- Product

- Solution for

For Your Industry

- Plans & Pricing

- Company

- Resources

For Your Industry

Turn competitor stockouts into strategic moments of growth

In eCommerce, every second counts — and so does every stock fluctuation. When a competitor’s product goes out of stock, it’s not just their missed opportunity. It’s yours.

Real-time awareness of competitor stock levels gives you a competitive edge: it helps you understand demand surges, optimize your pricing dynamically, and capture high-intent shoppers looking for alternatives.

But reacting effectively isn’t just about spotting an out-of-stock label. It’s about knowing what to do, how fast to do it, and how to align your pricing, promotions, and campaigns around it — all powered by reliable, real-time data.

In this article, we’ll explore how eCommerce leaders can leverage competitor stockouts strategically, what tools and processes make it possible, and how tgndata enables brands to act with precision the moment competitors go dark.

A competitor’s out-of-stock event is one of the most valuable — yet underused — data points in retail. It reveals not just an inventory issue, but a shift in the supply-demand balance of your category.

When multiple retailers run out of a product, it’s a clear sign of strong consumer demand. Monitoring those moments helps you anticipate demand trends before they appear in sales reports.

For example, if three major competitors suddenly go out of stock on a specific sneaker model, it’s not random — it’s a signal of rising popularity, a possible marketing trigger, and a stock optimization cue.

When a competitor disappears from a category search or marketplace listing due to stockout, the competitive pressure drops instantly. Your products can climb higher in visibility and conversion share — if you act quickly enough.

Frequent stockouts often indicate sourcing challenges or limited production capacity. Recognizing those patterns helps you position your brand as the reliable alternative that shoppers can depend on.

Stock availability shifts constantly — sometimes hourly — across marketplaces, retailers, and DTC sites. Relying on weekly reports or manual checks means you’re already too late.

Today’s leaders in retail intelligence use real-time data feeds to track:

Competitor inventory levels

Price fluctuations and promotions

New product listings or discontinued SKUs

Category availability trends

With this visibility, you can make instant, data-driven adjustments — changing bids, repricing SKUs, or launching tactical ads within minutes of a competitor’s stockout.

That’s the power of tgndata’s real-time market monitoring: enabling pricing and marketing teams to react automatically to competitor stock signals.

Let’s break down a practical framework for turning competitor stockouts into actionable growth opportunities.

Before you can react, you need to know — as it happens — when a competitor’s product goes out of stock.

Manual monitoring doesn’t scale. The most effective teams use automated tracking tools like tgndata, which collect and update availability data across thousands of SKUs and retailers in real time.

What to track:

SKU-level stock status (in stock / out of stock / low stock)

Product variants (size, color, capacity)

Category-level availability patterns

Historical stock trends

Why it matters: Real-time alerts let you identify high-value opportunities the moment they appear.

For example, if a top competitor’s gaming console bundle goes out of stock, your system can immediately flag the opportunity to raise bids on the same keywords or feature your alternative bundle more prominently.

Once a competitor runs out of stock, shoppers still looking for that item will continue browsing — and often, they’ll be willing to pay slightly more for a substitute.

This is where dynamic pricing shines.

With tools that integrate real-time competitor stock data, your pricing engine can automatically:

Increase prices slightly on equivalent items to capture added margin.

Hold or reduce prices strategically to attract comparison shoppers.

Launch short-term promotions with “In Stock Now” or “Ships Today” messaging.

The key is speed. Adjustments made hours after the event lose impact. Automation ensures you capture the moment at its peak.

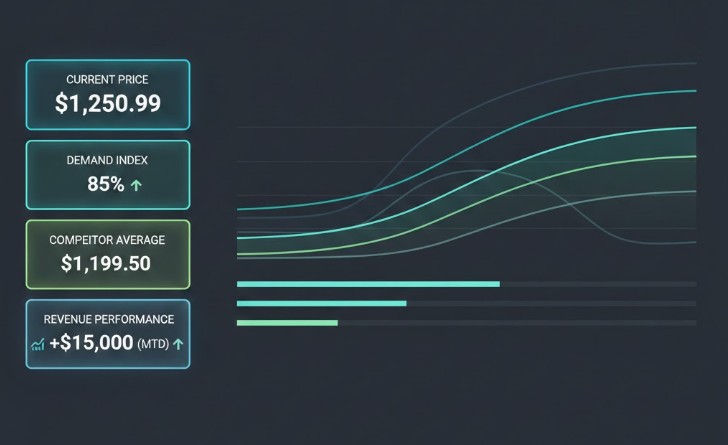

tgndata’s analytics platform enables exactly this — feeding competitor availability data into your pricing logic, so your decisions aren’t reactive, they’re proactive.

Visibility is everything when shoppers are actively searching for alternatives.

When you detect a competitor stockout, immediately shift focus to paid and organic channels where that traffic is likely to flow.

Tactical actions:

Increase your Google Shopping bids for the affected products.

Update ad copy with availability-driven messaging like “Available Now” or “No delays.”

Push category or brand-level ads on marketplaces highlighting your reliability.

Feature your in-stock SKUs in retargeting campaigns aimed at competitor visitors.

You’re not just filling a void — you’re guiding shoppers directly to your digital shelf while the competition is invisible.

When your competitors are out of stock, every shopper arriving at your site is a high-intent visitor. Make sure they see what they need to convert immediately.

Practical enhancements:

Add “In stock” or “Fast shipping available” callouts on relevant product pages.

Highlight similar SKUs in “Alternatives to [Competitor Product]” carousels.

Display real-time stock status to build trust and urgency.

Use urgency indicators (“Limited stock left!”) to reinforce decision speed.

Consistency across your ads, product pages, and checkout experience builds credibility — and positions your brand as the reliable choice when others aren’t.

Stock reliability isn’t just an operational metric; it’s a brand differentiator.

When competitors repeatedly go out of stock, it’s a chance to build trust by communicating stability and preparedness.

On social media, email, or your website, reinforce messages like:

“Always in stock. Always ready to ship.”

“You shouldn’t have to wait — we’ve got you covered.”

Use data-backed storytelling to position your fulfillment consistency as part of your brand identity.

tgndata’s analytics can even quantify your in-stock rate advantage versus competitors, providing proof points you can use in B2B partnerships, ads, or investor reports.

Once your basic response workflow is in place, more advanced eCommerce teams use competitor stock data as an input for broader strategic initiatives.

Let’s look at a few.

Historical stockout patterns reveal where and when demand spikes.

By analyzing stock availability over time, you can:

Identify seasonal gaps in competitor availability.

Adjust your inventory planning to meet expected demand surges.

Anticipate the next out-of-stock window and prepare your campaigns accordingly.

When tgndata integrates with your demand forecasting models, it turns competitor data into predictive insights, not just reactive signals.

When competitors run out of stock, price elasticity shifts. Customers may tolerate higher prices — but only temporarily.

By monitoring the duration and frequency of competitor stockouts, you can determine:

How long the pricing window stays open

When to raise or normalize prices again

Which SKUs are most resilient to competitor volatility

This data-driven margin control helps pricing analysts balance short-term profitability with long-term competitiveness.

Every stockout has a measurable impact on category share.

By mapping competitor stockouts against your own sales data, you can visualize how much share you capture during those windows — and which competitors’ outages benefit you the most.

tgndata’s reporting tools can track and visualize these shifts, giving teams a quantifiable ROI on market reactivity.

The most advanced retail operations integrate tgndata’s real-time stock data into their pricing engines, ad platforms, and BI tools.

Examples include:

Feeding stock data into Google Ads scripts to trigger bid changes.

Integrating with pricing optimization software for auto-adjustment.

Connecting to Tableau, Power BI, or internal dashboards for instant visibility.

This automation eliminates manual lag and ensures your team acts faster than the market average.

Even with great data, reacting to competitor stockouts can backfire if the execution isn’t balanced.

Here are common pitfalls — and how to avoid them.

Overpricing during stockouts:

While tempting, large price hikes can erode long-term trust. Keep adjustments subtle and time-bound.

Ignoring brand tone:

Availability messages should feel reassuring, not exploitative. Focus on reliability, not competitors’ shortcomings.

Neglecting supply readiness:

Acting on stockout data only makes sense if your own fulfillment is rock-solid. Never promote what you can’t deliver.

Working in silos:

Ensure marketing, pricing, and operations share visibility into stock data — otherwise opportunities are lost in translation.

Reacting too late:

Competitor stockouts can last hours or days. If your processes aren’t real-time, the opportunity window closes quickly.

tgndata solves that by delivering the immediacy and automation your team needs to stay consistently ahead.

You can’t improve what you don’t measure. To assess the value of responding to competitor stockouts, track key metrics such as:

Incremental revenue during competitor stockout periods

Conversion rate lifts on promoted SKUs

Margin improvements tied to dynamic pricing

Increased visibility in search or marketplace rankings

Market share changes across categories

tgndata’s dashboards allow you to correlate these outcomes directly with stock event timelines — showing you exactly how reactive intelligence drives ROI.

The eCommerce landscape is only getting faster. AI-driven pricing, predictive replenishment, and marketplace automation are redefining how brands compete.

In this environment, stock intelligence is no longer optional — it’s a competitive necessity.

The next evolution lies in predictive visibility: not just reacting when competitors run out, but forecasting when they will. With data pipelines that continuously learn from pricing, sales velocity, and replenishment patterns, tgndata is helping brands move from reaction to anticipation.

The goal isn’t simply to win the next stockout window — it’s to become the brand that never misses an opportunity to serve customers when others can’t.

Every out-of-stock moment tells a story — about demand, opportunity, and execution. The retailers who listen to those signals first are the ones who win market share and customer loyalty.

By combining real-time visibility, automated reaction, and strategic foresight, you can transform competitor weaknesses into measurable business growth.

That’s the essence of competitive intelligence in modern eCommerce — and it’s exactly what tgndata enables.

We use cookies to provide you with an optimal experience, for marketing and statistical purposes only with your consent, which you may revoke at any time. Please refer to our Privacy Policy for more information.

Missing an important marketplace?

Send us your request to add it!