- Product

- Solution for

For Your Industry

- Plans & Pricing

- About us

- Resources

For Your Industry

January is not just another trading month. It is a structural reset for retail pricing.

Key characteristics of January include:

Demand normalization after holiday peaks

Consumer price sensitivity driven by post holiday budgets

Elevated inventory levels from Q4

Reduced promotional noise compared to November and December

Increased competitor price divergence

Because of these dynamics, January pricing performance often sets the tone for Q1 margin health.

Retailers that benchmark pricing correctly in January gain early clarity on whether they are positioned for profitable growth or margin pressure.

Normal pricing does not mean uniform pricing or industry averages applied blindly.

In retail, “normal” means:

Prices aligned with market expectations

Competitive positioning consistent with brand strategy

Promotions scaled back but not eliminated

Margin recovery without demand collapse

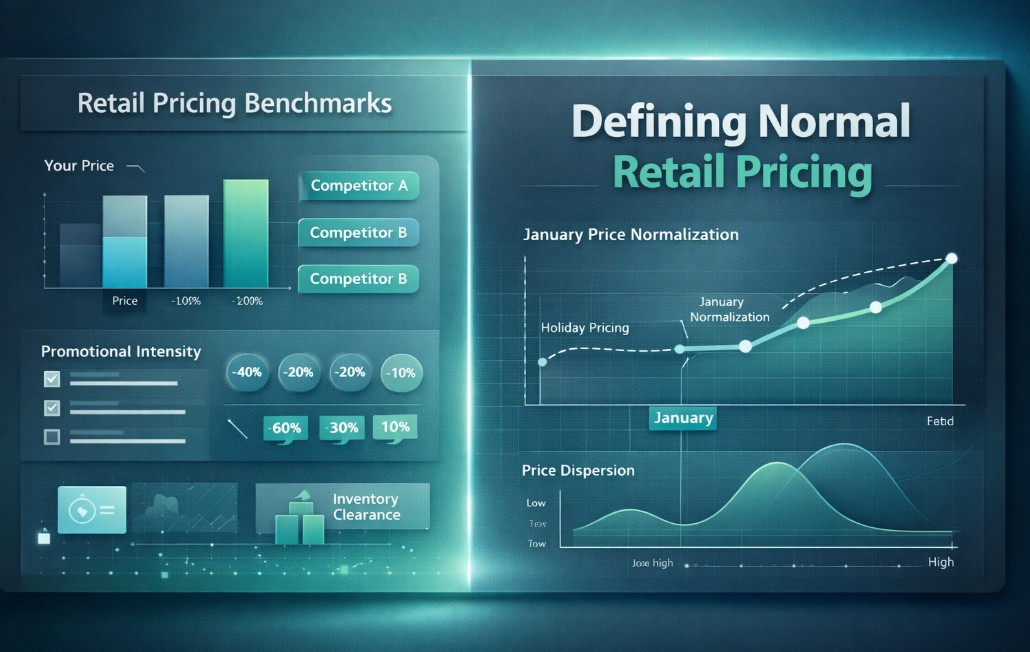

Retail pricing benchmarks help define this normal state by comparing your prices to relevant peers, not the entire market.

One of the most important January benchmarks is your price index relative to primary competitors.

In January, normal price index behavior typically shows:

Slightly higher index than December as promotions roll off

Lower index than peak season full price periods

Increased spread between premium and value retailers

Retailers that remain deeply under indexed in January often carry unnecessary promotional pressure forward from Q4.

Retailers that jump too high risk losing price sensitive demand early in the year.

January promotions are not unusual, but their intensity should decline significantly from December levels.

Normal January promotional benchmarks include:

Fewer sitewide discounts

More targeted category or inventory driven promotions

Reduced discount depth compared to holiday periods

A common mistake is treating January like an extension of holiday sales. This trains customers to expect continuous discounts and delays margin recovery.

Not all categories normalize at the same speed.

Typical January discount benchmarks:

Seasonal categories maintain higher discounts

Core replenishment categories normalize faster

Private label often returns to full price sooner than branded goods

Retailers should benchmark discount depth by category, not just at an aggregate level. Normal pricing behavior varies significantly across the assortment.

January often brings increased price dispersion as retailers reset at different speeds.

Normal dispersion patterns include:

Wider gaps between premium and mass market pricing

Reduced price matching behavior

More experimentation with price positioning

If your prices sit at the extreme low or high end of dispersion without strategic intent, it may signal misalignment with market norms.

Inventory levels heavily influence what normal pricing looks like in January.

Benchmarks to monitor include:

Percentage of SKUs on clearance

Average markdown depth for overstocked items

Time to inventory normalization

Retailers with excess inventory often distort pricing benchmarks by staying promotional longer. The key is to separate inventory driven pricing from strategic pricing.

One of the biggest mistakes is snapping prices back to pre holiday levels immediately in early January.

This often results in:

Sudden demand drops

Increased price sensitivity

Higher cart abandonment

Normal January pricing should be transitional, not abrupt.

While January includes clearance activity, it is not purely a clearance month.

Retailers that over rely on clearance pricing:

Delay margin recovery

Devalue full price perception

Create long term promotional dependency

Benchmarks should distinguish between clearance SKUs and core assortment pricing.

Some retailers focus solely on internal margin recovery targets and ignore market pricing in January.

Competitors often adjust prices dynamically during this period. Without real time price intelligence, retailers risk drifting out of alignment with market norms.

Faster return to normalized pricing

Lower promotional depth

High sensitivity to competitor pricing

Longer clearance cycles

Higher discount dispersion

Strong seasonal effects

Sharp post holiday price resets

High competitive intensity

Frequent manufacturer driven pricing changes

Understanding segment specific benchmarks is essential. There is no universal January pricing playbook.

Price intelligence allows retailers to move beyond assumptions and define normal pricing based on evidence.

Effective price intelligence in January includes:

Daily competitor price tracking

Promotion detection and classification

Category level price benchmarking

Historical January comparisons

This helps pricing teams understand whether observed price movements are seasonal norms or competitive threats.

Benchmarks define normal. Optimisation defines optimal.

There are situations where retailers should intentionally deviate from January benchmarks, such as:

Aggressive inventory reduction goals

Strategic price investments in traffic driving categories

Brand repositioning initiatives

Price optimisation models allow retailers to quantify the impact of deviating from normal pricing and make controlled, data driven decisions.

Top performing retailers treat January as a diagnostic month.

They use retail pricing benchmarks to:

Validate price positioning

Identify margin recovery opportunities

Reset promotional strategies

Feed insights into Q1 optimisation models

Instead of reacting to noise, they establish pricing discipline early in the year.

tgndata helps retailers define what normal looks like using market specific, category aware pricing benchmarks.

Our platform enables:

Real time competitor price benchmarking

January specific historical comparisons

Promotion intensity analysis

Integration with price optimisation workflows

Retailers gain clarity on when to follow the market, when to diverge, and how to do so profitably.

Normal pricing in January is not about copying competitors or eliminating discounts overnight.

It is about understanding market benchmarks, customer expectations, and internal constraints, then making informed pricing decisions.

Retailers that benchmark pricing correctly in January recover margin faster, stabilize demand, and enter Q1 with confidence instead of uncertainty.

Normal is not average. Normal is intentional.

We use cookies to provide you with an optimal experience, for marketing and statistical purposes only with your consent, which you may revoke at any time. Please refer to our Privacy Policy for more information.

Missing an important marketplace?

Send us your request to add it!