- Product

- Solution for

For Your Industry

- Plans & Pricing

- About us

- Resources

For Your Industry

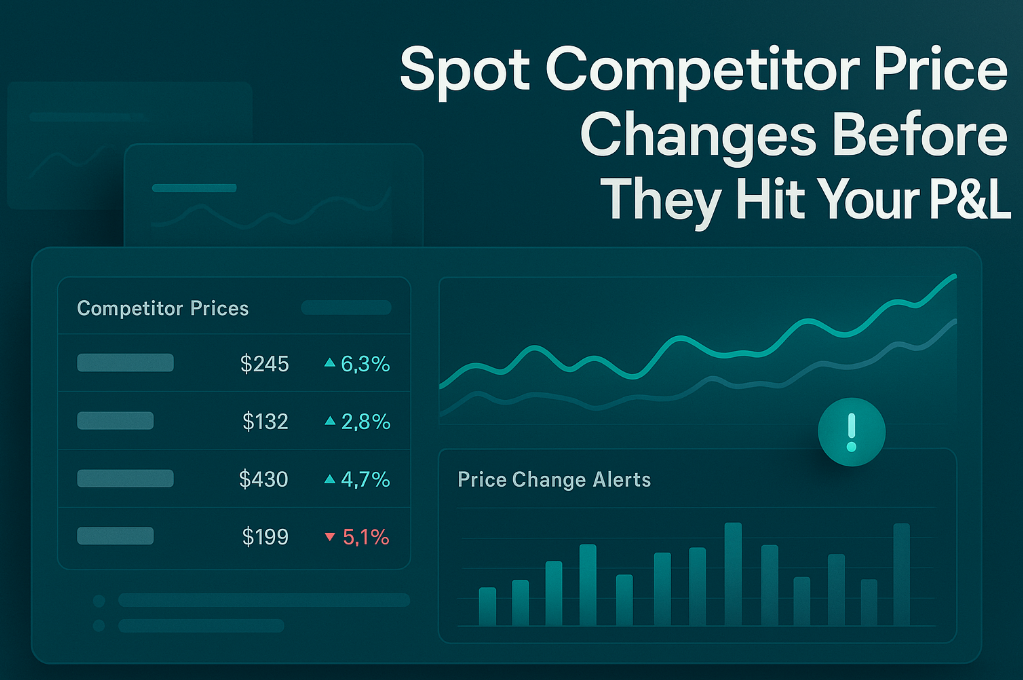

In today’s dynamic retail environment, competitor price tracking has become a critical capability for pricing managers and eCommerce teams. Without effective competitor price tracking, even small market changes can go unnoticed until they hit your profit and loss. The ability to spot and react to competitor price shifts in real time determines whether you protect your margins or lose them.

At tgndata, we help retailers implement real-time competitor price tracking systems that capture every market movement as it happens, ensuring data-driven pricing decisions that protect profitability.

Most pricing losses don’t occur because of strategy errors — they occur because teams react too late.

When a competitor drops a price by 5% on a high-volume SKU, and your team responds two days later, the impact compounds fast:

Lost sales due to price mismatch.

Unnecessary margin erosion once you finally adjust.

Reactive markdowns instead of strategic positioning.

In tgndata’s 2024 Pricing Agility Study, retailers with hourly competitor monitoring saw an average 2.7% improvement in gross margin retention compared to those using weekly data updates.

Example: A global sporting goods retailer discovered that delayed price updates were costing $1.8M annually in margin leakage. Once real-time monitoring was implemented, the same products achieved stable conversion and reduced markdown frequency by 14%.

Static competitor data — collected manually or in fixed intervals — belongs to another era. Markets today are fluid, promotions dynamic, and algorithms fast.

A vendor who delivers weekly or even daily competitor data can’t keep pace with:

Flash sales that appear and disappear within hours.

Algorithmic repricing on major eCommerce platforms.

Regional pricing variations in omnichannel environments.

Data fact: According to tgndata’s internal retail analytics, nearly 32% of all competitor price changes in fast-moving categories occur outside of regular business hours.

That means if you’re relying on batch updates, a third of competitive changes go unseen until it’s too late. The result is slower reaction, lost margin, and inaccurate pricing models.

To catch price changes before they hit your P&L, you need continuous, automated price tracking built on reliable, high-frequency data collection.

Key components of real-time tracking:

Automated web crawlers monitoring target SKUs and categories.

API integrations for instant data ingestion into pricing systems.

AI validation to detect false positives or promotional anomalies.

Instant alerts for material price deviations.

tgndata’s real-time monitoring architecture combines API-level data collection with smart caching and validation layers. This ensures retailers receive verified, actionable updates within minutes of a market change, not hours or days.

Example: A leading grocery chain used tgndata’s continuous monitoring to detect competitor price shifts within 30 minutes, reducing lost-margin exposure by 25% during promotion-heavy periods.

Competitor pricing changes often follow patterns — seasonal, promotional, or inventory-driven. Identifying these early signals allows you to anticipate moves before they happen.

Early warning indicators:

Competitor stock levels dropping below 20% (signal of incoming discount).

Price alignment across multiple SKUs in a brand (signal of planned campaign).

Historical data showing end-of-month price behavior (signal of cycle promotions).

By analyzing these signals through predictive analytics, you shift from reactive to anticipatory pricing. tgndata clients use these models to forecast competitor price adjustments up to 48 hours in advance, enabling smarter, pre-emptive decisions.

Example: A consumer electronics retailer identified a recurring pattern in a rival’s weekly promotions. Adjusting prices two days earlier improved sales volume by 9% without impacting margins.

Detection alone isn’t enough — action must follow instantly. The most advanced retailers integrate detection with dynamic pricing automation, ensuring immediate, rule-based adjustments.

Best-in-class systems:

Flag competitive price changes exceeding predefined thresholds.

Automatically simulate financial impact on margins and revenue.

Apply pricing rules aligned with business objectives (e.g., match only within specific margin guardrails).

tgndata’s Dynamic Response Engine enables pricing teams to decide the right level of automation — from human-approved alerts to fully autonomous repricing.

Example: An apparel retailer deployed automated repricing for 1,000 SKUs. Within two months, they increased price competitiveness by 18% and reduced manual workload by 70%.

Timely alerts are essential for agile response. But the key isn’t just speed — it’s relevance.

An overload of notifications leads to decision fatigue. The right system prioritizes alerts based on impact and context.

Effective alerting frameworks include:

Custom thresholds (e.g., 3% deviation triggers notification).

Tiered alert categories (critical vs. informational).

Role-based distribution (analysts, category managers, executives).

Example: tgndata’s smart alert system filtered over 100,000 daily updates into 200 actionable alerts per brand, allowing teams to focus on high-value changes without losing situational awareness.

Detecting competitor price changes is powerful — connecting them directly to P&L impact is transformative.

With data integration between pricing intelligence and financial analytics, pricing managers can quantify the real cost of delay or inaction.

What this integration enables:

Linking every missed price change to margin loss.

Measuring elasticity-based impact on revenue.

Forecasting profitability under multiple price scenarios.

Example: A home goods retailer integrated tgndata’s competitive feed with its ERP’s margin-tracking system. Within one quarter, it attributed $2.2M in annual savings to faster reaction times on competitor markdowns.

Competitor data is messy — inconsistent SKUs, promotional bundles, or currency conversions can distort results.

Without rigorous data validation, your pricing model can trigger false reactions.

tgndata’s validation process includes:

Automated SKU matching using AI models.

Detection of “promo” vs. “permanent” price differences.

Exclusion of outlier data and duplicate listings.

Example: A retailer discovered 15% of its competitor prices were linked to temporary bundle deals. tgndata’s classification model filtered these out, ensuring only true pricing changes informed strategy.

Advanced analytics turn data into foresight. Predictive models trained on historical competitor behavior can forecast future price movements with increasing precision.

Predictive use cases include:

Identifying high-probability price cuts before promotional events.

Forecasting cross-category effects (e.g., tech accessories following smartphone markdowns).

Measuring expected revenue shifts under different market conditions.

Example: A large home improvement retailer used tgndata’s machine learning models to predict seasonal competitor markdowns, reducing markdown reaction time by 60% and increasing sell-through rates.

Even with advanced technology, organizational agility determines success. Teams must build clear workflows for pricing intelligence response.

Foundational elements:

Defined ownership (who approves or overrides price changes).

Cross-team coordination between pricing, finance, and merchandising.

Continuous training on interpreting analytics and alerts.

Example: A retailer structured its pricing team into “react” and “analyze” units. The react team handled short-term moves, while the analyze unit optimized long-term pricing policy. This hybrid structure improved execution speed by 40%.

To ensure your investment in competitive intelligence pays off, define clear KPIs linked to financial performance.

Core metrics:

Average detection-to-action time.

Margin retention rate during competitor campaigns.

Reduction in manual repricing hours.

Incremental revenue from proactive price adjustments.

Example: tgndata benchmark data shows that retailers tracking these KPIs report a 25–35% improvement in pricing decision efficiency within six months of implementation.

The future belongs to real-time, AI-driven pricing ecosystems. As consumer behavior shifts faster than ever, static models and delayed data will continue to underperform.

Next-generation systems integrate:

Continuous competitor data monitoring.

Predictive forecasting engines.

AI-assisted pricing optimization with explainable insights.

Example: Early adopters of full-stack dynamic pricing solutions like tgndata’s saw measurable gains — a 7.5% increase in gross margin and 11% higher price index performance year-over-year.

The path to resilient, intelligent pricing starts with visibility. The faster you spot competitor price changes, the more control you have over your P&L.

Competitor price changes don’t have to surprise you — or damage your profits.

By combining real-time monitoring, smart alerts, predictive analytics, and process automation, pricing managers can move from reactive firefighting to proactive, strategic pricing.

Don’t wait until competitor price changes erode your profits.

tgndata helps retailers and eCommerce leaders monitor market movements in real time, turning competitive data into a measurable pricing advantage.

👉 Discover how tgndata can help you spot competitor price changes before they hit your P&L.

We use cookies to provide you with an optimal experience, for marketing and statistical purposes only with your consent, which you may revoke at any time. Please refer to our Privacy Policy for more information.

Missing an important marketplace?

Send us your request to add it!