- Product

- Solution for

For Your Industry

- Plans & Pricing

- About us

- Resources

For Your Industry

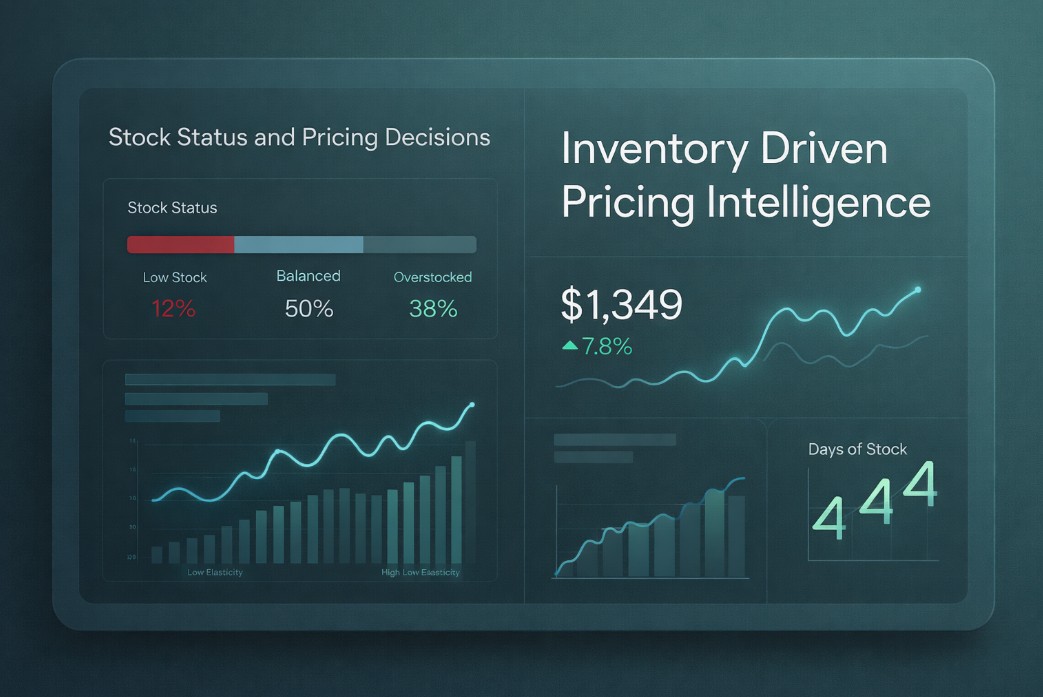

Modern pricing is no longer just about competitiveness or promotional calendars. It is about aligning price with availability in real time. As retail environments become faster and more complex, stock status must move from a reporting metric to a core pricing decision driver. This article explains why stock status matters, how it should influence pricing strategy, and how retailers can operationalize inventory-driven pricing at scale.

Stock status reflects the balance between supply and demand at a specific moment in time. Unlike historical sales or planned promotions, it captures the immediate risk and opportunity embedded in each SKU.

When inventory is limited, every unit sold becomes more valuable. Pricing that fails to reflect scarcity often leaves margin on the table. Conversely, when stock is abundant, pricing that remains too high slows sell through and increases holding costs.

Shoppers respond strongly to availability signals. Low stock indicators increase urgency and reduce price sensitivity, while abundant stock signals reduce urgency and increase comparison shopping. Pricing must adapt to these behavioral cues.

Inventory risk increases as products age or seasons end. Pricing decisions that ignore stock timing often result in deep reactive markdowns later. Proactive pricing based on stock status reduces this risk.

Pricing that aligns with stock status supports supply chain efficiency, warehouse utilization, and cash flow management. It transforms pricing from a commercial function into an enterprise wide lever.

For these reasons, stock status should be treated as a first class input in every pricing decision.

Not all stock positions are equal. Retailers must classify inventory accurately to apply the right pricing logic.

Overstock occurs when inventory exceeds forecasted demand within a defined time horizon. These SKUs carry elevated risk and cost.

Pricing implications include:

Increased urgency to stimulate demand

Targeted markdowns rather than blanket discounts

Micro segmentation by size, color, or region

Use of bundles to accelerate sell through without deep price cuts

Overstock pricing should aim to reduce exposure early rather than wait for forced clearance.

Healthy stock aligns closely with expected demand. These SKUs offer the greatest pricing flexibility.

Pricing implications include:

Maintaining price integrity

Using elasticity data to fine tune price levels

Responding selectively to competitive pressure

Avoiding unnecessary promotions

Healthy stock represents the baseline against which other stock driven pricing actions are measured.

Low stock signals scarcity. Demand often outpaces supply, especially during peak periods.

Pricing implications include:

Reducing or removing discounts

Applying modest price increases where elasticity allows

Prioritizing margin over volume

Protecting availability for high value customers or channels

Low stock pricing focuses on margin maximization rather than traffic generation.

Near stockout situations require careful handling to avoid customer dissatisfaction.

Pricing implications include:

Avoiding aggressive promotions

Adjusting prices to slow demand if replenishment is uncertain

Redirecting demand to substitutes through pricing differentials

Accurate stock classification ensures pricing actions match business objectives.

Pricing objectives shift depending on inventory position. Retailers who fail to adjust objectives dynamically often underperform.

When stock is constrained, the primary objective should be margin protection. Every unnecessary discount reduces total achievable profit.

When inventory is abundant, pricing must prioritize velocity. However, this does not mean indiscriminate discounting. Intelligent price reductions guided by stock thresholds outperform blanket markdowns.

As products approach end of season or end of life, pricing objectives shift toward risk reduction. Stock status helps determine how aggressively to pursue sell through.

Stock driven pricing must still align with brand and customer expectations. Sudden price spikes or drops without logic can damage trust.

Aligning pricing objectives with stock status creates clarity and consistency in decision making.

Stock status and price elasticity are tightly connected. Understanding this relationship enhances pricing accuracy.

When availability is limited, customers become less price sensitive. Elasticity models frequently show that demand remains stable even after modest price increases.

Abundant inventory reduces urgency and increases substitution. Customers respond more strongly to price changes, requiring more precise discounting.

Elasticity is not static. As stock levels decline or increase, demand sensitivity evolves. Pricing systems must update elasticity assumptions accordingly.

A drop in demand may reflect stock visibility or availability issues rather than true price sensitivity. Stock data is essential for correct interpretation.

Integrating stock status into elasticity modeling improves decision quality and reduces pricing errors.

Discounting is one of the most visible pricing actions, and stock status should determine both depth and timing.

Discounting healthy or low stock items reduces margin without driving incremental volume. Stock status helps identify where discounts are unnecessary.

Overstock does not automatically require deep discounts. Gradual, data-driven markdowns often outperform aggressive price cuts.

Early, targeted discounts on overstock reduce the need for extreme markdowns later. Stock status helps retailers act before risk escalates.

Once inventory reaches acceptable levels, discounts should be removed automatically. Stock driven rules prevent margin leakage.

Discount strategies grounded in stock status are more disciplined and profitable.

Modern retail operates across multiple channels, each with different inventory realities.

A product may be overstocked online but scarce in stores, or vice versa. Pricing must reflect channel level stock status.

Unified pricing without stock awareness can drive demand to constrained channels. Stock sensitive pricing balances demand across the network.

Demand and supply often vary by region. Regional stock status supports localized pricing that improves sell through and margin.

When selling through marketplaces, stock status should influence repricing rules to avoid unnecessary price competition when inventory is limited.

Omnichannel pricing becomes more effective when stock visibility is granular and integrated.

Static inventory snapshots are insufficient in fast moving retail environments. Real time stock signals enable responsive pricing.

Rapid changes in sell through indicate whether pricing is stimulating or constraining demand appropriately.

Days of supply provides a forward looking view of risk. Pricing actions can be triggered when coverage exceeds or falls below thresholds.

Delayed or uncertain replenishment increases the value of existing stock. Pricing should reflect this risk.

Low stock warnings influence customer behavior. Pricing systems should anticipate this effect rather than react after conversion changes.

Dynamic pricing systems that ingest real-time stock data outperform static rule-based approaches.

Automation is essential for scaling stock driven pricing across large assortments.

Retailers can define pricing actions tied to inventory levels, such as increasing price when stock falls below a threshold.

Automation applies stock aware pricing logic consistently across thousands of SKUs and multiple channels.

Pricing teams are freed from constant monitoring and can focus on strategy rather than execution.

Automated guardrails ensure pricing actions remain within approved limits and align with brand guidelines.

Automation transforms stock status from a passive metric into an active pricing lever.

Stock status affects categories differently, requiring tailored approaches.

High SKU complexity and seasonality make stock driven micro markdowns especially effective.

Low stock on popular models supports margin protection, while overstock on older versions requires targeted discounting.

Expiration dates and replenishment cycles demand rapid, stock sensitive pricing adjustments.

Clear seasonality makes early stock driven pricing decisions critical to avoid heavy clearance later.

Category awareness improves the effectiveness of stock based pricing strategies.

Even retailers with strong inventory data can misapply stock driven pricing.

Stock is not just in or out. Degrees of availability matter for pricing decisions.

Stock status must be interpreted alongside demand. Overstock with strong demand requires a different approach than overstock with weak demand.

Temporary stock changes should not trigger extreme pricing moves without confirmation.

Pricing decisions based on stock require coordination with merchandising and supply chain teams.

Avoiding these mistakes ensures stock driven pricing delivers consistent value.

Stock status is one of the most powerful signals available to pricing teams. It reflects real time supply risk, shapes customer behavior, and directly impacts margin and cash flow. Retailers that integrate stock status into pricing decisions move from reactive discounting to proactive optimization. By aligning price with availability, organizations can protect margins under scarcity, accelerate sell-through under excess, and reduce operational risk across the business.

tgndata helps retailers connect stock intelligence with advanced pricing analytics and automation. Contact us to build a pricing strategy where inventory reality drives profitability.

We use cookies to provide you with an optimal experience, for marketing and statistical purposes only with your consent, which you may revoke at any time. Please refer to our Privacy Policy for more information.

Missing an important marketplace?

Send us your request to add it!