- Product

- Solution for

For Your Industry

- Plans & Pricing

- About us

- Resources

For Your Industry

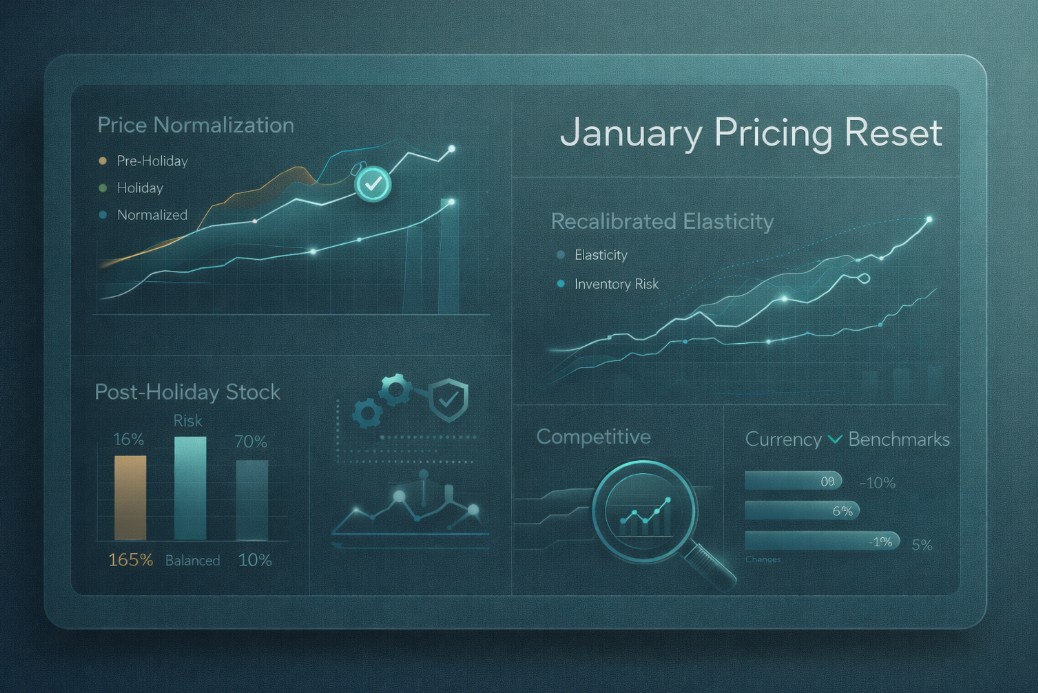

January is unique because it represents a sharp transition between two fundamentally different demand environments. December pricing behavior is driven by urgency, gifting psychology, fulfillment deadlines, and heavy promotional pressure. January demand, by contrast, reflects normalized consumer behavior, reduced promotional intensity, and renewed price sensitivity in many categories.

During the holiday period, retailers intentionally distort pricing signals to drive volume. Promotions are deeper, competitive responses are faster, and inventory constraints often override margin considerations. These conditions are temporary by design, yet the data generated during this period remains embedded in pricing systems unless it is explicitly corrected.

If holiday data is treated as representative of normal demand, pricing models will misinterpret customer behavior. Products may appear far more elastic than they truly are, or demand may seem artificially strong or weak depending on stock availability during peak periods. January is the moment to separate exceptional behavior from baseline reality.

In addition, January is when executive teams finalize annual plans, margin targets, and investment priorities. Pricing data that is inaccurate or polluted undermines these decisions from the outset. A January reset ensures that strategic planning is grounded in clean, trustworthy inputs rather than seasonal distortion.

Clean pricing data is often misunderstood as simply accurate prices or corrected errors. In reality, clean data is about signal quality. It reflects true customer willingness to pay, current market conditions, and operational reality rather than short lived anomalies.

Clean pricing data has several defining characteristics. It excludes expired promotions and one time holiday markdowns. It aligns demand metrics with stable price points. It reflects actual availability rather than stock constrained sales. It incorporates competitive prices that are still active and relevant. Most importantly, it supports reliable inference about cause and effect.

Without clean data, even advanced pricing analytics produce misleading outputs. Elasticity estimates become inflated. Competitive indices exaggerate pressure. Forecasts become unstable. A January pricing reset is the process of restoring analytical truth, not merely cleaning spreadsheets.

The holiday period introduces multiple layers of distortion that must be actively corrected.

Promotions inflate demand at discounted prices, making products appear highly price sensitive. In reality, much of this demand is driven by urgency and gifting necessity rather than price alone. If this behavior feeds elasticity models unchecked, those models will recommend unnecessary discounts in January and February.

Stockouts distort demand signals in the opposite direction. When popular items sell out quickly, recorded demand understates true willingness to pay. Pricing models may incorrectly infer low demand or low pricing power where scarcity was the true driver.

Competitive benchmarks are also distorted. Many competitors run short term promotions that disappear in early January. If these prices remain in competitive datasets, retailers feel pressure to match discounts that no longer exist.

Finally, fulfillment constraints during peak periods alter substitution behavior. Customers may accept higher prices or different products due to delivery deadlines. This behavior rarely persists into January.

A pricing reset removes these distortions and restores logical consistency to pricing models.

The foundation of any January pricing reset is a comprehensive audit of recent price history.

Retailers must first identify which price changes were promotional, which were reactive, and which represented intentional base price moves. This requires accurate promotional flags and clear documentation of pricing actions. Without this clarity, models cannot distinguish between strategic pricing and tactical discounting.

Normalization involves restoring base prices where appropriate and ensuring that historical price series accurately reflect what customers experienced. Temporary markdowns should not permanently influence baseline pricing assumptions. In some cases, it may be appropriate to exclude holiday weeks entirely from analytical models.

This step is often underestimated, yet it is the most critical. If price history is incorrect or ambiguous, every downstream pricing decision is compromised.

Once price history is normalized, demand metrics must be recalibrated to reflect post holiday reality.

January demand should not be compared directly to December peaks. Traffic, conversion rates, and units sold must be rebaselined using recent, stable periods. This allows pricing teams to distinguish between true performance changes and seasonal normalization.

Rebaselining often reveals that some products maintain strong demand even without discounts, indicating pricing power that was hidden during promotional periods. Conversely, other products may show sharp declines once promotions end, signaling reliance on discounting.

This insight is critical for early year pricing decisions. Without rebaselining, retailers risk overreacting to normal post holiday slowdowns and unnecessarily cutting prices.

Elasticity models are among the most vulnerable to holiday distortion.

During the holidays, urgency, gifting behavior, and limited substitutes reduce price sensitivity. Elasticity estimates derived from this period systematically overstate responsiveness to price changes. If these models are not reset, they often recommend excessive discounts in early Q1.

A January reset involves retraining or refreshing elasticity models using clean, normalized data. Retailers may exclude holiday weeks entirely, apply lower weights to promotional periods, or introduce structural adjustments that account for seasonal effects.

This reset restores elasticity models to their intended purpose: measuring how demand responds to price under normal conditions. Accurate elasticity is one of the strongest drivers of margin protection throughout the year.

Competitive pricing data collected during the holidays becomes obsolete quickly.

Many competitors remove promotions in early January, reduce assortment breadth, or shift focus to different categories. Pricing teams must validate which competitors remain relevant and which prices still influence customer perception.

A January reset includes refreshing competitor mappings, removing expired promotional prices, and reestablishing competitive indices based on current market conditions. This prevents unnecessary price matching and reduces exposure to price wars that no longer reflect reality.

Competitive benchmarks should represent current alternatives, not historical promotions.

Inventory dynamics change sharply after the holidays.

Some products face excess stock due to overbuying or slower than expected sell through. Others exit the season cleanly and no longer require pricing attention. Pricing decisions must align with this new reality.

A pricing reset integrates updated stock levels, days of supply, and replenishment outlooks into pricing logic. Products with healthy stock can maintain price integrity. Products with elevated exposure may require controlled, targeted adjustments.

This alignment prevents reactive clearance and supports more profitable inventory management throughout Q1 and beyond.

Manual pricing resets are slow, inconsistent, and error prone, especially for large assortments.

Pricing automation platforms significantly improve reset execution by enforcing rules consistently, removing expired promotions automatically, and reapplying baseline pricing logic at scale. Automation also ensures that margin guardrails and brand constraints are respected during the reset process.

Perhaps most importantly, automation allows pricing teams to focus on analysis and strategy rather than manual cleanup. This turns the January reset from a one time fire drill into a repeatable operational capability.

Even experienced pricing teams make avoidable errors in January.

One common mistake is reacting too quickly to post holiday demand slowdowns without first resetting data. Normal seasonal normalization is mistaken for underperformance, triggering unnecessary discounts.

Another frequent error is continuing to rely on holiday elasticity signals too long. This leads to excessive promotional activity in early Q1.

Many retailers also fail to refresh competitive benchmarks, leaving expired discounts in their pricing logic.

The most fundamental mistake is treating January as business as usual rather than as a transition period requiring deliberate recalibration.

The benefits of a January pricing reset extend far beyond Q1.

Clean data improves elasticity accuracy, which supports better decisions during promotions, peak periods, and clearance events later in the year. It strengthens inventory driven pricing by aligning decisions with true demand rather than noise. It improves forecasting, budgeting, and scenario modeling.

Retailers that start the year with clean data make fewer reactive decisions and maintain stronger pricing discipline during periods of stress.

Margin management is often discussed in the context of promotions or peak periods, but its foundation is set in January.

When pricing decisions in early Q1 are based on distorted data, margin leakage accumulates gradually and becomes difficult to reverse later. Conversely, a clean reset creates a margin positive bias that compounds throughout the year.

Retailers that perform structured pricing resets consistently show stronger price realization, fewer emergency markdowns, and lower clearance dependency.

A January pricing reset is not purely a pricing team exercise. It requires coordination across merchandising, supply chain, finance, and analytics functions.

Clear ownership, defined timelines, and shared objectives improve execution quality. Leadership sponsorship ensures that the reset is prioritized and not rushed.

Retailers that treat the reset as a cross functional initiative achieve more durable results.

To ensure the reset delivers value, retailers should track a focused set of metrics.

Key indicators include margin per unit, price realization versus recommendation, conversion stability, inventory turnover, markdown efficiency, and forecast accuracy. Improvements in these KPIs confirm that pricing decisions are grounded in clean data.

Monitoring these metrics reinforces confidence and highlights areas requiring further refinement.

Leading retailers formalize the January pricing reset as a repeatable process.

They define which data is excluded, adjusted, or reweighted. They document decision logic and automate execution where possible. They review outcomes and refine the process each year.

This repeatability ensures that pricing data quality improves over time rather than degrading.

Pricing maturity is not achieved through isolated improvements. It is built through disciplined processes that reinforce good decision making.

The January pricing reset is one of the most important of these processes. It establishes analytical integrity, strengthens trust in pricing systems, and supports confident decision making throughout the year.

Retailers that consistently execute strong resets develop a structural advantage over time.

A January retail pricing reset is not a housekeeping exercise. It is a strategic requirement for any retailer that wants to price with confidence, protect margin, and avoid reactive decision making. By cleaning price history, rebaselining demand, refreshing elasticity, validating competition, and aligning pricing with inventory reality, retailers create a reliable foundation for the year ahead.

Retailers that invest in this reset start the year with clarity instead of noise.

tgndata helps retailers execute January pricing resets with advanced pricing intelligence, automation, and analytics designed to restore data quality and support disciplined pricing decisions all year long. Contact us to start the year with clean data and stronger margins.

We use cookies to provide you with an optimal experience, for marketing and statistical purposes only with your consent, which you may revoke at any time. Please refer to our Privacy Policy for more information.

Missing an important marketplace?

Send us your request to add it!