- Product

- Solution for

For Your Industry

- Plans & Pricing

- Company

- Resources

For Your Industry

Price skimming is a pricing strategy that has gained popularity among vendors, retailers, and tech companies alike. This method involves launching a product or service at a high price point to capture early adopters, then gradually lowering the price over time to reach a broader market. It’s an appealing tactic for businesses looking to maximize profits, but like any pricing strategy, it comes with its own set of risks and rewards.

In this comprehensive article, we will dive into how price skimming works, its benefits and drawbacks, factors influencing its success, ethical considerations, and whether it is a smart move or a potential money pit.

Price skimming refers to setting an initially high price for a new product or service and gradually reducing it over time. The goal is to capture maximum revenue from early adopters who are willing to pay a premium for being the first to experience new technology, innovation, or exclusivity.

The main appeal of price skimming lies in its potential to recover research and development (R&D) costs quickly while establishing a premium brand image. This pricing approach can be particularly effective in industries with high levels of innovation and rapid product evolution, such as technology, luxury goods, and entertainment.

To understand why price skimming works, it’s important to explore the psychology driving consumer behavior.

Price skimming is implemented in a phased manner:

Initial High Price: The product is introduced to the market at a premium price, targeting early adopters who are less price-sensitive and more focused on innovation or exclusivity.

Gradual Price Reductions: Once the initial demand from early adopters starts to decline, the price is gradually reduced. This opens the market to more price-sensitive consumers.

Equilibrium Price: Over time, the price stabilizes at its long-term equilibrium, balancing between profitability and broad market appeal.

Price skimming is not a one-size-fits-all strategy. It’s most effective under specific conditions:

Product Differentiation: When the product offers unique or innovative features that aren’t available in competing products, customers may be willing to pay more for that distinct value.

Limited Competition: In markets where competition is limited, businesses can leverage price skimming to capture early profits without the pressure of being undercut by lower-priced competitors.

Price Insensitivity: If the target market is less sensitive to price, focusing more on product attributes like quality, innovation, or status, then price skimming can be a successful approach.

High Initial Demand: Price skimming works well when there’s pent-up demand for a new product, particularly when customers are willing to pay a premium for early access.

Brand Strength: Companies with strong brand equity, like Apple and Tesla, can command higher prices initially because of their reputation for innovation and quality.

Apple has been a master of price skimming. When a new iPhone is launched, it’s often priced at a premium, attracting early adopters willing to pay top dollar. Over time, Apple reduces the price to capture price-sensitive consumers while also introducing newer models at higher prices again. This cycle allows Apple to maximize revenue across different customer segments.

Tesla’s electric vehicles (EVs) also exemplify price skimming. Early models were launched at high prices, appealing to eco-conscious early adopters and luxury car buyers. Over time, as production efficiencies improved and the market expanded, Tesla introduced lower-priced models to reach a broader audience.

New video games often use price skimming. Titles like “Call of Duty” or “FIFA” are launched at premium prices to capture dedicated gamers who want the latest experience on day one. As sales slow, the price is reduced to attract casual gamers.

By charging a premium price at launch, companies can capture the highest possible revenue from early adopters who are less price-sensitive. This is particularly important for covering high initial costs, such as R&D and marketing.

High prices can enhance the perceived value of a product, helping to position it as a premium offering. This strategy works well for luxury goods and high-end technology, where consumers often equate price with quality and exclusivity.

Price skimming allows businesses to recover the upfront costs of developing and launching a new product more quickly. This is especially important for companies that have invested heavily in innovation.

High initial prices may alienate customers who are more price-sensitive. This can create a perception of the brand being elitist or unaffordable for the general public.

One of the risks of price skimming is that competitors might enter the market with similar products at lower prices, attracting price-sensitive customers and undercutting your market share.

Price skimming can make inventory management difficult. If a company overestimates demand from early adopters, they could be left with excess stock at the high price point, leading to steep discounts or losses later.

Beyond the basic principles, several external factors can impact the success of price skimming:

Price skimming works best at the beginning of the product lifecycle when the product is new and differentiated. As the product matures and competitors catch up, price reductions become necessary to maintain sales.

In a strong economy, consumers may be more willing to pay premium prices for new products. However, in a downturn, price-sensitive consumers may delay purchases, making price skimming less effective.

A company’s brand image plays a significant role in price skimming. Strong, well-regarded brands can implement price skimming successfully, as consumers perceive the high price as justified. Weaker brands may struggle to convince consumers of the product’s worth.

In rapidly evolving industries like technology, where innovation happens quickly, price skimming can help businesses capitalize on early demand before newer models or competing technologies reduce consumer interest in older products.

While price skimming can be profitable, businesses must consider its ethical implications. Aggressively high pricing, especially if combined with misleading marketing practices, can alienate consumers and damage a brand’s reputation. Transparency is key in maintaining consumer trust.

For instance, launching a product at an inflated price without clear justification can lead to customer backlash. Ethical concerns also arise when companies delay price reductions longer than necessary, artificially inflating prices and excluding lower-income customers from accessing the product.

Tesla’s journey in the electric vehicle (EV) market offers a clear example of how price skimming can be executed effectively. When Tesla first introduced its Roadster, it was priced at a premium, aimed at early adopters who could afford the high price and were enthusiastic about EV technology. As Tesla expanded its model lineup with the Model S and Model 3, it gradually introduced lower-priced vehicles. This allowed Tesla to penetrate different market segments while maintaining its innovative brand image.

Tesla’s strategy also allowed it to recover R&D costs quickly, reinvesting profits into developing more affordable models and expanding its market reach. By using price skimming, Tesla captured premium profits in the early stages of its product life cycle while building a loyal customer base.

As markets evolve, so too must pricing strategies. Traditional price skimming may be affected by new pricing models, such as subscription-based services, dynamic pricing, and personalized pricing.

Subscription Models: With the rise of subscription services in various industries (e.g., SaaS, media), companies are exploring ways to implement skimming in subscription tiers, charging premium prices for early access or exclusive features.

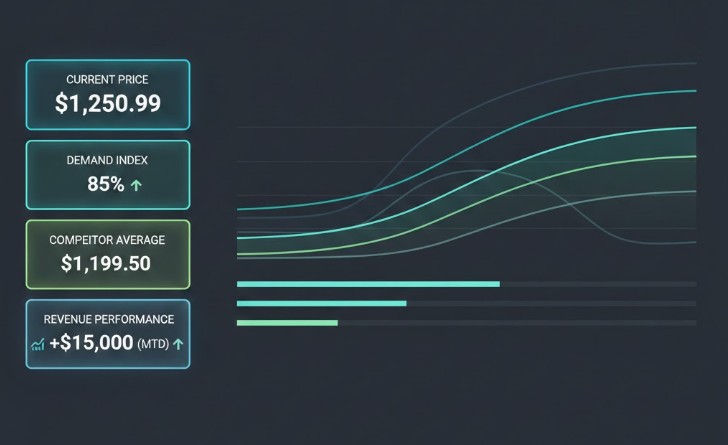

Dynamic Pricing: Advances in AI and machine learning allow companies to adjust prices in real time based on demand, competition, and consumer behavior. Dynamic pricing can be seen as an evolution of price skimming, adjusting prices more fluidly rather than through predetermined stages.

Personalized Pricing: Leveraging big data, companies can offer personalized pricing to individual consumers based on their purchase history, demographics, or preferences, ensuring that premium prices are charged to those most willing to pay them.

Price skimming can be a highly effective pricing strategy, especially for companies launching innovative, differentiated products. By capturing early profits and creating a premium brand image, businesses can capitalize on consumer psychology and maximize revenue. However, the strategy comes with risks, including potential backlash from price-sensitive customers and the threat of competitors undercutting prices.

The success of price skimming depends on several factors: market conditions, product lifecycle, brand strength, and ethical considerations. When implemented thoughtfully, price skimming can be a smart move that yields substantial financial rewards. However, businesses must be mindful of the pitfalls and adapt their strategies to changing market dynamics to avoid falling into a money pit.

We use cookies to provide you with an optimal experience, for marketing and statistical purposes only with your consent, which you may revoke at any time. Please refer to our Privacy Policy for more information.

Missing an important marketplace?

Send us your request to add it!