- Product

- Solution for

For Your Industry

- Plans & Pricing

- About us

- Resources

For Your Industry

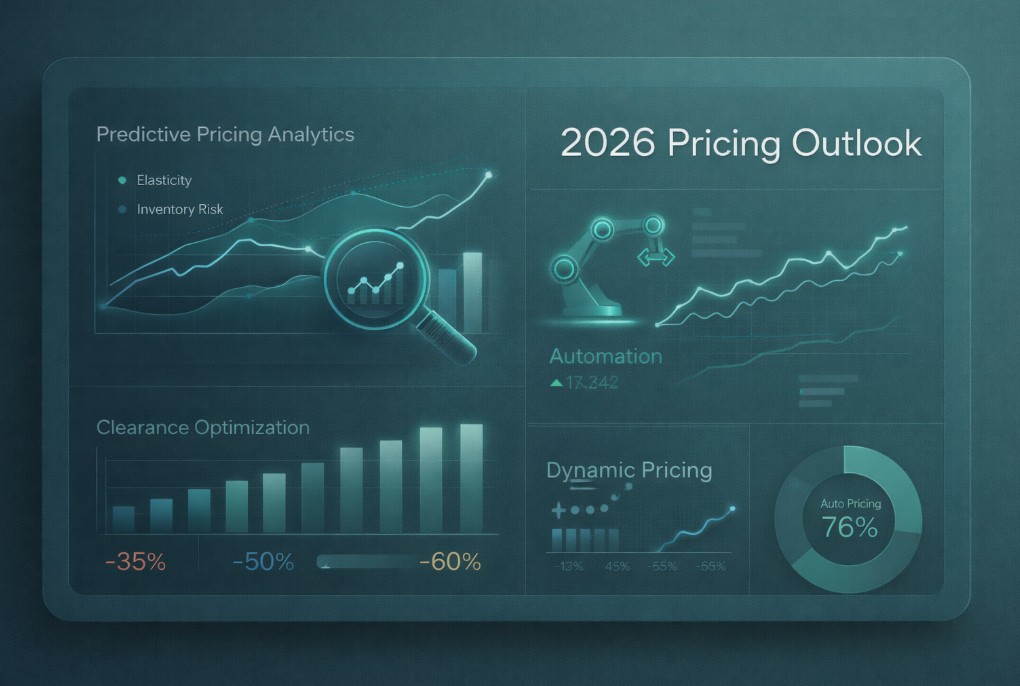

The shift from 2025 into 2026 represents a structural evolution in how pricing is designed, executed, and governed across retail and consumer brands. Pricing is no longer viewed as a reactive function focused on promotions or competitive response. Instead, it is becoming a continuous decision system that integrates demand intelligence, inventory forecasting, competitive context, and automation. The 2026 Pricing Outlook makes it clear that retailers and brands must prepare for an environment where pricing maturity, not price aggression, defines competitive advantage.

Throughout 2025, many organizations learned that speed alone does not guarantee success. Faster reactions without analytical discipline often led to margin erosion and customer confusion. In 2026, the emphasis shifts toward precision, predictability, and control. Pricing leaders will distinguish themselves by knowing when to act, when to hold, and how to align pricing decisions with broader commercial and operational objectives. This article explores the key pricing shifts expected in 2026 and outlines what retailers and brands must do now to prepare.

In previous years, pricing strategy was largely shaped by volatility management. Teams reacted to inflation, supply disruption, and aggressive competition with frequent price changes designed to protect volume. In 2026, this reactive posture becomes increasingly ineffective. Volatility still exists, but it is no longer the core challenge. The real challenge is converting constant market movement into structured, repeatable optimization.

Continuous pricing optimization replaces episodic decision making. Instead of weekly or monthly price reviews, pricing systems operate continuously, evaluating demand signals, inventory risk, and competitive behavior in near real time. This allows retailers to make smaller, more controlled price adjustments that prevent the need for disruptive corrections later. Over time, this approach stabilizes both margin and customer perception.

Retailers that fail to adopt continuous optimization will find themselves stuck in cycles of overreaction. Those that succeed will use volatility as an input, not a threat, embedding pricing discipline into everyday operations.

Price elasticity modeling continues to mature, but its role expands significantly in 2026. In earlier stages, elasticity was often treated as a static SKU level attribute, updated infrequently and applied uniformly. This approach is no longer sufficient in a market where demand sensitivity changes rapidly based on context.

In 2026, elasticity becomes contextual rather than purely product based. Pricing teams increasingly evaluate elasticity through the lens of timing, fulfillment promise, inventory availability, competitive intensity, and customer behavior. A product may be price sensitive in one context and resilient in another. Modern elasticity models reflect this reality by updating continuously and incorporating multiple dimensions beyond historical price response.

Retailers that continue to rely on category averages or infrequent elasticity updates risk systematic pricing errors. Those that invest in dynamic elasticity modeling gain the confidence to raise prices where demand is resilient and apply minimal, precise discounts where stimulation is truly required.

Stock status has already proven its importance in pricing decisions, but in 2026 its role becomes predictive rather than descriptive. Instead of reacting to excess or scarcity after it appears, pricing systems increasingly act on forecasted inventory risk.

Predictive inventory driven pricing allows retailers to intervene earlier in the product lifecycle. Slow moving items are identified weeks in advance, enabling shallow, controlled price adjustments that prevent deep clearance later. Conversely, products projected to face scarcity can maintain price integrity with greater confidence, protecting margin without sacrificing conversion.

This shift fundamentally changes the economics of pricing. Clearance becomes a managed outcome rather than a forced response, and margin protection improves as fewer products reach distressed pricing stages.

Clearance pricing does not disappear in 2026, but its execution becomes far more disciplined. One of the most consistent lessons from recent years is that late clearance destroys margin. In response, retailers move clearance logic upstream.

In 2026, analytics identify clearance risk earlier, often while products are still selling at acceptable rates. Pricing teams apply targeted adjustments designed to improve velocity without signaling distress. As a result, clearance windows become shorter, more decisive, and more profitable.

Success in clearance pricing is increasingly measured by margin recovery rather than inventory liquidation alone. This reframes clearance from an operational necessity into a controllable pricing phase with defined objectives and accountability.

Automation continues to expand its role in pricing, but 2026 marks a shift from rule execution to intelligent autonomy. Rule based systems remain important, especially for governance and guardrails, but AI driven engines increasingly recommend and execute price changes within approved boundaries.

This evolution reduces reliance on manual intervention, which has historically introduced inconsistency and emotional decision making. Automated systems apply logic uniformly, responding proportionally to demand, competition, and inventory signals. Human teams shift their focus upstream toward policy design, performance analysis, and exception handling.

Retailers that resist automation maturity will struggle to scale pricing discipline across large assortments and multiple channels. Those that embrace autonomy gain speed without sacrificing control.

Uniform pricing across channels and regions continues to lose effectiveness in 2026. Customer behavior, inventory availability, and fulfillment economics vary too widely for one size fits all pricing strategies to perform optimally.

Retailers increasingly differentiate pricing by region, fulfillment zone, or store cluster. Local demand strength, local stock exposure, and service levels shape price tolerance, and pricing systems reflect this nuance more accurately. Products with fast delivery or convenient pickup often support higher prices, while slower or constrained regions require different strategies.

This contextual approach improves both margin and customer relevance. Omnichannel pricing in 2026 prioritizes alignment with reality over internal simplicity.

Competitive pricing remains important, but its role becomes more selective and strategic. In prior years, many retailers matched competitor price changes reflexively, often eroding margin without improving performance. In 2026, competitive intelligence evolves toward anticipation rather than reaction.

Advanced models identify which competitor moves are meaningful and which represent noise. Pricing teams learn when not to respond, preserving margin where differentiation exists. Predictive signals highlight patterns in competitor behavior, allowing retailers to position prices proactively instead of defensively.

This disciplined approach reduces price wars and strengthens long term pricing stability.

As pricing grows more dynamic, customer trust becomes a limiting factor. Retailers learn that optimization without consistency damages brand equity and long term loyalty.

In 2026, successful pricing strategies balance flexibility with transparency. Prices may change frequently, but the logic behind them remains consistent. Customers respond positively to availability, service quality, and clarity, even when prices are not the lowest.

Strong governance ensures that optimization does not undermine credibility. Trust becomes a competitive advantage rather than an afterthought.

Technology alone does not determine pricing success in 2026. Organizational alignment plays an equally critical role.

Pricing decisions increasingly intersect with merchandising, supply chain, marketing, and finance. Retailers that establish clear ownership, shared objectives, and escalation paths execute faster and with fewer conflicts. Executive sponsorship ensures that pricing investments receive the priority they require.

Pricing maturity emerges as an enterprise capability, not a departmental function.

The metrics used to evaluate pricing performance continue to evolve. In 2026, retailers emphasize quality of revenue rather than volume alone.

Margin per unit, inventory exposure, markdown efficiency, price realization, and conversion stability become central indicators. These KPIs reward disciplined pricing behavior and discourage short term volume chasing that undermines profitability.

Measurement reinforces strategy, ensuring that pricing decisions align with long term goals.

Preparation for 2026 begins immediately. Retailers that delay investment in pricing intelligence and automation will find the gap difficult to close.

Organizations should modernize elasticity modeling, integrate pricing with inventory forecasting, expand automation responsibly, and strengthen cross functional alignment. These steps create the foundation for predictive, disciplined pricing execution.

The work required is substantial, but the payoff is sustained competitive advantage.

The 2026 Pricing Outlook confirms that the era of reactive pricing is ending. Retailers and brands that succeed will be those that embed pricing intelligence into daily operations, anticipate risk before it materializes, and execute decisions with consistency and confidence. Pricing excellence in 2026 is defined by foresight, not speed alone.

tgndata helps retailers build this level of pricing maturity through advanced analytics, predictive intelligence, and automation designed for continuous optimization. Contact us to prepare your pricing strategy for 2026 and beyond.

We use cookies to provide you with an optimal experience, for marketing and statistical purposes only with your consent, which you may revoke at any time. Please refer to our Privacy Policy for more information.

Missing an important marketplace?

Send us your request to add it!