- Product

- Solution for

For Your Industry

- Plans & Pricing

- About us

- Resources

For Your Industry

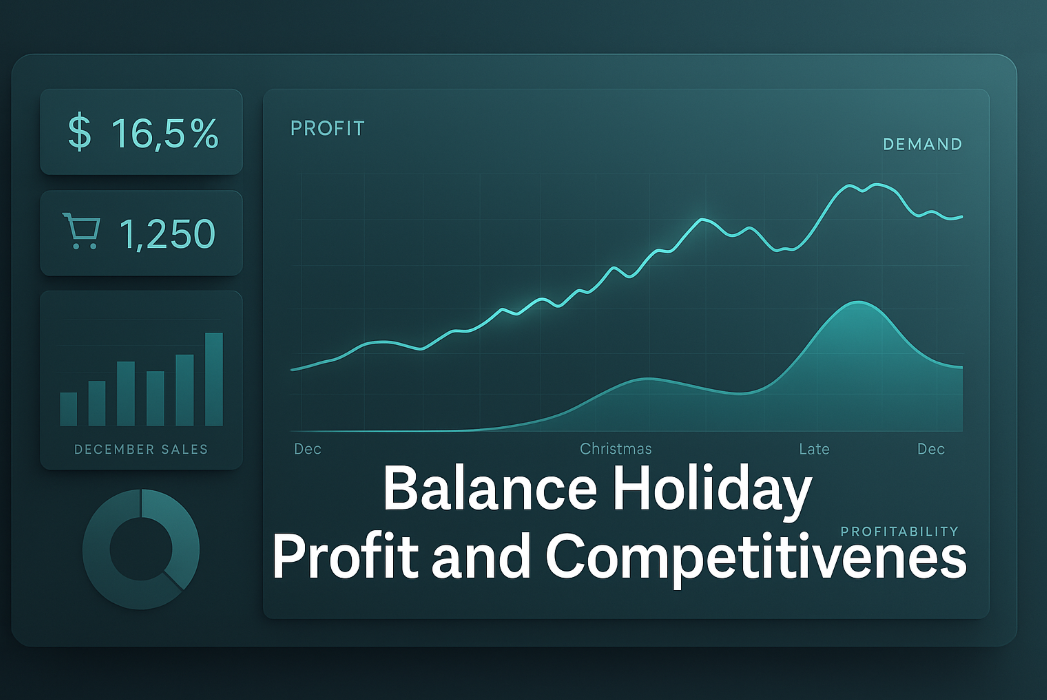

In the final shopping days before Christmas, retailers face extreme volatility as shoppers rush to complete purchases, competitors adjust prices rapidly, and inventory scarcity drives unpredictable demand curves. Knowing how to balance profit and competitiveness in these final days is critical for retailers who want to protect margins without losing market share. Advanced pricing analytics and automation give teams the data and precision needed to execute profitable strategies during the most intense window of the holiday season.

Customer behavior shifts dramatically during the last week before Christmas. Traditional elasticity patterns flatten, urgency increases, and competition intensifies. Retailers must balance price sensitivity with elevated willingness to pay.

Higher urgency lifts conversion rates

Lower elasticity for gift items

Supply constraints reduce promotional pressure

Competitors make reactive price changes

Last minute buyers prioritize speed over discounts

The challenge is to maintain competitiveness without unnecessary margin erosion.

Data driven pricing gives retailers visibility into how customers behave hour by hour. AI forecasting models identify demand surges, recommend price increases or protection strategies, and detect when discounts no longer drive meaningful lift.

Real time conversion rates

Price elasticity changes

Store and warehouse inventory levels

Competitor pricing movements

Shipping cutoff deadlines

Regional weather conditions

Retailers who use these signals can adjust tactics with confidence.

AI forecasting engines help teams understand where demand will spike, which SKUs face scarcity risk, and which products can sustain higher prices.

Predicts last minute demand acceleration

Identifies SKUs with reduced elasticity

Recommends targeted price increases

Flags items that require competitive matching

Adjusts forecasts in real time as new data arrives

This leads to more profitable pricing decisions during a period when human judgment alone is too slow.

Dynamic pricing engines automate price adjustments based on rules, guardrails, and forecast outputs. During the peak holiday window, these systems ensure retailers stay aligned with the market without relying on manual overrides.

Immediate reaction to competitor price changes

Automatic pause on promotions when inventory is low

Smart discounts based on true elasticity

Protection against margin leakage

Price updates across all channels with full consistency

Retailers who use dynamic pricing outperform those who rely on static promotional calendars.

Competitor behavior becomes hyperactive in December. Price intelligence platforms detect sudden drops, short lived flash promotions, and regional price variations that can influence your demand.

Category wide price reductions

Marketplace seller undercutting

Last minute bundle promotions

Temporary discounting by major retailers

Unexpected price increases on scarce items

Balancing competitiveness means knowing when to respond and when to hold position based on elasticity and inventory conditions.

Inventory is one of the strongest pricing levers in the final shopping days before Christmas. When stock runs low, prices can increase without affecting conversion. When inventory is abundant, promotions may be required to meet sales targets.

Increase prices on scarce high demand SKUs

Reduce discounts on items nearing sellout

Promote overstocked items with controlled markdowns

Use inventory forecasts to schedule price changes

Stop matching competitor prices on constrained items

Combining inventory and demand signals maximizes profit opportunities.

Shoppers behave differently as Christmas approaches. Artificial deadlines, emotional pressure, social expectations, and convenience needs influence willingness to pay.

Buyers value certainty more than savings

In store pickup and fast shipping become key drivers

Product availability becomes a deciding factor

Brand loyalty weakens when urgency peaks

Gift suitability outweighs discount depth

Pricing strategies that reflect shopper psychology outperform generic promotions.

Many retailers unintentionally give away margin or lose competitiveness due to reactive or untargeted pricing.

Over discounting due to fear of losing market share

Matching competitor prices on constrained inventory

Running promotions that no longer influence demand

Ignoring real time conversion and elasticity data

Using blanket price cuts across all SKUs

A well governed pricing framework prevents these pitfalls.

Retailers who prepare scenarios can act faster and more strategically during the final week.

What happens if we stop discounting a fast selling SKU

How margin shifts if we increase prices on scarce items

The revenue effect of matching a competitor flash promotion

The cost of overstock for certain categories

Expected demand if weather triggers a late season surge

Scenario planning helps teams respond with precision instead of guesswork.

While the final days before Christmas prioritize immediate revenue, retailers must also consider the long term effects of pricing decisions.

Excessive discounting can devalue the brand

Unavailability or high pricing on essentials may frustrate customers

Transparent price increases preserve goodwill

Personalized offers strengthen loyalty

Balanced pricing keeps shoppers returning in the new year

Smart retailers optimize both profit and customer relationship outcomes.

Knowing how to balance profit and competitiveness in the final shopping days before Christmas gives retailers a measurable advantage. AI forecasting, dynamic pricing automation, competitor intelligence, and inventory aware strategies help teams make precise, confident decisions during the most intense period of holiday commerce. Retailers who apply data driven pricing improve revenue, protect margins, and deliver better customer experiences throughout the season.

To learn how tgndata supports peak season pricing with advanced analytics and automation, connect with our team.

We use cookies to provide you with an optimal experience, for marketing and statistical purposes only with your consent, which you may revoke at any time. Please refer to our Privacy Policy for more information.

Missing an important marketplace?

Send us your request to add it!