- Product

- Solution for

For Your Industry

- Plans & Pricing

- Company

- Resources

For Your Industry

Competitive pricing is entering a new era as retailers prepare for 2026. Shifts in consumer behavior, AI powered pricing engines, economic volatility, and rising marketplace competition are reshaping how brands set and adjust prices. The keyphrase competitive pricing trends going into 2026 captures a reality that every pricing team must now confront. The pace of change is accelerating and data shows that companies with mature pricing intelligence systems outperform peers in revenue growth, margin stability, and market share retention.

This extensive analysis breaks down the most important pricing developments shaping 2026. It compiles data backed insights, retail trends, and analytics strategies from leading pricing intelligence frameworks used by enterprise retailers and digital marketplaces. Pricing managers, ecommerce analysts, and revenue leaders will gain a clear understanding of what the next twelve months require, along with practical steps to modernize pricing strategies before competitors pull ahead.

As 2026 approaches, the pricing landscape is defined by heightened competition, AI accelerated automation, and pressure to maintain profitability while absorbing operational cost volatility. Retailers are no longer adjusting prices weekly or even daily. They are competing in markets where leading brands refresh prices hundreds or thousands of times per day. This is the direct result of algorithmic pricing, advanced competitor monitoring systems, and the need to react instantly to stock movements, promotional activity, and shifting shopper demand.

Three forces define the competitive environment:

Consumers have more options than ever and switching costs are extremely low. Competitors can undercut prices within minutes of detecting changes.

Enterprise retailers are now investing heavily in data pipelines, competitor tracking, and elasticity modeling. By 2026, more than seventy percent of large retailers are expected to use dynamic pricing at scale.

Governments are examining automated price changes, especially in sectors with concentrated market share. Pricing systems must be transparent, explainable, and compliant.

These shifts highlight why monitoring competitive pricing trends going into 2026 is no longer optional. Pricing organizations must evolve from reactive price setting to predictive price optimization supported by strong analytics.

Economic conditions directly shape pricing strategy. Data reveals several macroeconomic signals that will influence 2026 pricing approaches across retail, ecommerce, CPG, travel, and marketplaces.

Supply chain cost swings are not expected to settle until late 2026. Retailers will need rapid cost pass through logic embedded in pricing engines. Traditional annual or quarterly cost updates will be too slow.

Certain categories like food, health products, durable goods, and home supplies are projected to remain inflation sensitive. Competitive pricing models must therefore treat these categories differently from non essential discretionary goods.

Real wages are recovering, but unevenly across regions. Pricing teams must incorporate regional demand factors into models, especially for omnichannel retailers with localized assortments.

Consumers increasingly evaluate whether a price feels justified. Perceived price fairness is now a measurable competitive advantage. Behavioral pricing and transparent value messaging will play a growing role in 2026 pricing decisions.

Marketplaces like Amazon, Walmart Marketplace, Allegro, Shopee, Lazada, and regional platforms continue to normalize AI driven competition. Sellers adjust prices multiple times per day to stay Buy Box eligible or to maintain search visibility.

Pricing data shows that sellers often enter price spirals as they compete for algorithmic rewards. Without guardrails, these patterns trigger price erosion that harms margin stability. Retailers entering 2026 must implement anti erosion rules in their pricing engines.

New scraping and API based architectures detect competitor price changes in minutes rather than hours. This speed advantage reshapes competitive response times. Brands without automated price monitoring will struggle to maintain relevance.

Cross border ecommerce creates entirely new sets of competitors with lower costs, flexible logistics models, and aggressive discounting. Competitive pricing trends going into 2026 must account for cross border entrants that challenge conventional pricing tiers.

Artificial intelligence is becoming the backbone of advanced retail pricing. By 2026, pricing engines will lean heavily on predictive models that evaluate competitor behavior, elasticity shifts, stock levels, and promotional events in near real time.

Static elasticity assumptions are no longer sufficient. AI models continuously learn from transaction logs, clickstream behavior, stockouts, competitor reactions, and seasonality. These models automatically detect when elasticity changes and adjust pricing rules accordingly.

Automated systems evaluate millions of micro events per day. These include:

Competitor price drops

Sudden demand spikes

Changes in conversion rate

Promotional calendar conflicts

Stock depletion signals

Weather or regional events

Supplier cost updates

A modern retailer simply cannot manage these manually. Real time automation is a competitive necessity for 2026.

Predictive models now forecast competitor pricing behavior, including anticipated promotions or markdown cadences. This allows retailers to plan preemptive pricing strategies before competitors act.

AI agents assist pricing teams by simulating outcomes and generating optimized pricing strategies. These systems allow managers to experiment with rules, thresholds, and what if scenarios to evaluate revenue and margin impact.

Understanding how consumers behave is essential when analyzing competitive pricing trends going into 2026. Retailers cannot rely on simplified models of customer intention. Instead, they must capture the full spectrum of what drives purchase decisions in an environment with rising uncertainty and heightened information transparency.

Consumers across nearly every demographic have become more deliberate in the way they judge prices. Even higher income shoppers compare prices more frequently than they did just two years ago. Several factors contribute to this shift. Digital shelf clarity allows shoppers to compare dozens of offers within seconds. Search engines, browser extensions, and AI powered shopping assistants show differences in price, shipping cost, and promotions instantly. As a result, consumers anchor their expectations on the lowest visible price unless a retailer demonstrates superior value or service. This makes value communication a strategic necessity rather than a marketing afterthought.

Retailers that want to maintain healthy margins through 2026 must build pricing strategies around perceived value. This includes clear benefit framing, transparent quality scoring, and price justification messaging on product detail pages. Without strong perceived value, price sensitive shoppers will switch immediately to lower priced competitors.

Brand loyalty remains one of the most significant variables affecting elasticity. The traditional idea that long term customers will accept higher prices no longer holds true. Research shows that shoppers defect quickly when competing products offer similar quality at a better price. In categories like electronics, home goods, personal care, and sports equipment, price driven switching exceeds forty percent in competitive markets.

Subscription models, loyalty programs, and bundled services help retention but cannot fully offset aggressive competition. Retailers must measure loyalty decay in real time using behavioral signals, repeat visit intervals, and churn forecasts. This data improves elasticity modeling by providing a true picture of how easily a customer will switch.

Large generalized customer groups no longer predict elasticity accurately. Retailers must identify micro segments that behave differently based on purchase frequency, geographic region, intention signals, and personal values. For example, a price sensitive bargain seeker in urban regions behaves very differently from a convenience driven suburban shopper. Both might search for the same item but respond to price changes in opposite ways.

Micro segmentation improves pricing precision. Retailers can apply different elasticity thresholds to similar products based on the segment most likely to convert. This reduces revenue loss from unnecessary markdowns and prevents margin compression in premium segments.

Comparison shopping is no longer limited to motivated bargain hunters. AI assistants, automated deal trackers, and mobile price checkers give every consumer instant access to competitive information. Shoppers can see real time price changes at competing stores long before they reach checkout. This transparency shifts pricing power toward the consumer. Retailers that fail to identify these competitive moments lose sales even when their internal pricing models appear correct.

Consumers care about fairness more than ever. If a price feels arbitrary or inconsistent, they hesitate or abandon the purchase. Retailers must avoid sudden unexplained price changes that appear disconnected from product value. Transparent pricing builds trust. Techniques such as clear price comparison blocks, explanations of product quality differences, and reduction of unnecessary price variation enhance perceived fairness and improve elasticity in categories with heavy competition.

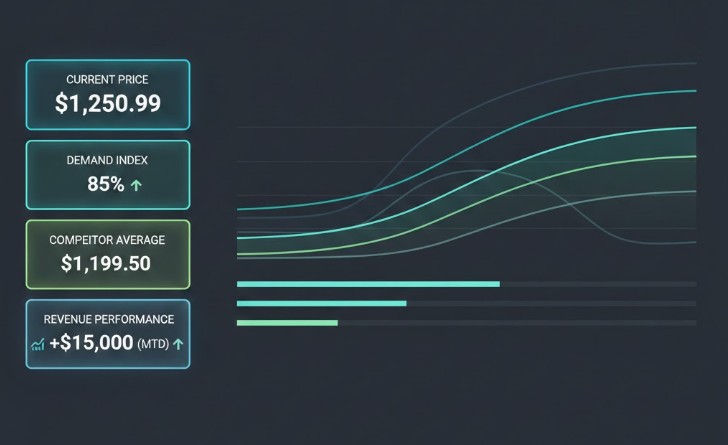

For retailers to compete effectively with the competitive pricing trends going into 2026, they must build infrastructure capable of handling large scale data flows, real time analytics, and automated decisioning.

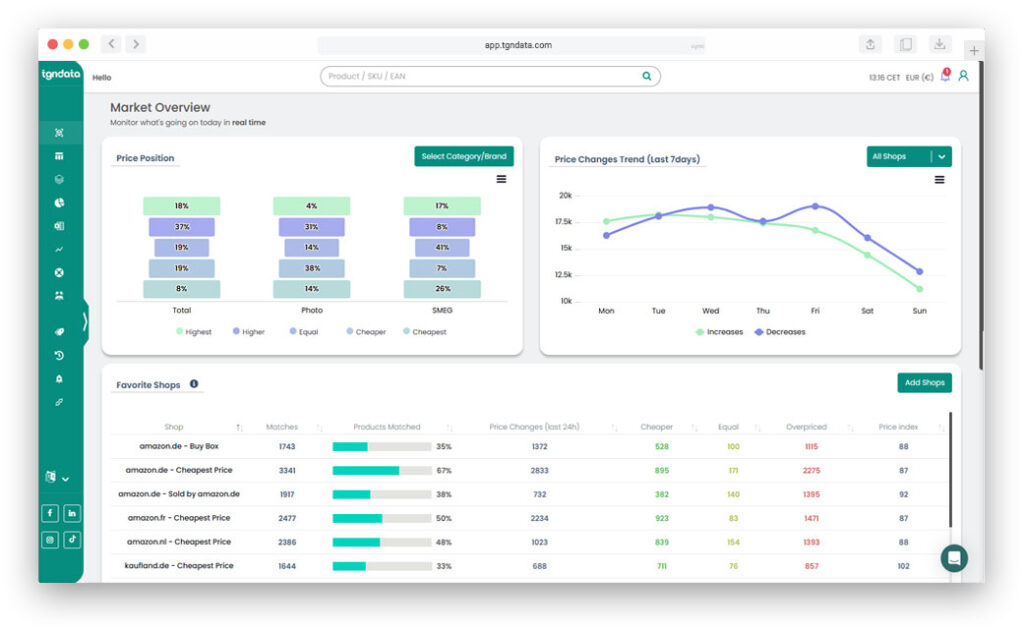

The most advanced pricing engines depend on extremely fresh data. Competitor price updates, marketplace fees, shipping adjustments, and promotional changes must be captured in near real time to fuel automated decisions. Retailers that rely on daily or manual updates fall behind because competitors act faster.

A modern system should support:

Continuous scraping and API based collection

Real time alerts for price drops or stockouts

Cross channel tracking across marketplaces, direct to consumer sites, and retail catalogs

Geographic price variation detection

Clean, normalized product level comparison

High frequency data reduces blind spots and improves the accuracy of downstream elasticity models.

Competitive intelligence is only valuable when products are matched correctly. Misaligned product catalogs cause incorrect price comparisons, flawed rule triggers, and poor elasticity assumptions. Retailers should invest in machine learning based product matching, unified taxonomy structures, and attribute standardization. Clean matching reduces risk and unlocks more advanced pricing automation at scale.

Modern pricing engines merge rule based pricing with analytical insights. Elasticity curves, demand forecasts, projected margin performance, and competitor reactions must come together in one decision layer. Retailers that separate forecasting from pricing rules create bottlenecks and increase error frequency.

Integrated pricing engines allow retailers to:

Adjust prices instantly with guardrails

Simulate revenue and margin impact

Detect elasticity shifts in near real time

Optimize price ladders and product families

Coordinate promotions across categories

This unified approach prepares pricing teams for a more competitive 2026 environment.

As automation grows, so does the importance of governance. Retailers need audit logs, approval workflows, role based access controls, and traceability for every price change. Governance reduces the risk of unintended price spirals, compliance issues, and internal misalignment. Central oversight ensures that strategic objectives remain intact even during rapid automated updates.

A variety of pricing models will rise in importance as organizations prepare for increased competition in 2026. Each model serves a different purpose, and most retailers will rely on a hybrid strategy.

Dynamic competitive pricing adjusts prices automatically based on competitor activity. Most retailers already use some form of this model, but 2026 will bring significant evolution. Retailers will add stronger margin guardrails, richer data sources, and predictive modeling to avoid harmful price races. The best systems do not just match competitor prices. They understand where strategic gaps exist and respond intelligently.

Value based pricing tailors price points to perceived consumer value instead of focusing only on cost or competitor pricing. Brands with strong narratives or superior quality benefit significantly from this approach. For example, premium coffee, skincare, home decor, and fitness products often maintain higher price points when value communication is clear. Retailers must invest in product content, customer storytelling, and clear feature comparison charts to support value based prices.

Rules provide structure and consistency. Machine learning enhances these rules by identifying patterns, exceptions, and opportunities. Retailers using hybrid systems see improved margin stability and fewer pricing anomalies. Machine learning models also reduce manual overhead by learning when rules should relax or tighten based on competitive intensity and consumer behavior.

Price ladders maintain logical price gaps between related products. Poorly maintained ladders confuse consumers and reduce conversion because product value appears inconsistent. AI assisted ladder optimization ensures that price differences accurately reflect quality, features, and demand patterns. This model is especially useful in electronics, apparel, and home goods.

Regional pricing accounts for differences in demand, local competition, supply chain cost, and consumer willingness to pay. Retailers with multiple fulfillment centers or physical stores must consider regional patterns to remain competitive. Sophisticated engines can now adjust prices automatically by city, region, or fulfillment zone. This increases revenue while preserving margin.

Promotions require careful planning to avoid cannibalization, margin erosion, and inventory risk. Advanced optimization systems simulate expected outcomes, predict halo effects, and analyze the long term value of promotional customers. Retailers can reduce over discounting and achieve more profitable promotional cycles through better forecasting and analytics.

Pricing governance will be one of the most important components of a retailer’s pricing strategy in 2026. As automation scales, new risks emerge and regulatory expectations increase.

Regulators are increasingly concerned about how automated pricing algorithms behave. There is growing interest in understanding whether pricing engines unintentionally contribute to harmful price coordination or consumer disadvantage. Retailers must maintain clear documentation for how price changes occur and which inputs influence decisions. Explainability becomes a competitive and compliance requirement.

Automation without guardrails can damage profitability within hours. Retailers must enforce:

Minimum margin thresholds

Competitor trust rules that identify unreliable or unaligned sellers

Frequency caps that prevent excessive price changes

Alerts that detect abnormal downward trends

Safety zones for sensitive product categories

Guardrails ensure that automation works within strategic boundaries.

Pricing teams, executives, regulators, and customers all benefit from transparency. Explainable pricing systems clarify why a price changed, which competitive signals influenced it, and what outcomes were expected. When teams understand pricing logic, they make faster decisions and maintain stronger alignment across merchandising, finance, and operations.

Retailers who want to thrive must modernize pricing operations before 2026 to stay ahead of accelerating competition. The following actions provide a roadmap for leaders who want to outperform their category peers.

Retailers must replace outdated manual systems with real time competitive intelligence pipelines. This enables faster reaction times, stronger data accuracy, and improved pricing automation. Data should feed directly into pricing engines without manual intervention.

Automation should not replace strategic oversight. Instead, it should allow pricing teams to focus on high value decisions. Predictive engines can analyze thousands of signals per minute, enabling rapid response to competitor pricing, demand trends, stock levels, and cost changes.

Elasticity and demand forecasting must update continuously using machine learning. Retailers who rely on static historical models will misjudge demand and over or under price in competitive environments. Continuous learning improves long term pricing accuracy.

Promotions should be managed using predictive analytics rather than traditional seasonal patterns. AI systems can evaluate which promotions generate incremental value and which simply shift demand between products. This ensures that promotional budgets drive real returns.

Governance protects pricing integrity and ensures compliance. Leaders must establish standardized workflows, documented rule sets, version control systems, internal oversight committees, and robust reporting dashboards.

AI changes the daily responsibilities of pricing professionals. Teams must learn to manage automated rules, interpret model recommendations, and align pricing decisions with broader business goals. Training programs for strategic pricing competency will become essential.

The competitive pricing trends 2026 reveal a marketplace where speed, intelligence, and precision determine which retailers gain or lose ground. Companies that continue using outdated manual pricing processes will struggle to keep up with real time competitors. The next year will reward organizations that adopt advanced data systems, integrate predictive analytics, strengthen governance, and implement structured automation.

tgndata empowers retailers to compete effectively with modern pricing intelligence, dynamic pricing automation, and deep analytics expertise. If your organization wants to optimize margins, protect market share, and operate at the speed of tomorrow’s retail environment, connect with tgndata to begin transforming your pricing performance.

We use cookies to provide you with an optimal experience, for marketing and statistical purposes only with your consent, which you may revoke at any time. Please refer to our Privacy Policy for more information.

Missing an important marketplace?

Send us your request to add it!