- Product

- Solution for

For Your Industry

- Plans & Pricing

- About us

- Resources

For Your Industry

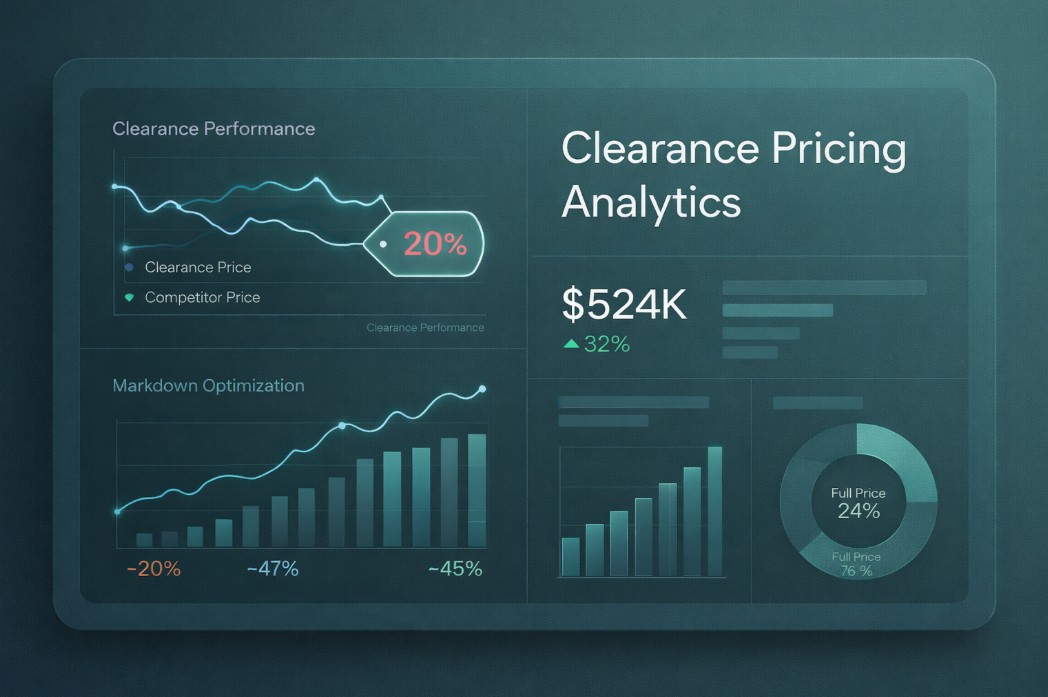

Clearance does not have to mean surrendering margin. In fact, clearance periods often reveal hidden pricing power that goes unrealized due to rushed decisions and limited analytics. By understanding demand signals, inventory exposure, elasticity, and competitive behavior, retailers can design clearance pricing strategies that balance speed and profitability. This article explores how clearance pricing analytics works, why retailers lose margin during clearance, and how to build a disciplined framework that maximizes value even at the end of the product lifecycle.

Clearance pricing failures rarely stem from lack of effort. They are usually the result of structural issues in how pricing decisions are made under pressure.

One of the most common mistakes is applying uniform markdown percentages across broad categories. This ignores SKU level differences in demand, elasticity, and remaining inventory. Some products sell easily with shallow discounts, while others require deeper reductions. Treating them the same leads to unnecessary margin loss.

Retailers often delay clearance action until inventory risk becomes obvious. By the time markdowns are applied, the only remaining option is deep discounting. Early analytics driven interventions reduce the need for drastic price cuts later.

Many clearance strategies rely on age or seasonality alone. Without demand analytics, retailers cannot distinguish between slow sellers due to price resistance and those affected by temporary visibility or availability issues.

Clearance pricing frequently happens without understanding how competitors are pricing similar products. This leads to discounts that overshoot market requirements and erode margin unnecessarily.

Clearance pricing analytics addresses these issues by replacing reactive decisions with structured, data driven logic.

Clearance pricing analytics is the systematic use of data to guide pricing decisions for aging or excess inventory. Its goal is not just liquidation, but optimized liquidation.

Traditional clearance focuses on clearing stock as fast as possible. Clearance pricing analytics focuses on clearing stock at the highest achievable margin within a defined time horizon.

Analytics enables pricing decisions at SKU or variant level rather than category level. This precision uncovers opportunities to preserve margin on items that still have pricing power.

Clearance pricing analytics is not static. Prices adjust based on sell through, demand response, inventory risk, and competitive changes.

Clearance pricing analytics aligns pricing with inventory exposure, lifecycle stage, and replenishment outlook.

By shifting the mindset from clearance as a failure to clearance as a managed process, retailers gain control over one of the most margin sensitive phases of retail operations.

Effective clearance pricing depends on the quality and breadth of data inputs.

Retailers must understand how much stock remains, how long it has been held, and how quickly it must be sold. Metrics such as days of supply and weeks of cover are critical.

Past performance reveals how similar products responded to price changes and promotions. This context informs expected clearance behavior.

Elasticity data indicates how sensitive demand is to price reductions. Highly elastic SKUs may respond strongly to small discounts, while inelastic items may require alternative strategies.

Traffic, conversion, add to cart rates, and search behavior provide immediate feedback on clearance effectiveness.

Competitor clearance activity sets market expectations. Analytics help retailers position prices appropriately without over discounting.

Clearance performance often varies by channel and location. Granular data enables localized pricing decisions.

When these inputs are unified, clearance pricing becomes a controlled, analytical process rather than an emergency response.

Clearance shoppers behave differently from full price shoppers, and pricing analytics must account for these differences.

Clearance customers are highly value focused, but not all are equally price sensitive. Some prioritize availability, size, or convenience over the lowest price.

During clearance, customers often accept substitutes more readily. Pricing analytics can leverage this by adjusting relative prices across similar SKUs.

Seasonal goods often face hard deadlines, while evergreen products can sell over longer horizons. Pricing urgency should reflect this difference.

Clearance demand is influenced by merchandising and placement. A lack of sales may reflect poor visibility rather than price resistance.

Analytics that incorporate these behavioral factors reduce the risk of over discounting.

Margin leakage during clearance usually occurs because retailers apply discounts without understanding true demand response.

Analytics often reveal that certain SKUs continue to sell at higher prices despite age. Holding price on these items preserves margin without harming sell through.

Rather than defaulting to 30 or 50 percent discounts, analytics determine the minimum effective price reduction needed to trigger demand.

Gradual, data driven markdown sequences outperform single deep cuts. Analytics help retailers time each adjustment for maximum impact.

Once sell through improves or inventory risk falls, discounts should be reduced or removed. Automated analytics driven rules prevent discounts from running longer than necessary.

These practices collectively reduce margin loss while still achieving clearance objectives.

Clearance pricing should be viewed as a phase within the broader product lifecycle.

Identifying underperforming products early allows for smaller, more controlled price adjustments. This often avoids extreme end of season clearance.

Not all aged inventory is equal. Some products still attract demand with the right price, while others require aggressive action. Analytics helps distinguish between the two.

Products nearing end of life require different pricing logic than those with extended relevance. Clearance pricing analytics adapts to lifecycle timing.

Effective clearance analytics reduce the volume of stock carried into the next season, improving cash flow and reducing operational complexity.

Lifecycle aligned clearance pricing improves both financial and operational outcomes.

Competitive context is essential during clearance periods.

Analytics reveal how aggressively competitors discount similar products and when they do so.

Matching competitor clearance prices without understanding demand often destroys margin. Analytics help identify when matching is truly necessary.

Reacting immediately to competitor markdowns is not always optimal. Analytics support strategic timing of responses.

In some cases, maintaining higher prices is justified if service, availability, or brand value differs.

Competitive intelligence ensures clearance pricing aligns with market reality without defaulting to the lowest price.

Clearance does not have to mean margin surrender. With the right analytics, retailers can manage excess inventory intelligently, accelerate sell through, and preserve far more profit than traditional clearance approaches allow. Clearance pricing analytics replaces broad, reactive markdowns with precision, timing, and insight. By integrating demand signals, elasticity, competitive context, and automation, retailers transform clearance from a cost center into a controlled optimization process.

tgndata helps retailers implement advanced clearance pricing analytics that protect margins while reducing inventory risk. Contact us to turn clearance into a strategic pricing advantage.

We use cookies to provide you with an optimal experience, for marketing and statistical purposes only with your consent, which you may revoke at any time. Please refer to our Privacy Policy for more information.

Missing an important marketplace?

Send us your request to add it!