- Product

- Solution for

For Your Industry

- Plans & Pricing

- About us

- Resources

For Your Industry

Competitive pricing is no longer reactive. In fast moving digital markets, brands and retailers need a structured competitive price monitoring process that translates market signals into pricing decisions. Without it, teams chase noise, miss margin opportunities, and lose price perception control.

This guide breaks down how to build a competitive price monitoring process in six practical steps that scale with your category complexity.

The first step in a competitive price monitoring process is defining clear objectives. Decide whether your goal is protecting margin, maintaining price index leadership, supporting promotions, or enforcing MAP compliance. Without a defined purpose, monitoring creates noise instead of strategic insight.

Most organizations start tracking competitor prices without defining why.

That creates a reality gap. Data volume increases, but decision clarity does not.

Before collecting a single price point, align on:

Are you defending a price index position?

Are you identifying underpriced SKUs?

Are you protecting premium positioning?

Are you detecting unauthorized discounting?

Situation: A retailer tracks 20,000 SKUs daily.

What breaks: Analysts drown in data. No prioritization.

What changes with clarity: They focus on 2,000 price-sensitive SKUs that drive 80 percent of revenue.

Strategic takeaway: Monitoring must be tied to revenue impact, not catalog size.

A focused objective defines your monitoring scope, cadence, and reporting model.

Selecting the right competitors and SKUs ensures monitoring efforts focus on decision critical price signals. Prioritize direct competitors, marketplace sellers, and price leaders. Then identify high revenue, high elasticity, or high visibility products that influence price perception.

Not all competitors matter equally.

Direct assortment competitors

Marketplace price disruptors

Promotional aggressors

Regional specialists

Traffic drivers

High margin products

Private label items

Promotional anchors

If your price index fluctuates heavily, check whether you are tracking irrelevant competitors or low impact SKUs.

Situation: A brand monitors global retailers equally.

What breaks: European discounting distorts US strategy.

What changes: Monitoring is segmented by region and channel.

Strategic takeaway: Competitive price monitoring must reflect market structure, not organizational charts.

Accurate SKU matching and normalization become critical here. This is where validation layers, such as tgndata help ensure competitor comparisons are product equivalent and not mismatched variants.

Data collection in a competitive price monitoring process can be manual, scraped, API based, or platform driven. Automated systems improve accuracy and frequency, but require data normalization and validation to ensure reliable price comparisons.

There are three primary approaches:

Useful for small catalogs. Unsustainable at scale.

Automated but often unstable without monitoring.

Provide SKU matching, validation, and structured reporting.

The real risk is not automation failure. It is inaccurate data.

Variant mismatches

Currency misalignment

Shipping cost exclusion

Promotional price misclassification

Cause → Effect → Scale Narrative

Inaccurate inputs distort price index. Distorted price index drives incorrect pricing reactions. Incorrect pricing reactions compress margin.

Data normalization

Alert thresholds

Price change detection

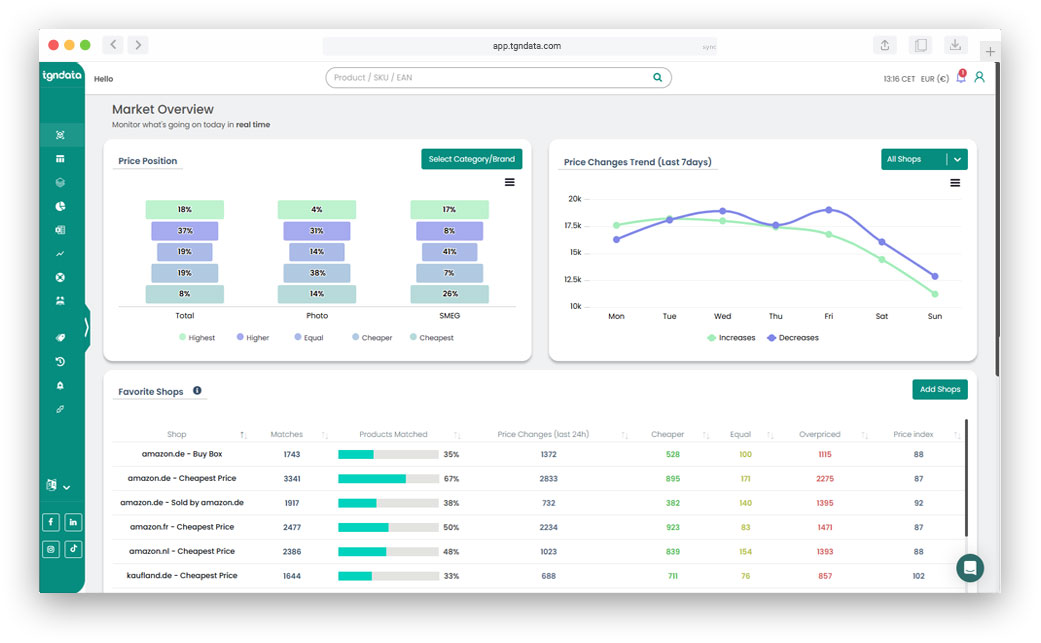

Platforms like tgndata act as operational monitoring systems, ensuring competitive price feeds remain clean and decision ready.

A competitive price monitoring process requires defined frequency and clear ownership. High volatility categories may require daily tracking, while stable industries may operate weekly. Governance ensures insights convert into actions rather than static reports.

Monitoring without ownership becomes reporting.

Who reviews competitor alerts

Who approves price changes

What thresholds trigger action

How frequently reports are reviewed

Situation: Daily monitoring, no action framework.

What breaks: Teams ignore alerts.

What changes: Price change threshold set at 5 percent deviation.

Strategic takeaway: Governance reduces alert fatigue and improves execution speed.

Daily tactical review

Weekly strategic adjustment

Monthly price index analysis

Competitive price monitoring only creates value when insights drive pricing decisions. Use price index thresholds, elasticity models, and margin guardrails to determine when to match, hold, or differentiate.

Data without decision logic is noise.

Create decision trees:

If competitor price drops and elasticity is high → consider matching.

If competitor drops but margin is constrained → protect profit.

If you lead on brand equity → maintain premium gap.

Situation: Competitors discount aggressively.

What breaks: Brand perception erodes when matching discounts.

What changes: Monitoring used to enforce MAP compliance, not price matching.

Strategic takeaway: Not every price gap requires a response.

This is where structured pricing intelligence, supported by platforms like tgndata, helps align monitoring with business rules rather than emotional reactions.

| Feature | Business Benefit | KPI Impact | Role Owner |

|---|---|---|---|

| Automated price tracking | Reduced manual workload | Faster reaction time | Pricing Manager |

| SKU matching validation | Accurate competitor comparison | Stable price index | eCommerce Analyst |

| Alert thresholds | Controlled price adjustments | Margin protection | Category Manager |

| Price index dashboard | Strategic visibility | Revenue optimization | Pricing Director |

| Historical price tracking | Trend forecasting | Promotional ROI | Brand Strategist |

Situation: Reactive repricing every hour.

What breaks: Margin erosion.

What changes: Monitoring tied to margin guardrails.

Strategic takeaway: Optimization requires balance between competitiveness and profitability.

Continuous improvement may involve refining SKU lists, adjusting competitor sets, or integrating forecasting models.

A competitive price monitoring process is a structured system for tracking competitor prices, analyzing price gaps, and integrating insights into pricing decisions. It includes competitor selection, SKU matching, data collection, governance, and KPI tracking to improve margin and price index performance.

Select competitors based on direct assortment overlap, price leadership, promotional aggressiveness, and regional relevance. Avoid tracking irrelevant players that distort your price index and distract from revenue-driving SKUs.

Frequency depends on category volatility. High velocity ecommerce categories may require daily tracking, while stable B2B markets may operate weekly. Align cadence with margin risk and promotional intensity.

Key metrics include price index, gross margin, revenue growth, conversion rate, and promotional lift. Monitoring effectiveness is measured by both competitiveness and profitability outcomes.

Building offers control but requires maintenance and data expertise. Buying accelerates deployment and improves validation. Hybrid models often provide the best balance between flexibility and reliability.

Use elasticity analysis and margin guardrails before reacting. Not every competitor price drop requires matching. Structured decision trees prevent emotional or reactive repricing.

A competitive price monitoring process is not about collecting more data. It is about building a structured, governed, and validated system that converts market signals into margin protected pricing decisions.

When objectives are clear, competitor sets are strategic, data is accurate, and governance is defined, monitoring becomes a strategic lever.

For organizations scaling complexity, tgndata acts as an operational backbone that ensures price intelligence remains accurate, actionable, and aligned with business KPIs.

The difference between tracking prices and owning your market position lies in process discipline.

We use cookies to provide you with an optimal experience, for marketing and statistical purposes only with your consent, which you may revoke at any time. Please refer to our Privacy Policy for more information.

Missing an important marketplace?

Send us your request to add it!