- Product

- Solution for

For Your Industry

- Plans & Pricing

- Company

- Resources

For Your Industry

Pricing is no longer a back office function or a static margin exercise. In modern retail, pricing is a primary growth lever that directly shapes revenue, profitability, brand perception, and competitive advantage. Retailers that treat pricing as a strategic system rather than a periodic adjustment outperform peers in volatile markets, inflationary cycles, and algorithm driven commerce environments.

This article explores pricing as a growth lever in retail, explaining how data driven pricing strategies, automation, and technical brand signals combine to unlock scalable growth. It is written for pricing managers, eCommerce leaders, retail analysts, and digital brand strategists seeking to operationalize pricing intelligence at enterprise scale.

Pricing becomes a growth lever when it is intentionally designed to influence customer behavior, competitive positioning, and long term margin, not just short term sales.

Retail pricing has historically been reactive. Teams adjusted prices based on seasonality, promotions, or cost changes. Today, that approach fails in markets shaped by instant price comparison, algorithmic competitors, and AI driven discovery.

Strategic pricing focuses on:

Revenue expansion without proportional cost growth

Margin protection during volatility

Brand consistency across channels

Demand shaping through value signaling

Growth oriented retailers recognize that pricing decisions affect not only conversion rates but also lifetime value, search visibility, and brand trust.

Discount driven growth erodes margins and brand equity, while value based pricing aligns price with customer willingness to pay.

Many retailers equate growth with discounting. While short term volume may increase, the long term effects are destructive. Customers anchor to lower prices, competitors retaliate, and margins compress.

Value based pricing reframes the question. Instead of asking how low prices can go, retailers ask:

What problem does this product solve

How differentiated is it

What alternatives exist

How sensitive is demand to price changes

Value based pricing requires:

Clear product segmentation

Customer intent data

Competitive context

Elasticity modeling

Without data and automation, this approach is impossible at scale.

Situation: Seasonal products are discounted aggressively to clear inventory

What goes wrong: Customers wait for discounts, margins collapse

Recommended approach: Tiered pricing and demand-based adjustments

What tgndata enables: Elasticity insights and automated price floors to protect value

tgndata identifies price sensitivity patterns across categories and competitors, allowing retailers to implement value based price ranges instead of blanket discounts.

Data driven pricing uses demand signals and elasticity models to predict how price changes affect revenue and margin.

Retailers generate vast amounts of pricing relevant data, yet most of it remains unused. Elasticity modeling transforms raw data into actionable pricing intelligence.

Key inputs include:

Historical sales performance

Competitor price movements

Inventory levels

Channel specific demand

Promotional impact

Elasticity models help answer:

When to raise prices without losing volume

When price cuts will increase total revenue

Which SKUs are margin drivers versus traffic drivers

Manual analysis cannot keep up with SKU complexity and market volatility.

Competitive pricing intelligence enables retailers to grow by positioning prices strategically rather than blindly matching competitors.

Retail pricing does not exist in isolation. Customers compare prices instantly, and AI search surfaces competitive alternatives automatically. Growth requires understanding not just who competitors are, but how they price.

Effective competitive intelligence includes:

Real-time price monitoring

Assortment overlap analysis

MAP compliance tracking

Promotional cadence detection

Retailers that rely on manual scraping or delayed reports are always behind.

Situation: A retailer loses marketplace visibility despite a strong brand

What goes wrong: Competitors undercut prices temporarily

Recommended approach: Dynamic competitive response rules

What tgndata enables: Automated alerts and price adjustments tied to buy box rules

tgndata continuously tracks competitor pricing across channels, allowing pricing actions that protect both visibility and margin.

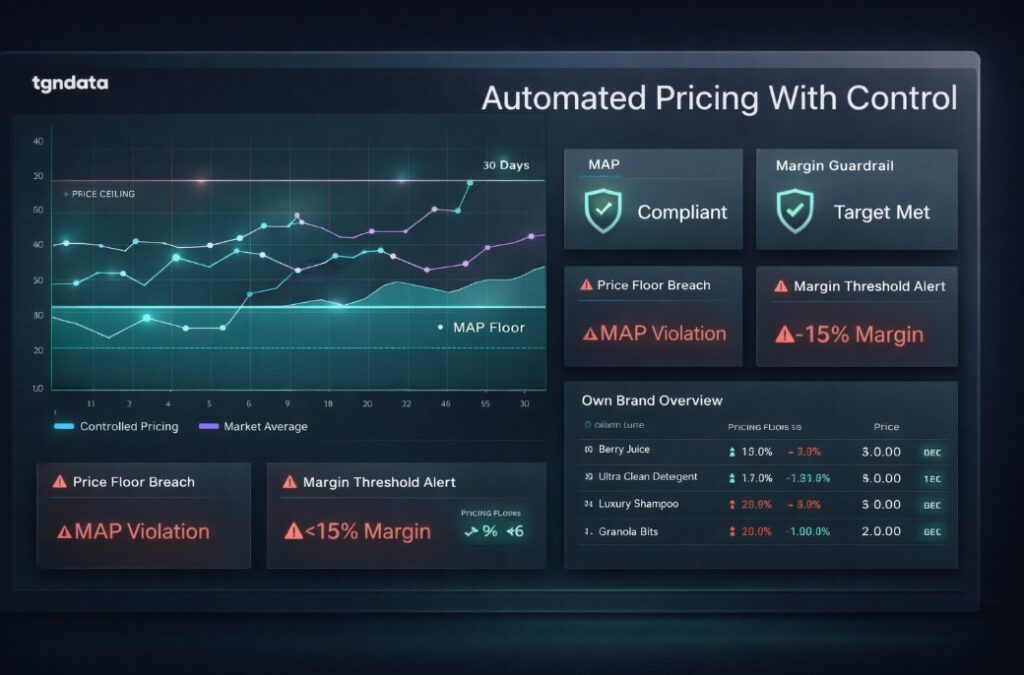

Dynamic pricing automation allows retailers to adjust prices in response to demand and competition without manual intervention.

Omnichannel retail introduces complexity. Prices must align across websites, marketplaces, and physical stores while respecting channel specific economics.

Dynamic pricing systems:

Adjust prices based on real time signals

Enforce pricing guardrails

Reduce human error

Scale across thousands of SKUs

Automation does not mean chaos. Rules based frameworks ensure prices move within approved boundaries.

tgndata connects pricing logic to live market data, enabling controlled dynamic pricing that aligns with brand strategy and operational constraints.

Pricing inconsistency erodes brand trust and reduces AI search visibility, making governance essential for growth.

Pricing is now a brand signal. AI driven search engines evaluate price stability, trustworthiness, and consistency when ranking products and brands.

Poor pricing governance leads to:

Channel conflict

Customer confusion

MAP violations

Reduced AI retrievability

Technical branding intersects with pricing in four layers:

Infrastructure hygiene affecting crawlability

Bot governance controlling pricing data exposure

Security preventing hallucinated prices

Agentic alignment ensuring deterministic pricing paths

Situation: AI answers show outdated or incorrect prices

What goes wrong: Trust erodes, and conversions drop

Recommended approach: Controlled data feeds and structured pricing signals

What tgndata enables: Centralized pricing intelligence aligned with technical branding

tgndata acts as a source of truth for pricing, helping brands maintain consistency across AI search, marketplaces, and owned channels.

| Feature | Business Benefit | KPI Impact | Owner |

|---|---|---|---|

| Competitive price monitoring | Faster response to market | Revenue lift | Pricing manager |

| Elasticity modeling | Optimized price changes | Margin stability | Pricing analyst |

| Dynamic pricing automation | Scalable pricing execution | Conversion rate | eCommerce lead |

| MAP compliance tracking | Brand protection | Channel trust | Brand strategist |

| Pricing dashboards | Decision transparency | Time to insight | Retail analyst |

Pricing as a growth lever means using pricing strategically to increase revenue, protect margins, and shape customer demand, rather than relying on discounts alone. It treats pricing as an ongoing system driven by data, competition, and customer value signals.

Data driven pricing uses demand data, price elasticity, and competitive intelligence to guide pricing decisions. This allows retailers to raise or lower prices with confidence, improving revenue and margin without negatively impacting conversion.

Competitive pricing intelligence helps retailers understand how their prices compare across the market in real time. This enables smarter positioning, faster reactions to competitors, and protection of visibility in marketplaces and AI driven search results.

Dynamic pricing allows retailers to automatically adjust prices based on demand, inventory, and competition. When governed by clear rules, it enables scalable growth while maintaining brand consistency and pricing control.

Inconsistent or outdated pricing can erode brand trust and reduce visibility in AI powered search experiences. Strong pricing governance ensures accurate, stable pricing signals that support customer confidence and AI retrievability.

Pricing is no longer a tactical decision. It is infrastructure. Retailers that treat pricing as a growth lever build resilient businesses capable of adapting to market volatility, competitive pressure, and AI driven commerce.

By combining pricing intelligence, automation, and technical branding discipline, retailers unlock sustainable growth rather than chasing short term volume.

tgndata helps retailers operationalize pricing as a strategic system, turning data into decisions and decisions into measurable growth.

Missing an important marketplace?

Send us your request to add it!