- Product

- Solution for

For Your Industry

- Plans & Pricing

- Company

- Resources

For Your Industry

The 2025 holiday season is shaping up to be the most competitive eCommerce quarter yet. Retailers across categories will adjust prices in near real time, responding to traffic spikes, stock movements, and competitor activity. Dynamic pricing, powered by data and automation, enables brands to stay profitable without losing customers to discount wars.

In this Holiday Edition of Dynamic Pricing 101, tgndata breaks down the essentials of how retailers can use pricing intelligence to adapt, automate, and win margin during the year’s most volatile sales period.

Dynamic pricing is a data-driven strategy where product prices change automatically based on internal and external signals.

Instead of relying on static pricing or weekly updates, dynamic systems react to:

Competitor prices and promotions

Market demand fluctuations

Stock levels and supply costs

Seasonality and event triggers

Conversion rates and customer behavior

During November and December, these signals intensify. Retailers leveraging pricing automation typically update prices 10 to 20 times more often than those using manual methods.

Black Friday, Cyber Week, and the weeks before Christmas generate price competition unlike any other season. Even a 1% difference in price visibility can swing conversion rates dramatically. Dynamic pricing helps you defend share and protect profit.

Holiday demand is volatile. Products that trend unexpectedly can sell out overnight, while slow movers may require aggressive markdowns. Dynamic rules ensure you react before losing sales or margins.

Retailers that rely on broad, manual discounts often destroy margin unnecessarily. Dynamic pricing applies data thresholds, ensuring that only competitive SKUs get discounted while profitable lines maintain premium pricing.

| Component | Function | Holiday Impact |

|---|---|---|

| Data Collection | Aggregate competitor prices, promotions, and stock data across marketplaces. | Enables real-time reaction to market changes. |

| Pricing Logic | Apply rule-based or machine-learning models that decide new prices. | Automates pricing decisions for thousands of SKUs. |

| Execution Layer | Push updated prices instantly to web, feed, and marketplace endpoints. | Delivers agility without manual lag. |

A strong pricing intelligence layer ties all three together, ensuring accuracy, speed, and control during high-traffic periods.

Dynamic pricing systems generally operate under two approaches:

Retailers define explicit conditions such as:

Match the lowest competitor if margin ≥ 15%

Undercut competitors by 2% if stock > 500 units

Hold price if product rating < 4 stars

Pros: Predictable, easy to audit, transparent to management.

Cons: Rigid when market data changes rapidly.

Machine learning models evaluate elasticity, conversion probability, and competitor volatility to predict optimal price points.

Pros: Adapts automatically to complex market signals.

Cons: Requires robust data, governance, and simulation before rollout.

Most tgndata clients run hybrid models, combining rule control with AI flexibility for the holiday season.

Competitor Price Index: Your average price position versus top five competitors.

Stock Velocity: The rate at which inventory depletes relative to daily sales.

Buy Box Frequency: For marketplace sellers, the percentage of time your offer wins the buy box.

Promotion Overlap: How often your discount period coincides with competitors’.

Price Elasticity by SKU: The correlation between price change and conversion rate.

Tracking these metrics within a centralized dashboard allows data teams to spot emerging opportunities before the next pricing round.

Dynamic pricing can be powerful, but mistakes are costly. Retailers must avoid these pitfalls:

Failing to set minimum and maximum thresholds can erode margins or trigger MAP violations.

Automation should enhance decision-making, not replace human judgment. Always audit high-impact SKUs manually during promotions.

If competitors run out of stock, holding price (not cutting) can preserve profitability and signal brand strength.

Old data equals poor decisions. tgndata recommends hourly or near-real-time updates during the Black Friday window.

Integrate pricing feeds with your ERP, BI, and marketing tools. Unified visibility leads to faster reactions.

| Step | Action | Outcome |

|---|---|---|

| 1. Define Objectives | Choose between revenue growth, profit protection, or share gain. | Clear KPI alignment. |

| 2. Gather Data | Collect competitor prices, stock, and historical demand. | Baseline market visibility. |

| 3. Set Guardrails | Configure minimum margins, MAP rules, and elasticity thresholds. | Risk control. |

| 4. Automate Updates | Deploy pricing engine and monitor updates daily. | Operational efficiency. |

| 5. Measure Results | Track conversion lift, margin change, and price index. | Continuous optimization. |

Retailers who follow this roadmap can implement a functioning dynamic pricing engine in under four weeks, often before mid-December.

Key metrics to evaluate performance include:

Gross Margin Return on Investment (GMROI)

Price Index vs. Competitors

Conversion Rate Uplift

Revenue per Visitor (RPV)

Discount Ratio per Category

tgndata benchmarks show that optimized retailers often realize 5–8% higher margins and 10–15% better conversion rates over manual pricing approaches during Q4.

A mid-sized European electronics retailer implemented tgndata’s dynamic pricing system in October 2025.

Before:

Manual daily updates

22% margin erosion during promotional events

After 30 Days:

Automated hourly repricing across 12,000 SKUs

11% margin lift

9% conversion increase

17% fewer MAP violations

This case highlights the value of coupling automation with strict control rules and continuous elasticity learning.

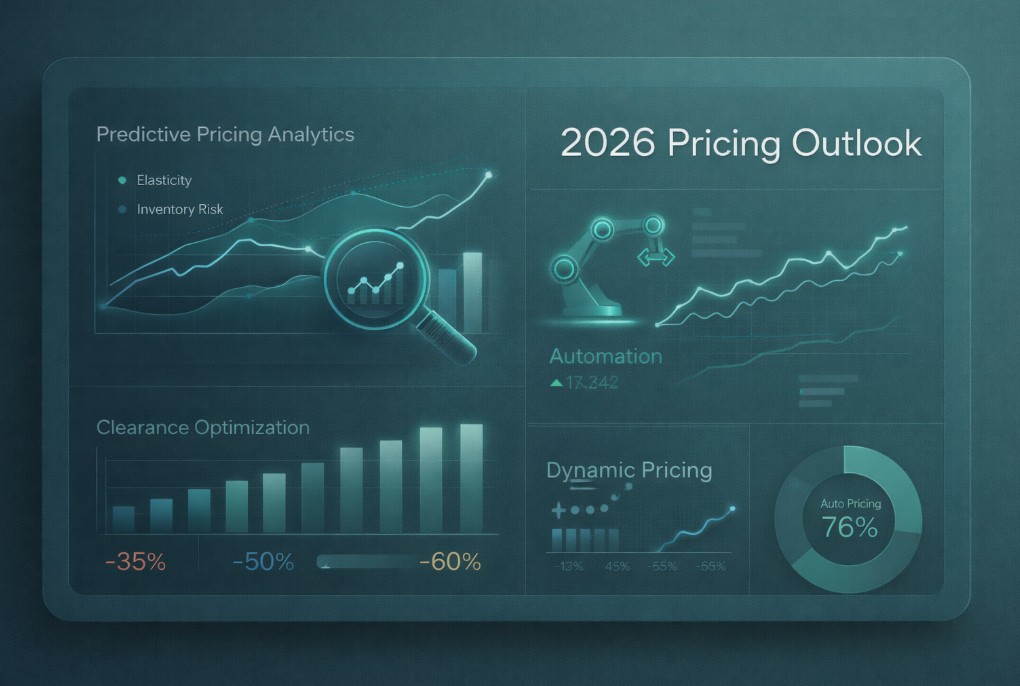

By 2026, most retailers will use AI-enhanced pricing tools that simulate outcomes before deployment. Predictive analytics will integrate with marketing campaigns, ensuring that every discount aligns with inventory and promotional ROI.

Dynamic pricing will no longer be a luxury technology but a core component of retail intelligence ecosystems.

Dynamic pricing is the most direct path to profitability and competitiveness in today’s fast-moving retail environment. For the 2025 holiday season, the key is precision — not panic.

Retailers who combine pricing intelligence, automation, and analytics can respond faster, discount smarter, and protect profits during the year’s busiest weeks.

Missing an important marketplace?

Send us your request to add it!