- Product

- Solution for

For Your Industry

- Plans & Pricing

- Company

- Resources

For Your Industry

Retail markets continue to evolve quickly as shoppers switch channels, adjust expectations, and respond to price signals across an increasingly complex landscape. Many retailers struggle to maintain or grow market share as competitors accelerate their pricing strategies and leverage real time intelligence. This case study expands on how retailers gain market share with pricing data and explores the measurable performance gains achieved when modern pricing intelligence replaces outdated manual processes.

Pricing data has become one of the most powerful competitive assets in retail. It reveals true market conditions and gives decision makers the ability to act with speed, accuracy, and context. With the right data, retailers understand competitive pressures, identify elasticity patterns, detect assortment gaps, and make informed choices that drive profitable growth. This expanded case study breaks down the complete transformation of a mid size retailer that used pricing data to recover lost market share and build a stronger pricing strategy.

The article covers the retailer’s initial challenges, the analytics framework they adopted, the dynamic pricing automation that scaled their efforts, and the measurable financial and operational improvements that followed. It also includes lessons learned and a detailed review of the technology stack powering this success. Most importantly, it demonstrates why pricing data has become a central pillar in modern retail strategy.

Retail competition is shaped by speed, transparency, and value perception. Pricing data enhances each of these factors. It helps pricing managers and analysts understand how the market behaves, how competitors position their products, how demand shifts across segments, and how price changes influence performance. Through accurate pricing data, retailers can optimize for profitability and competitive strength at the same time.

Retailers gain market share with pricing data for several key reasons.

Without direct visibility into competitive moves, retailers make assumptions that often lead to overpricing, underpricing, or delayed reactions.

Pricing teams can anticipate demand shifts, seasonal patterns, and promotional impacts instead of reacting after the fact.

Unified pricing across stores and eCommerce strengthens customer trust and reduces cart abandonment.

Pricing managers spend less time on manual checks and more time on strategy.

Retailers avoid unnecessary discounting and understand when price cuts or adjustments are likely to improve conversion.

These capabilities form the backbone of stronger market share performance. Over time, data driven pricing becomes a competitive asset that shapes brand trust and customer loyalty.

The retailer in focus operated across both digital and physical channels and served a diverse customer base through three primary categories. Despite stable traffic, they experienced a four quarter decline in market share. Competitors with strong digital capabilities responded quickly to demand shifts and frequently recalibrated prices. This retailer, however, relied on slow internal processes and limited visibility into market behavior.

Falling conversion rates in high traffic categories

Prices that drifted above market averages by 5 to 10 percent

Promotions that failed to influence demand

Increasing cart abandonment caused by uncompetitive price points

Weak visibility into competitor assortment and price updates

Manual weekly price checks that delayed corrective action

Lack of alignment between store and digital pricing

Leadership realized that their pricing approach was outdated and disconnected from modern retail realities. They needed comprehensive pricing data to understand what was happening in the market and why performance continued to decline.

The retailer began their transformation by implementing a competitive price tracking and data enrichment program. This created the foundation for later predictive and automated improvements.

Daily price tracking for thousands of SKUs across multiple competitors

Automated assortment matching to ensure apples to apples comparisons

Price history tracking to reveal promotional cycles and long term positioning

Cross channel monitoring to assess both digital and in store competitor pricing

Integrated dashboards for pricing teams, buyers, and category managers

Competitors updated prices far more often than expected

Promotional events were shorter and more targeted across top categories

Elasticity patterns differed by segment and product tier

Outlier prices were common, especially in categories with high SKU volumes

These insights confirmed that the retailer’s past assumptions did not match actual market behavior.

Once the retailer had consistent competitive data, they expanded their analysis to include elasticity modeling and demand pattern detection. This phase aimed to understand customer behavior in detail.

Entry tier SKU elasticity was significantly higher than expected

Mid tier products responded strongly to small price drops

Premium tier products showed low sensitivity to price changes

Seasonal items had predictable demand peaks that enabled strategic pricing adjustments

Some products drove traffic even when margins were low, a signal of category influence

Predictive analytics provided further value. It revealed when demand would shift based on seasonality, weather conditions, promotions, and historical patterns. Together, these insights led to more precise pricing strategies that boosted conversion while protecting profitability.

The retailer reached its highest gains after implementing dynamic pricing automation that acted on competitive and elasticity insights. Automated rules and decision frameworks replaced slow manual work.

Adjusting high visibility SKUs to align with or beat primary competitors

Correcting price gaps greater than acceptable thresholds

Triggering price updates during competitor promotional windows

Adjusting prices based on predicted demand, not only historical trends

Preventing unnecessary price changes when elasticity showed limited customer response

Maintaining consistent digital and store pricing for transparency and trust

Automation enabled pricing managers to focus on strategy instead of manual updates. It ensured consistent and timely actions across the entire catalog and across all channels.

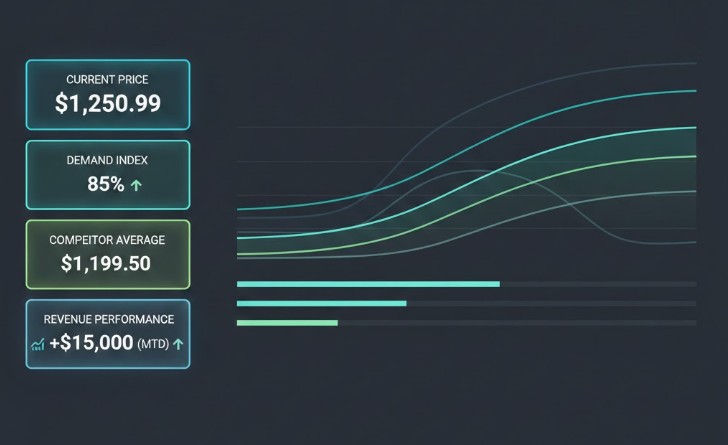

By combining pricing data, predictive analytics, and automation, the retailer delivered measurable improvements across multiple dimensions. The gains extended beyond the initial categories and influenced company wide performance.

Category A increased market share by 4.1 percent within 90 days

Category B increased market share by 3.4 percent during the same period

Category C reversed a long term decline and returned to positive growth

Cross category visibility improved, enabling unified strategy instead of isolated actions

Long tail items gained attention through more accurate pricing alignment

Conversion improved by 12 to 17 percent across optimized product groups

Margin increased by 3 percent in categories supported by elasticity based pricing

Promotional spend decreased by 22 percent due to targeted discounting

Price accuracy improved across more than 90 percent of the SKU base

Stock rotation improved because price adjustments aligned with demand patterns

Cart abandonment dropped by 11 percent in the digital channel

Sell through improved for end of season, seasonal, and slow moving items

These gains illustrate how retailers gain market share with pricing data, predictive analytics, and dynamic pricing automation working together.

This case study illustrates broader industry patterns. Retailers who consistently gain market share behave differently in several key areas.

Real-time competitive tracking reveals actionable insights that periodic price checks cannot match.

Elasticity and demand models help teams understand what customers value and how price influences choice.

Consistent pricing across channels strengthens trust and reduces friction.

Automation enables faster reactions and reduces human error.

Pricing is not an isolated function. It influences margin, inventory flow, customer retention, and brand perception.

As pricing intelligence matures, retailers build additional layers that expand the impact of data driven decisions.

Retailers adjust prices based on customer segments and behavior patterns, always within ethical and regulatory boundaries.

Stores in competitive regions can adapt faster than those in stable regions.

Data helps retailers forecast the true ROI of promotions and avoid unnecessary markdowns.

Integrating stock levels with pricing data helps reduce overstocks and shortages.

Machine learning models detect early demand shifts and help teams anticipate market changes.

Each advanced strategy builds on the foundation of high quality pricing data.

A successful pricing data program relies on a structured and integrated technology stack.

Competitive price tracking system

Assortment matching engine

Dynamic pricing automation platform

Elasticity and predictive analytics models

Unified data pipeline that feeds all channels

KPI dashboards and alerting systems for decision makers

A platform like tgndata provides these layers with accuracy, scale, and automation.

The retailer discovered important lessons that apply across the industry.

Data driven pricing directly influences market share.

Competitors move faster than traditional pricing processes.

Manual workflows cannot support real time retail demands.

Pricing data must be actionable, not just collected.

Automation is essential for scale and consistency.

Elasticity modeling prevents unnecessary discounting.

Customers reward transparent and consistent pricing.

Demand forecasting improves long term planning and margin performance.

Price precision supports inventory optimization.

Retailers who adopt pricing intelligence outperform those who rely on intuition.

This expanded case study demonstrates how retailers gain market share with pricing data. The combination of competitive intelligence, elasticity modeling, predictive analytics, and dynamic pricing automation creates a powerful engine for growth. Retailers who embrace these tools improve conversion, reduce promotional waste, increase margin stability, and gain a durable competitive advantage.

Pricing data has become a strategic asset in modern retail. It shapes price perception, drives customer decisions, and enables businesses to react quickly to market changes. Retailers who commit to data driven pricing are better equipped to defend and expand market share.

If your organization is ready to build a data driven pricing strategy, tgndata can help you modernize your approach and unlock measurable performance gains.

We use cookies to provide you with an optimal experience, for marketing and statistical purposes only with your consent, which you may revoke at any time. Please refer to our Privacy Policy for more information.

Missing an important marketplace?

Send us your request to add it!