- Product

- Solution for

For Your Industry

- Plans & Pricing

- About us

- Resources

For Your Industry

The weeks leading up to Christmas represent the most margin-sensitive period of the retail year. Demand surges, competitor activity intensifies, and pricing decisions made in this window can determine whether the season ends as a profit driver or a margin drain. Many retailers rely on promotional calendars or intuition when adjusting prices before Christmas, yet the most successful organizations use elasticity data to guide every pricing move. Understanding how shoppers respond to price changes at a granular level allows retailers to raise prices where demand is resilient, discount only where necessary, and avoid unnecessary margin erosion during peak demand.

Elasticity data reveals where pricing power exists and where it does not. In the pre-Christmas period, this insight becomes especially valuable because consumer urgency, gifting behavior, and inventory pressure distort normal purchasing patterns. Retailers who use elasticity data strategically can convert demand volatility into a margin opportunity rather than a risk. This article explains how elasticity works, how it changes before Christmas, and how retailers can operationalize elasticity-driven pricing to maximize margins without sacrificing conversion.

Price elasticity measures how sensitive demand is to price changes. While elasticity is relevant year round, it becomes far more powerful in the weeks before Christmas due to shifts in consumer behavior and market dynamics.

As Christmas approaches, many shoppers become less price sensitive. The need to secure gifts on time outweighs the desire to find the lowest possible price. This creates temporary pockets of inelastic demand where prices can increase modestly without harming sales volume.

Retailers flood the market with promotions during the holiday season. Without elasticity data, teams often match or beat competitor discounts unnecessarily. Elasticity insight helps distinguish between price moves that truly affect demand and those that do not.

Over discounting high demand items can result in stockouts and lost revenue, while under discounting slow moving inventory can leave retailers with excess stock after Christmas. Elasticity data helps align price moves with inventory reality.

A one or two percent pricing mistake in December can translate into millions in lost margin. Elasticity driven pricing minimizes guesswork and improves financial outcomes.

Before Christmas, elasticity data is not just an analytical metric. It is a strategic tool for protecting profitability during the most important sales period of the year.

Elasticity behaves differently during the holiday season than it does during regular trading periods. Retailers must account for these differences to avoid misinterpretation.

Demand sensitivity shifts as Christmas approaches. Items that were highly elastic in October may become far less elastic in mid-December due to the urgency of holiday shopping, gifting deadlines, and limited substitutes.

Not all products experience the same demand patterns. For example, must-have toys, popular electronics, and branded gifts often show low elasticity near Christmas, while discretionary accessories and non-seasonal items remain more price sensitive.

Products with guaranteed fast delivery or in store pickup often tolerate higher prices. Customers are willing to pay a premium for certainty as shipping deadlines approach.

Gift driven purchases carry emotional weight. Shoppers are less likely to abandon carts over small price differences when buying for loved ones.

Recognizing these holiday specific elasticity dynamics is critical for accurate pricing decisions.

Before retailers can use elasticity data effectively, they must establish a reliable analytical foundation.

Elasticity modeling requires accurate records of price changes and corresponding demand outcomes. This includes promotions, markdowns, and competitor driven price shifts.

Category level averages hide important variation. Elasticity should be measured at the SKU or product cluster level to support precise decisions.

Understanding elasticity without competitive context is incomplete. Retailers need visibility into competitor pricing to separate true demand response from market driven shifts.

Elasticity interpretation must consider stock levels. A drop in demand may reflect availability constraints rather than price sensitivity.

Pre Christmas pricing decisions benefit from frequent updates. Elasticity models should refresh as new demand data becomes available.

A strong data foundation ensures elasticity insights are actionable rather than theoretical.

Elasticity data allows retailers to identify where margin can be expanded safely before Christmas.

When elasticity is low, demand does not decline significantly with price increases. These SKUs represent prime margin expansion opportunities, especially when inventory is limited.

Elasticity analysis often reveals that some items maintain strong conversion even at higher prices. Discounting these products reduces margin without driving incremental volume.

For elastic products, elasticity data helps determine the minimum discount required to stimulate demand. This prevents over discounting while still driving sales.

Retailers can focus pricing efforts on SKUs where elasticity changes produce meaningful financial impact, rather than spreading effort evenly across the catalog.

Using elasticity data shifts pricing from reactive discounting to proactive margin optimization.

Elasticity insights must be translated into operational pricing actions. The following use cases demonstrate how retailers can apply elasticity data before Christmas.

When elasticity data shows low price sensitivity and demand is strong, retailers can raise prices slightly or remove promotional discounts. This is especially effective for:

Popular branded gifts

Limited inventory SKUs

Items with few substitutes

Products tied to specific trends or releases

These adjustments often generate incremental margin without reducing conversion.

Highly elastic products benefit from carefully calibrated discounts. Elasticity data helps retailers determine the optimal markdown depth needed to drive incremental volume.

Elasticity changes as Christmas approaches. Retailers can delay promotions on inelastic items until demand softens, preserving margin earlier in the season.

Elasticity data often shows lower sensitivity for items with guaranteed delivery or pickup. Retailers can price these SKUs higher as shipping deadlines approach.

Elasticity insights help determine which bundles increase perceived value without requiring deep discounts on core items.

These actions demonstrate how elasticity data translates into real margin gains.

Elasticity data becomes even more powerful when combined with inventory intelligence.

When inventory is constrained and elasticity is low, retailers should protect or increase prices. This maximizes margin and prevents premature stockouts.

Excess stock combined with high elasticity signals the need for targeted markdowns to accelerate sell through.

Size, color, or configuration level elasticity often differs. Retailers can discount only the variants that require stimulation while holding price on others.

Using elasticity data before Christmas helps clear vulnerable inventory early, reducing the need for deep markdowns after the holiday.

Inventory aligned elasticity pricing improves both margin and operational efficiency.

Manual pricing processes cannot keep up with the speed and complexity of pre-Christmas demand. Automation is essential for executing elasticity-based decisions.

Automated systems can update elasticity estimates as new demand data arrives, ensuring decisions reflect current behavior.

Retailers can encode elasticity thresholds into pricing rules, such as increasing price when elasticity falls below a defined level.

Automation applies elasticity insights consistently across thousands of SKUs and multiple channels.

Automated guardrails ensure that price increases and discounts remain within approved margin and brand limits.

Automation turns elasticity insights into consistent, repeatable pricing actions.

Elasticity behavior varies widely across retail categories during the pre-Christmas period.

Toys and seasonal gifts

These items often become highly inelastic as Christmas approaches, especially for trending or limited availability products.

Consumer electronics

Elasticity varies by brand and model. Flagship products often tolerate price increases, while older models remain more elastic.

Apparel

Elasticity remains relatively high for fashion-driven items, though urgency increases for occasion wear and gifts.

Beauty and personal care

Gift sets may show reduced elasticity closer to Christmas, while replenishment items remain price sensitive.

Understanding category-level patterns improves elasticity interpretation and pricing accuracy.

Even with strong analytics, retailers can misapply elasticity insights.

Treating elasticity as fixed

Failing to update elasticity during the holiday season leads to outdated decisions.

Ignoring competitive context

Elasticity must be interpreted alongside competitor pricing to avoid false conclusions.

Over-generalizing results

Category-level elasticity masks important SKU-level differences.

Using elasticity without an inventory context

Price sensitivity alone does not determine optimal pricing. Inventory risk must be considered.

Avoiding these mistakes ensures elasticity data delivers its full value.

The weeks before Christmas offer unparalleled revenue opportunity and equally significant margin risk. Elasticity data provides the clarity retailers need to navigate this complexity with confidence. By identifying where demand is resilient, where discounts truly drive volume, and how price sensitivity shifts as urgency increases, retailers can make smarter pricing decisions that protect profitability. When combined with inventory intelligence, competitive monitoring, and automation, elasticity driven pricing becomes one of the most powerful tools for maximizing margins before Christmas.

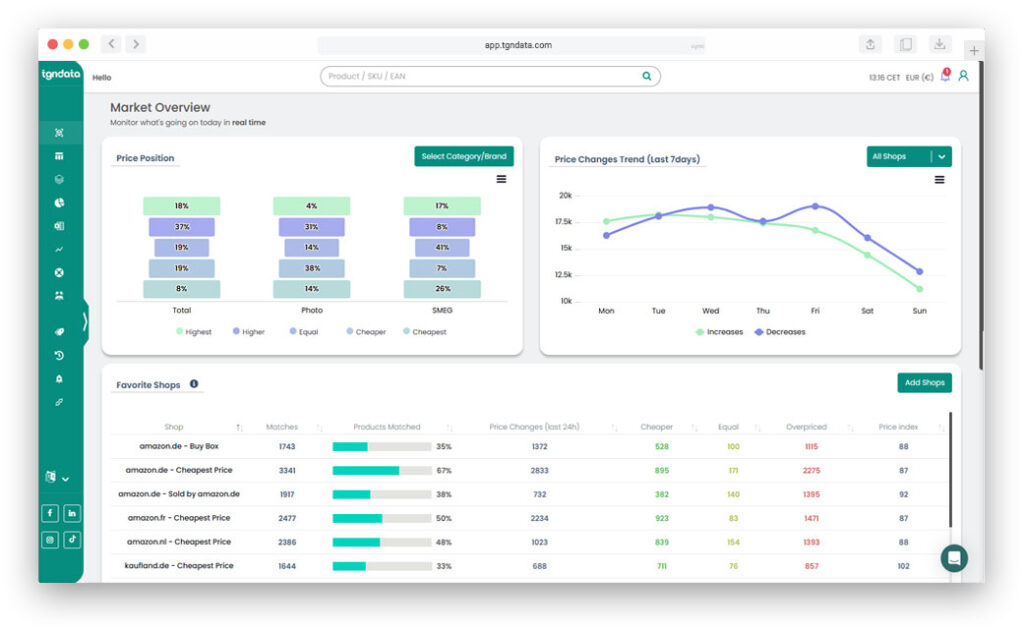

tgndata helps retailers unlock this value through advanced elasticity modeling, real time pricing intelligence, and automated execution. Contact us to transform your pre Christmas pricing strategy into a margin driven advantage.

We use cookies to provide you with an optimal experience, for marketing and statistical purposes only with your consent, which you may revoke at any time. Please refer to our Privacy Policy for more information.

Missing an important marketplace?

Send us your request to add it!