- Product

- Solution for

For Your Industry

- Plans & Pricing

- Company

- Resources

For Your Industry

Black Friday and Cyber Week create extraordinary conditions inside the retail ecosystem. Prices move faster, competitors react more aggressively, and consumer expectations shift dramatically as deep discounts flood every digital shelf. Retailers enter the period with planned promotional calendars and strategic intent, but the aftermath often brings uncertainty. Once the surge in demand tapers off, pricing teams must unwind aggressive discounts, stabilize margins, and rebuild value perception. Understanding how retailers should adjust prices after Black Friday and Cyber Week is essential for any organization that wants to protect profitability while guiding customers back toward regular price acceptance.

This expanded analysis provides a complete, research backed guide to post event repricing. It includes behavioral data, inventory logic, competitor intelligence, psychological pricing principles, promotional analytics, and strategic decision frameworks. The goal is to give pricing managers and ecommerce leaders a blueprint for the most critical pricing transition period of the retail year.

Black Friday and Cyber Week create unique distortions in price perception, shopper intent, competitor activity, and category level elasticity. Once the event closes, retailers must respond decisively, because delays in price restoration can create structural revenue losses that last beyond the holiday season.

Consumers anchor their expectations to the lowest price they observed during Cyber Week. This deeply influences their willingness to pay in the subsequent weeks. If retailers restore prices too quickly without reinforcing value, conversion rates fall. If they take too long, profit opportunities collapse and margin recovery becomes difficult. Many retailers struggle precisely because they underestimate the psychological impact of heavy discounts and the speed at which competitors unwind their price cuts.

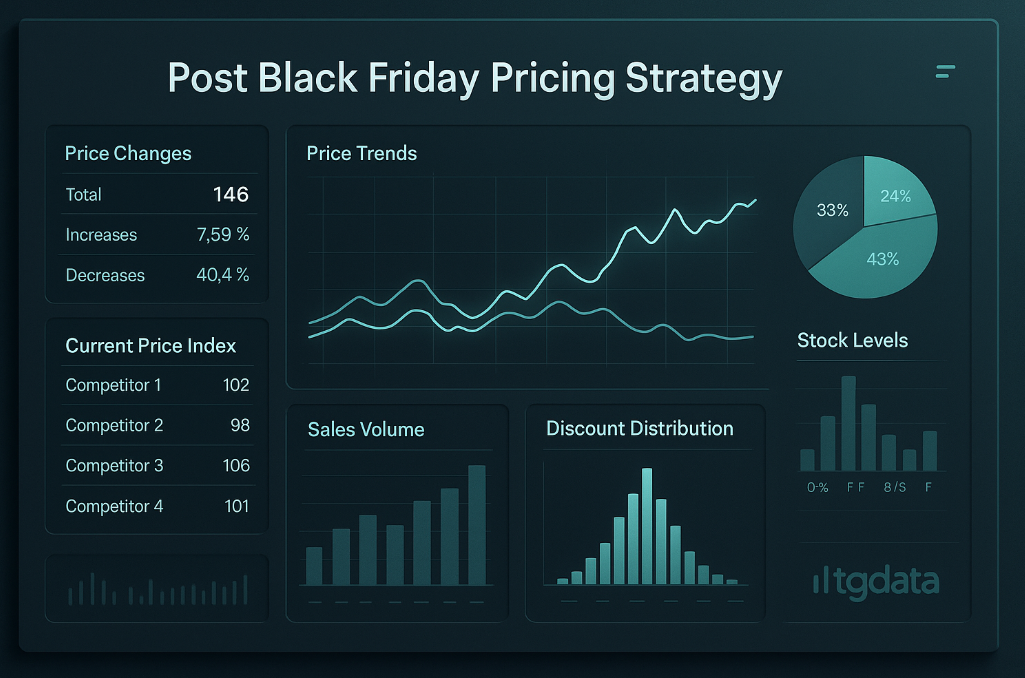

Competitor repricing timing varies widely. Some organizations return to full price within hours after Cyber Monday closes. Others stretch promotions into early December to satisfy inventory requirements or meet revenue goals. Retailers must understand these time windows clearly, because misalignment with dominant competitors triggers lost visibility, lower Buy Box share, and reduced cart value.

Inventory imbalances intensify the need for a strong post event pricing strategy. Some categories sell through efficiently during Cyber Week, while others lag despite aggressive discounts. Pricing teams cannot rely on generic scripts or predetermined playbooks. They must evaluate category specific sell through patterns and assess which SKUs can return to full margin and which require targeted markdowns or strategic incentives.

A strong post event pricing framework is essential because it determines how smoothly a retailer transitions from an extreme promotional environment into a deliberate and profitable December strategy.

To understand how retailers should adjust prices after Black Friday and Cyber Week, it is crucial to understand how shopper behavior shifts in the days following the event. Data shows that consumers behave very differently once the urgency and excitement of the holiday sale window dissipate.

During Cyber Week, consumers get accustomed to unusually steep discounts. This results in a behavior known as discount anchoring. Customers reference the lowest price they saw and use it as a benchmark for what they believe the product should cost. If the retail price increases suddenly, they perceive a loss of value even if the new price appears reasonable in historical context. Successful retailers counter this by restoring prices gradually, using strong value communication, and reinforcing context through messaging and comparison blocks.

After Cyber Week, demand moves toward gifting categories and away from big ticket items that dominated Black Friday. This shift affects elasticity. For example, gifting items often maintain strong willingness to pay even as promotions taper off, because shoppers prioritize availability and convenience over price. Pricing teams should look at category specific post event demand curves and separate gifting behavior from general consumption.

Impulse purchases surge during Black Friday and Cyber Week, which drives an increase in returns during early and mid December. These returns affect inventory levels, which then influence post event pricing strategy. Retailers must anticipate higher return rates when restoring prices to avoid misjudging true stock positions.

Shoppers rely heavily on historical price data. Browser extensions and price tracking tools show whether a product’s current price is above or below trend. Because consumers analyze this information more closely after Cyber Week, retailers must provide strong product content, customer reviews, quality signals, sustainability messaging, and other forms of value justification.

The sense of urgency that drives Cyber Week conversions fades quickly afterward. Shoppers take more time to consider alternatives, analyze value, and compare retailers. This requires pricing teams to use subtle incentives, refined messaging, and careful timing when restoring higher prices.

Pricing adjustments after Cyber Week must be driven by precise inventory analysis. Retailers often experience varied sell through patterns across categories, leading to inconsistent stock levels. Understanding these dynamics is vital when determining how retailers should adjust prices after Black Friday and Cyber Week.

Retailers must identify SKUs that remain significantly above forecasted stock levels after Cyber Week. Overstock often hides within subcategories or variant lines. AI powered forecasting tools help determine which SKUs require accelerated markdowns and which can maintain regular pricing.

Products that sold well during Cyber Week often retain high demand afterward. These SKUs should not be rediscounted unless necessary. This preserves margin and reinforces value.

Some product variants underperform due to color, size, region, or bundle mix. Retailers should not markdown entire lines if only specific variants need additional incentives. Dynamic variant pricing ensures more accurate margin recovery.

End of life and discontinued SKUs are best cleared during Cyber Week, but if they persist afterward, retailers must use structured markdown planning. This includes automated markdown optimization, demand based discounting, and liquidation channels.

Post event sales patterns often deviate from historical models. Retailers must adjust replenishment pricing carefully, using real time data to avoid over ordering, over discounting, or missing revenue opportunities.

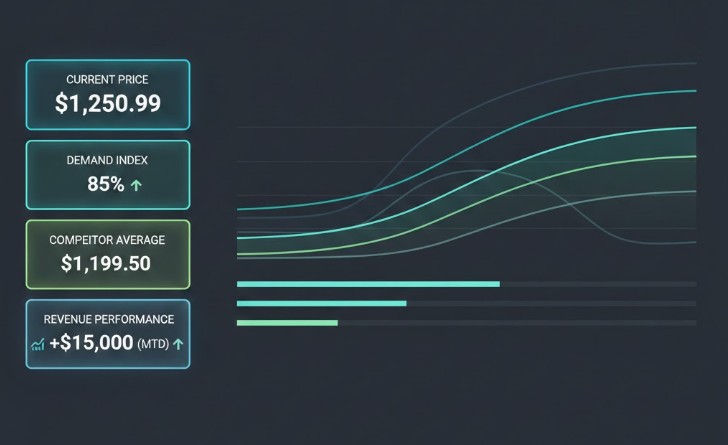

Competitive intelligence is one of the most important components when deciding how retailers should adjust prices after Black Friday and Cyber Week. Competitors rarely reset prices at the same speed, and these differences create opportunities and risks.

Some retailers return to normal pricing immediately, while others maintain extended sales. Understanding this variation helps determine your own price restoration pacing. If key competitors maintain discounts, returning to full price too quickly results in lost traffic.

Cyber Week introduces new sellers who temporarily enter the market. Some remain active afterward. Pricing teams must track these emergent sellers to avoid misjudging category competitiveness.

Competitors often shift from public promotions to email only or app only discounts. These hidden promotions distort real competition and must be included in your post event analysis.

Logistics providers increase surcharges after Cyber Week. Competitors may adjust prices to offset these costs. Retailers must analyze these changes to remain competitive without eroding margin.

Consumers evaluate price fairness using historical graphs. Retailers must ensure restored prices appear reasonable within multi month price ranges.

Margin restoration requires precision. Retailers must rebuild price levels carefully to avoid shocking customers who expect continued discounts.

An incremental approach avoids sudden jumps in price that reduce conversion. Gradual restoration aligns with competitor behavior and customer psychology.

When prices rise, product detail pages should highlight unique features, materials, quality assurances, sustainability, and brand reputation. This supports higher prices.

Strikethroughs, compare at prices, and contextual reference prices help customers understand value and maintain trust as prices increase.

Marketing and merchandising must coordinate. If marketing continues to emphasize deals while prices rise, customers experience dissonance.

Non discount incentives protect margin while improving conversion. Examples include:

Free shipping thresholds

Loyalty points

Gift wrap bundles

Access to limited stock

Dynamic pricing becomes even more important after Cyber Week, as customer behavior stabilizes and competitors adjust pricing less predictably.

Daily or hourly competitive monitoring ensures that pricing engines react appropriately to the slower but still significant price adjustments made by competitors.

Dynamic pricing should respond to stock levels. Products with limited remaining supply should maintain regular pricing, while overstocked SKUs may require targeted markdowns.

Urgency increases again before Christmas. Consumers prioritize speed and availability. Pricing teams can take small margin advantages in this period.

January often sees heavy clearance cycles. Retailers must use predictive models to determine which SKUs require early markdowns and which can maintain pricing through Q1.

Retailers must plan margin recovery based on expected Q1 elasticity. Some categories naturally allow higher margins early in the year due to reduced competition.

Effective promotions must support price restoration rather than undermine it.

onsumers become desensitized if promotions continue without pause.

Retailers must reintroduce full price positioning carefully.

Different categories require different discount intensities based on Cyber Week performance.

Price resets must be communicated clearly across all channels to avoid customer confusion.

These reduce reliance on price cuts. Examples include loyalty bonuses, shipping perks, and curated gift bundles.

Pricing transparency and compliance matter significantly after Cyber Week.

Automation must not trigger unplanned discounts.

Some sellers use misleading tactics to influence market prices.

Consumers expect consistency. With price tracking tools, unfair pricing becomes visible instantly.

Understanding how retailers should adjust prices after Black Friday and Cyber Week is essential for maintaining profitability and customer trust. Retailers who rely on structured competitive intelligence, strong inventory analytics, and predictive pricing engines outperform organizations that restore prices through intuition alone.

tgndata equips retailers with real time competitive data, advanced pricing models, and dynamic automation tools that ensure a seamless transition from peak promotions to profitable seasonal pricing. The brands that modernize their pricing strategy now will enter Q1 with a stronger position, clearer margins, and sustained customer trust.

We use cookies to provide you with an optimal experience, for marketing and statistical purposes only with your consent, which you may revoke at any time. Please refer to our Privacy Policy for more information.

Missing an important marketplace?

Send us your request to add it!