- Product

- Solution for

For Your Industry

- Plans & Pricing

- Company

- Resources

For Your Industry

Competitor benchmarking is one of the most critical capabilities in modern retail and eCommerce. Senior pricing leaders, category managers and data analysts depend on accurate competitive intelligence to understand market movements and adjust pricing strategies with confidence. Many organizations still rely on manual spreadsheets for competitor tracking, even as markets become more dynamic, product assortments expand and price changes accelerate. Manual tools cannot keep up with the pace of digital retail. Teams that continue using them risk lost revenue, poor decision making and reduced visibility into market conditions.

This article provides a complete guide to the evolution of competitor benchmarking, from manual spreadsheets to fully automated competitor feeds. It explains why manual tracking breaks at scale, how automated systems work and what competitive advantages retailers gain when they adopt advanced pricing intelligence and retail analytics. The goal is to equip pricing teams with a strategic, data driven understanding of how to modernize their competitive monitoring capabilities for the AI powered retail landscape.

Competitor benchmarking is the systematic process of collecting, comparing and analyzing competitor product data. This includes prices, promotions, stock levels, product attributes, seller behavior and marketplace dynamics. It provides pricing teams with clarity about their market position, revenue risks and pricing opportunities.

Modern retail environments are shaped by fast price movements and constant competitive activity. Customers compare prices instantly on marketplaces and search engines. Retailers adjust promotions daily to capture demand. Sellers on marketplaces update prices based on algorithms rather than manual review. Competitor benchmarking gives retailers the data needed to navigate this pace with accuracy.

Several factors make competitive intelligence essential rather than optional.

Customers use digital comparison tools.

Marketplaces update prices frequently.

Promotions have shorter cycles.

New entrants can alter category dynamics quickly.

Price transparency increases expectations for fairness.

Retailers cannot rely on outdated information or intuition. They need structured, accurate competitor data at scale.

Competitive intelligence supports a range of analytics and decision frameworks.

Price elasticity and demand modeling

Market share estimation

Assortment planning

Promotion strategy alignment

Margin protection

Buy box or share of voice analysis

Accurate benchmarking allows teams to understand not only what competitors do but also why those actions matter to performance.

Many pricing teams still use spreadsheets for competitor tracking. Although spreadsheets are familiar tools, they create significant limitations when used for large scale benchmarking. As markets grow more complex, these limitations become harder to ignore.

Manual processes rely on team members visiting competitor websites or marketplaces, copying prices and pasting them into a spreadsheet. This is slow and resource intensive. Teams often update data once a week or once per month. In categories where prices change several times per day, these delays produce outdated intelligence that cannot support dynamic pricing.

Manual spreadsheets introduce inconsistencies.

Incorrect product links

Typographical errors

Wrong currency conversions

Missing competitor listings

Mismatched SKUs

Even small errors cause major distortion in automated pricing models or pricing index calculations.

Manual tracking forces teams to choose a small number of competitors and products. This leaves blind spots across categories. In marketplaces, hundreds of sellers might carry the same product. Manual tracking cannot replicate that level of visibility.

Competitor benchmarking requires more than price. It requires knowledge of promotions, availability, product content, seller count, rating trends and historical changes. Spreadsheets cannot maintain this depth without becoming unmanageable.

Because spreadsheets are disconnected from pricing engines, teams must manually enter prices or update rules. This slows down reactions to market dynamics and increases the risk of lost margin.

These limitations make manual spreadsheets unsuitable for competitive environments that require accuracy, speed and coverage.

Automated competitor feeds replace manual tracking with structured, real time data pipelines. Automated systems collect, match, clean and deliver competitor data directly into pricing engines, BI tools or internal analytics platforms.

Automated systems capture competitor changes as they happen. This includes:

Price changes

Promotion launches

Stock availability adjustments

Marketplace seller updates

New product listings

Content modifications

Teams gain a real time view of the competitive landscape.

Automated feeds apply cleaning and normalization processes that improve data quality.

Normalized product titles

Standardized pricing formats

Deduplicated marketplace listings

Accurate product matching

Unified attribute naming

Clean data is essential for accurate benchmarking and automated pricing decisions.

Automated feeds scale easily. Teams can monitor:

Hundreds of competitors

Tens of thousands of SKUs

Global markets

Multiple channels at once

Depth across brands and categories

This level of coverage is impossible with manual work.

Automated feeds connect directly to dynamic pricing engines and business intelligence tools. This creates a complete loop from data to action.

Automated systems remove variability in update cycles. Feeds run hourly or daily without manual involvement. This produces dependable data pipelines that pricing teams can trust.

Automated competitor feeds are the backbone of modern pricing intelligence and create significant competitive advantages.

Automated competitor benchmarking requires a wide range of data types. Price is only one part of the competitive landscape. Retailers who benchmark only against price miss critical signals that shape performance.

This includes list price, sale price, loyalty price and any final price displayed at checkout. Accurate benchmarking requires all components of the price structure.

Availability shows whether competitors are out of stock, low stock or actively restocked. This data influences price elasticity and demand substitution patterns.

Promotion tracking captures:

Discount depth

Promotion start and end dates

Promotion type

Bundle offers

Category wide sales

Promotions influence both demand and pricing strategy.

Historical price data identifies patterns in competitor pricing behavior. These patterns reveal:

Seasonal cycles

Promotional rhythms

Margin strategies

Dynamic pricing responsiveness

Historical data is essential for forecasting.

Product content includes titles, descriptions, specifications and images. Differences in content often create pricing power or customer perception gaps.

Customer ratings influence perceived value and willingness to pay. Benchmarking without ratings provides an incomplete view.

Marketplace products often have multiple sellers. Automated benchmarking must track:

Seller count

Price dispersion

Buy box winner

Seller strategies

These dynamics directly affect sales volume.

Accurate competitor benchmarking depends on capturing and analyzing all these data types together.

Modern competitor feeds rely on a robust technical architecture designed for scale, accuracy, and continuity.

This layer gathers raw data from competitor channels.

Website crawlers

Public APIs

Marketplace integrations

Structured data feeds

Supplemental data sources

Collection systems must adapt to frequent site updates.

Raw data is cleaned, normalized and matched.

Attribute standardization

Currency conversion

Product title cleaning

Duplicate removal

Category alignment

Machine learning based product matching

Accurate matching is critical to reliable benchmarking.

Quality checks ensure correctness and consistency.

Outlier detection

Missing data checks

Anomaly detection

Price trend validation

Strong governance improves trust in the feed.

Systems monitor feed health, freshness and completeness.

Data freshness alerts

Matching accuracy monitoring

Source reliability tracking

Feed latency measurement

This ensures continuity and reliability.

Automated competitor feeds require an infrastructure built for accuracy, scale and resilience.

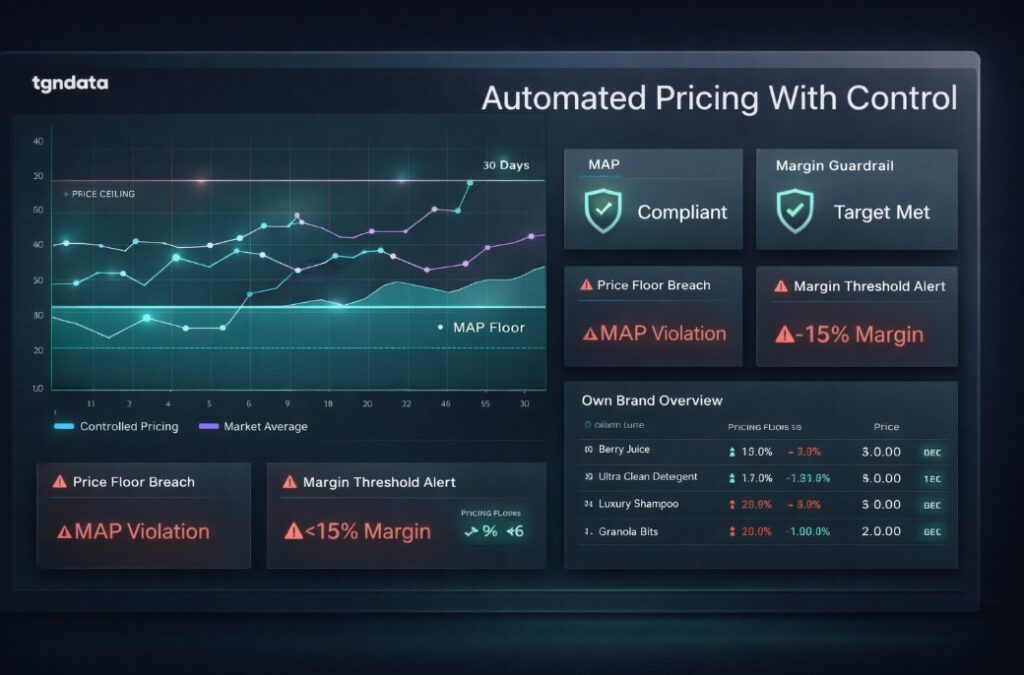

Dynamic pricing relies on a constant flow of market signals. Automated competitor feeds provide the data required to make smart, timely price adjustments.

When competitor prices move, dynamic pricing engines respond. Automated feeds reduce reaction time from days to minutes, protecting margin and competitiveness.

Pricing engines use automated competitor feed data to enforce rules.

Maintain price parity

Stay within a set index range

Beat competitor prices within limits

Respect margin floors

Avoid unnecessary discounts

These rules create predictable and consistent pricing behavior.

If a competitor launches a promotion, systems can trigger a matching or protective promotion. Teams only discount when competition requires it.

Competitor availability interacts with internal inventory.

If competitors are out of stock and you are in stock, prices can increase.

If all competitors discount aggressively, promotions can expand.

Automated feeds provide the competitive context needed for inventory sensitive pricing.

Marketplace sellers adjust prices frequently. Automated feeds monitor seller count and price dispersion to influence dynamic rules.

Dynamic pricing becomes much more accurate when powered by automated competitor data.

Retail analytics links competitor benchmarking with customer decisions.

Price elasticity by region

Conversion rate changes

Basket analysis

Promotion response analysis

Teams gain a complete picture of competitive influence.

Competitors often follow seasonal or strategic pricing patterns. Analytics reveals the intent behind their changes, such as inventory clearance or premium positioning.

Retail analytics surfaces patterns across categories.

Categories where competition is intense

Categories with stable pricing

Categories where margins can increase

Categories with high promotional frequency

This helps category managers plan more effectively.

By comparing competitor price changes with sales data, teams can measure how sensitive customers are to price shifts. This reveals opportunities to adjust pricing strategy.

Retail analytics enhances the value of competitor data. Pricing teams use analytics to uncover deeper insights and connect competitive activity to business performance.

AI powered search engines and product finders rely on accurate, structured data. Competitor benchmarking has become essential for optimizing digital shelf presence.

AI search algorithms use product content, attributes, stock and pricing data to determine visibility. Accurate competitor benchmarking ensures content quality and market alignment.

Incorrect or stale pricing reduces product relevance in AI driven recommendations. Automated competitor feeds help maintain consistency.

Brands must maintain consistent product data across channels. Competitor feeds provide reference points to verify accuracy.

AI powered pricing and content tools depend on real time market inputs. Automated feeds accelerate training and optimization.

Teams transitioning from manual spreadsheets to automated competitor feeds follow a structured roadmap.

Understand which competitors and SKUs are tracked manually and identify gaps.

Clarify which data types are needed, how often they must be updated and in what formats.

Choose a platform with strong accuracy, product matching and integration capabilities.

Automated feeds work best when integrated with pricing engines, dashboards and data warehouses.

Teams compare manual data with automated outputs to confirm accuracy and consistency.

Once validated, automated systems replace manual processes entirely.

With automation in place, teams can add elasticity modeling, promotion optimization and predictive analytics.

Content quality, delivery costs and promotions require deep benchmarking beyond simple price.

Automated competitor feeds deliver value across all these sectors.

Many brands compete with seasonal assortment changes. Automated benchmarking helps optimize timing and price differentials.

Large SKU catalogs require advanced product matching to ensure accuracy.

Thin margins and high frequency promotions make automation essential. Teams rely on hourly updates.

Frequent stockouts and dynamic promotions require continuous monitoring. Automated feeds reveal pricing pressure and competitor timing.

Promotions in this sector often follow long duration cycles. Automated tracking helps identify seasonal patterns.

Prices change rapidly and assortments update frequently. Automated feeds ensure price accuracy and visibility across marketplaces.

Competitor benchmarking has broad relevance across industries. Each sector benefits differently from automated feeds.

Competitor benchmarking becomes significantly more powerful when teams adopt advanced metrics and models.

Price index measures competitive position and highlights where prices are too high or low.

This metric shows how often competitors run promotions and how aggressively they discount.

Out of stock tracking reveals demand pressure and shows when customers might shift to your products.

Marketplace share of voice measures your visibility relative to competitors. It influences conversion rates.

Volatility shows which competitors experiment with dynamic pricing or aggressive price changes.

By analyzing historical gaps between your price and the market price floor, you can identify when raising prices will not reduce competitiveness.

These models adjust pricing based on product age, demand cycles or end of life transitions.

AI driven forecasting predicts competitor behavior and helps teams prepare ahead of price shifts.

These metrics turn competitor benchmarking into a strategic decision making engine.

Teams often encounter challenges during the transition to automated competitor feeds. Awareness of these pitfalls helps avoid common errors.

Inaccurate matching produces misleading comparisons. Teams must validate matching algorithms or supplier capabilities carefully.

Ownership of data freshness, accuracy and monitoring must be clearly assigned.

Integrations with pricing engines and BI tools require careful planning to avoid data latency.

Teams sometimes design rules without testing. This can cause sudden margin loss or price instability.

Running manual and automated processes together for a period helps validate feed performance.

Avoiding these pitfalls ensures a smooth migration to automation.

Competitor benchmarking has evolved from slow manual spreadsheets to fast, scalable and accurate automated data feeds. Pricing teams that remain dependent on manual processes risk outdated insights, operational inefficiency and reduced margin. Automated competitor feeds provide the precision, speed and coverage required for modern retail. They support dynamic pricing, retail analytics and AI-powered optimization, giving teams clear visibility into market changes and competitive movements.

If your organization is ready to modernize its pricing intelligence, tgndata provides high accuracy data feeds, advanced analytics, and dynamic pricing automation solutions. Contact tgndata to strengthen your competitive advantage and build a future ready pricing strategy.

Missing an important marketplace?

Send us your request to add it!