricing in the Airline Industry

An airline uses historical pricing data to monitor the pricing strategies of its competitors. By analyzing competitors’ fares for similar routes, the airline can adjust its own prices to remain competitive. For example, if a competitor lowers fares for a particular route, the airline may need to match or undercut that price to attract customers.

Example 3: Dynamic Pricing for a Ride-Sharing Service

A ride-sharing company uses historical pricing data to implement dynamic pricing. By analyzing factors such as time of day, location, and demand, the company can adjust fares in real-time to optimize revenue. For example, during peak hours or in areas with high demand, the company may increase fares to balance supply and demand.

Example 4: Product Lifecycle Pricing

A technology company analyzes historical pricing data to understand the product lifecycle of its products. They discover that prices for new products tend to be high initially, but gradually decline as the product becomes more widely available and competition increases. Based on this analysis, the company can develop a pricing strategy that aligns with the product lifecycle, maximizing revenue at each stage.

Example 5: Impact of Economic Factors on Pricing

A manufacturing company analyzes historical pricing data to assess the impact of economic factors on product demand. They discover that during economic downturns, demand for their products decreases, leading to lower prices. Conversely, during economic upturns, demand increases, allowing the company to raise prices. Based on this analysis, the company can develop contingency plans to adjust pricing in response to changing economic conditions.

Learning your competitors’ price history is a highly efficient strategy that can help you present your product most efficiently and prevent costly mistakes. Once choose the most reliable Price Intelligence solution, this data can boost your sales, optimize manufacturing and distribution costs, and help obtain new market segments.

We use cookies to provide you with an optimal experience, for marketing and statistical purposes only with your consent, which you may revoke at any time. Please refer to our Privacy Policy for more information.

Missing an important marketplace?

Send us your request to add it!