- Product

- Solution for

For Your Industry

- Plans & Pricing

- Company

- Resources

For Your Industry

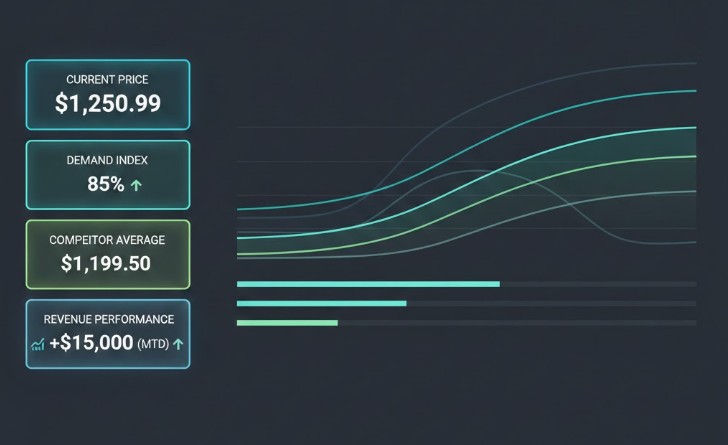

December creates the most intense pricing and margin pressure of the entire retail calendar. As customer acquisition peaks and promotional noise skyrockets, brands face a constant battle to remain competitive without eroding profitability. Real-time competitor monitoring has become the missing link for organizations that want to respond instantly and intelligently to December’s volatile market. This capability aligns directly with the pricing automation strategies that retailers and eCommerce leaders rely on to protect revenue during one of the most chaotic sales periods of the year.

Real-time competitor monitoring gives teams the visibility and speed needed to adjust prices with accuracy, plan profitable promotions, and defend margin while staying agile. It is no longer optional. It is the central engine that drives data informed pricing decisions across December’s high stakes shopping events.

December produces a uniquely compressed pricing environment. Retailers experience several overlapping forces that collectively accelerate decision making requirements and compress the margin window. Understanding these forces shows why real-time competitor monitoring is now mission critical.

Customer behavior becomes unpredictable in December. Consumers switch between deal hunting and urgent shopping within a single day. Traffic volumes can surge by 100 percent within minutes, especially during flash sales or same day delivery deadlines. Static weekly or daily pricing cycles cannot keep up with these swings. Real-time competitor monitoring allows teams to detect market changes as they happen and respond with precision.

Discounts flood the market from early December until year end. Competitors launch frequent micro promotions that traditional pricing systems often fail to detect. A rival dropping a price by even five percent can shift conversion share instantly. Without real-time detection, retailers risk losing visibility of these shifts until it is too late.

Final shipping dates vary by carrier, region, and product type. Competitors adjust prices around these deadlines to capture the last wave of holiday demand. Retailers who monitor these adjustments in real time can position their offers to win high intent buyers.

Low stock levels create conditions for both premium pricing opportunities and necessary markdowns. Monitoring competitor stockouts in real time allows retailers to capture incremental margin when demand peaks and alternatives diminish.

Many retailers operate simultaneous online, mobile app, and physical promotions in December. Customers cross check prices across channels more aggressively than at any other time of year. Real-time competitor monitoring ensures pricing consistency and removes blind spots that can undermine trust and conversion.

Many organizations believe they already conduct competitive monitoring. However, traditional competitor tracking methods rarely operate at true real-time speed. Real-time competitor monitoring is defined by three operational standards.

Price, promotion, and availability data must update minute by minute, not daily. The system must detect competitor changes instantly. A delay of even one hour during December can translate to thousands of lost conversions.

Data must be captured using automation, structured in consistent formats, and validated without manual intervention. Manual sampling or manual screenshot collection cannot support December’s velocity.

Competitor insights must feed directly into pricing engines, dashboards, and decision workflows. Real-time monitoring has limited value unless pricing teams can act on it immediately.

Retailers that meet these standards gain a strategic advantage. They respond faster, identify profit opportunities earlier, and avoid being blindsided by tactical competitor activity.

December intensity highlights the weaknesses of traditional pricing tracking processes. These older methods were designed for slow moving monthly or weekly cycles. They collapse under holiday level sales pressure.

Teams that rely on manual checks or third party reports receive data far too late. A competitor can adjust a price at 10 AM, capture market share all morning, then restore the higher price by afternoon. Without real-time monitoring, retailers miss the entire competitive window.

December promotions can last as little as one hour. Many retailers create time boxed deals that are invisible to daily crawlers. These promotions shift the market and influence consumer perception even if they are short lived.

Incorrect matchups lead to poor decisions. Real-time competitor monitoring platforms rely on automated product clustering that ensures accurate matching across variants, bundles, and multi pack SKUs.

Daily or weekly reports force teams into reactive mode. December demands proactive action. Real-time monitoring gives teams early warning signals that allow strategic adjustments instead of panicked last minute changes.

Organizations that integrate real-time competitor monitoring into their December operations experience measurable improvements across pricing execution, conversion, and profitability.

Retailers stay aligned with market expectations, maintaining visibility into even the smallest price shifts. The result is higher conversion rates and lower cart abandonment.

Teams can evaluate competitor promotional calendars and launch counter offers at optimal moments. Real-time insight helps identify when a competitor over discounts or under discounts a key product.

Accurate view of competitive pressure enables retailers to avoid unnecessary markdowns. They can maintain price discipline when competitors are out of stock or when demand remains inelastic.

Pricing teams eliminate bottlenecks and execute changes quickly. Real-time data supports pricing automation that updates prices instantly, allowing retailers to operate at the speed December requires.

By monitoring competitor availability, retailers can highlight opportunities to capture market share when demand surges and supply diminishes. This reduces overstocks and improves clearance outcomes.

Retailers that excel in December use a structured framework to guide strategic and tactical pricing actions. Real-time competitor monitoring is the data engine for every step.

Constant scanning of competitor product pages reveals price changes, stock updates, shipping cutoff times, and promotional mechanics. This provides early indicators of competitive shifts.

Signals are evaluated using pricing intelligence to identify margin expansion opportunities, price increase windows, or defensive actions. For example, if three competitors sell out of a top holiday item, a retailer can maximize margin immediately.

Pricing automation updates prices based on rules, elasticity data, and competitive thresholds. Teams can set guardrails to avoid margin erosion while staying aligned with market expectations.

Real-time dashboards track conversion changes, price rank movement, and price perception indicators. December pricing success depends on instant feedback loops.

Pricing teams iterate on rules or thresholds to improve outcomes, ensuring each cycle becomes more precise throughout December.

Retailers at the forefront of pricing intelligence rely on real-time competitor monitoring as a foundation for modern December operations. Several common use cases illustrate the impact.

When a competitor launches an unexpected flash sale, real-time alerting allows retailers to respond quickly. They can match the discount within minutes or choose to hold price if elasticity data suggests high demand.

Retailers identify the products with the highest conversion sensitivity in December and track these SKUs minute by minute. This enables hyper precise pricing strategy.

If a particular category shows aggressive promotional activity, real-time monitoring enables cross category defense. Retailers adjust pricing selectively rather than applying blanket discounts.

As shipping cutoff dates approach, competitors often increase prices. Real-time visibility helps retailers capture incremental profit during these high urgency purchasing windows.

Retailers monitor competitor pricing across web, mobile, and marketplace channels to ensure consistent positioning. This prevents customer confusion and protects brand perception.

Real-time competitor monitoring requires specialized infrastructure that can operate at massive scale during peak retail periods.

Systems must capture competitor data continuously and distribute updates to pricing engines immediately.

AI powered matching algorithms classify products across competitor catalogs with high precision. This prevents pricing errors that occur when products are mismatched.

December traffic spikes can double or triple load on monitoring systems. Real-time infrastructure must scale dynamically to ensure uninterrupted data flow.

Retailers need seamless integration between competitor insights, pricing intelligence, and p

To extract full value from real-time competitor monitoring, retailers track specific KPIs tailored to December’s unique dynamics.

Price rank position across key SKUs

Competitor promotion frequency

Time to match competitor price changes

Time to detect competitor stockouts

Margin impact of price reactions

Conversion rate changes following competitive shifts

Share of voice across top holiday categories

Percentage of automated price updates versus manual updates

These indicators help pricing teams refine their strategy throughout December and maximize the value of real-time monitoring.

Pricing automation systems depend on accurate and timely competitive data. Real-time monitoring enhances automation by delivering high-quality inputs.

Pricing rules activate based on actual competitive events, not delayed snapshots.

Real-time demand and competitor signals improve elasticity models, leading to better pricing outcomes.

Teams can set intelligent thresholds to protect margin and avoid race to the bottom scenarios.

Retailers can test micro promotions or small price changes and observe the competitive landscape instantly.

The retail industry is moving toward continuous and dynamic pricing models that rely heavily on real-time data. December is the proving ground where retailers discover whether their systems are agile enough to keep pace with market velocity.

In the future, real-time competitor monitoring will integrate predictive analytics, automated promotional intelligence, and smarter product clustering. Retailers that invest early will gain significant competitive advantage in December and beyond.

Real-time competitor monitoring is the missing link in the intense pricing landscape of December. Retailers face unprecedented pressure to balance competitiveness with profitability, and traditional methods cannot keep up with December’s speed and volatility.

With real-time monitoring, pricing teams gain the visibility, speed, and intelligence required to respond instantly to market changes, optimize promotions, and protect margin at the most critical point of the retail calendar.

To transform your December pricing strategy and unlock the full value of real-time competitor monitoring, partner with tgndata. Our pricing intelligence and automation solutions provide retailers with the accuracy and agility needed to confidently win the holiday season.

We use cookies to provide you with an optimal experience, for marketing and statistical purposes only with your consent, which you may revoke at any time. Please refer to our Privacy Policy for more information.

Missing an important marketplace?

Send us your request to add it!