- Product

- Solution for

For Your Industry

- Plans & Pricing

- Company

- Resources

For Your Industry

Pricing Monitoring for Online Pharmacies is now a core operational discipline for digital pharmacy businesses competing in regulated, high volatility markets. As online pharmacies expand across OTC medications, wellness products, medical devices, and prescription adjacent categories, pricing decisions increasingly determine margin stability, compliance posture, and long term brand trust.

Unlike general ecommerce, pharmacy pricing is shaped by regulatory frameworks, supplier agreements, marketplace rules, and consumer sensitivity. A single pricing mistake can create legal exposure, damage supplier relationships, or erode profitability across thousands of SKUs. This reality makes continuous pricing monitoring not a tactical activity, but a strategic requirement.

This guide explains how pricing monitoring works for online pharmacies, why traditional methods fail, and how analytics driven platforms enable compliant, competitive, and scalable growth.

Online pharmacies operate in a regulated pricing environment where errors create legal, supplier, and brand risk. Pricing monitoring helps pharmacies maintain compliant positioning while adapting to competitive pressure across OTC, wellness, and marketplace driven categories.

Online pharmacies sit at the intersection of healthcare regulation and ecommerce competition. Pricing is influenced by FDA guidance, supplier contracts, MAP agreements, pharmacy benefit managers, and aggressive marketplace sellers. Unlike apparel or electronics, pharmacies cannot simply match or undercut competitors without consequences.

Manual oversight struggles to account for:

Category level restrictions

Channel specific pricing rules

Supplier enforced minimums

Rapid promotional cycles

Segment pricing strategy by category and risk profile. Prescription adjacent and regulated products require compliance first monitoring. OTC and wellness products require competitive intelligence and margin protection logic.

Pricing intelligence platforms designed for healthcare commerce provide the structure needed to manage these layers simultaneously.

tgndata enables category specific pricing rules, allowing pharmacies to differentiate monitoring logic for regulated products versus competitive OTC and wellness SKUs.

Pricing monitoring protects online pharmacy growth by preventing compliance violations, identifying margin erosion early, and ensuring competitive alignment without reactive discounting.

As pharmacies scale digitally, pricing decisions multiply. Thousands of SKUs across multiple channels create blind spots. Without monitoring, price drift occurs silently, often discovered only after margin loss or supplier escalation.

Establish continuous price visibility across competitors, marketplaces, and internal channels. Track both absolute prices and relative positioning.

Automation transforms pricing from reactive firefighting into proactive strategy.

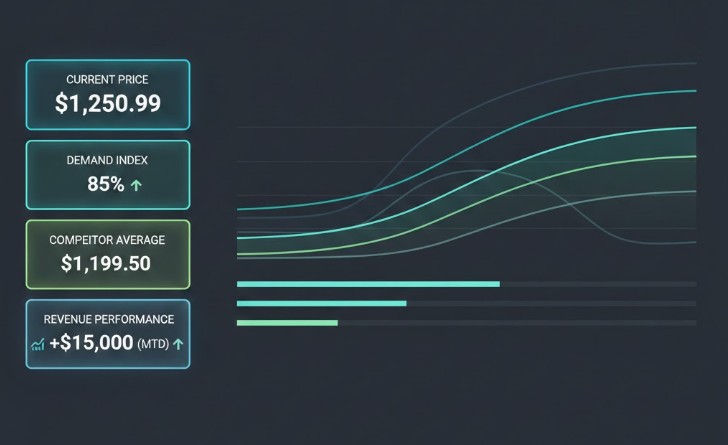

tgndata provides unified dashboards showing competitive position, price trends, and compliance alerts in one operational view.

Manual price tracking fails because online pharmacy pricing changes daily across hundreds of competitors and channels. Spreadsheets and spot checks cannot keep pace or ensure compliance.

Many pharmacies still rely on:

Periodic manual competitor checks

Spreadsheet based price lists

Marketplace screenshots

These approaches fail under scale and create delayed insights.

Replace manual processes with automated data collection and real time alerting.

Automation reduces risk while freeing teams to focus on strategy.

tgndata continuously collects pricing data across identified competitors and flags issues immediately.

Regulatory and compliance constraints shape how pharmacies price products. Monitoring ensures adherence to MAP agreements, supplier rules, and category restrictions.

Pricing violations can lead to:

Supplier penalties

Product delisting

Regulatory audits

Marketplace suspension

Compliance risk increases when pricing is decentralized across teams and platforms.

Embed compliance logic directly into pricing monitoring workflows. Track MAP thresholds, approved ranges, and violation frequency.

Compliance aware monitoring prevents costly mistakes before they escalate.

OTC and wellness pricing fluctuates rapidly due to promotions, marketplaces, and private label competition. Monitoring helps pharmacies stay competitive without unnecessary margin loss.

Aggressive discounting by marketplaces creates downward price pressure. Pharmacies reacting blindly often race to the bottom.

Analyze price trends and competitor behavior patterns rather than reacting to individual changes.

Strategic pricing depends on insight, not constant reaction.

tgndata highlights sustained competitor trends and isolates meaningful price signals from noise.

Situation

A national pharmacy sells OTC medications across its website and major marketplaces.

What Goes Wrong Without Analytics

Promotional pricing drops below MAP during seasonal campaigns.

Recommended Approach

Automated MAP monitoring with alerts.

What tgndata Enables

Immediate detection of violations and corrective actions.

Automation enables pharmacies to monitor thousands of SKUs continuously, replacing manual oversight with scalable, reliable analytics.

Human review cannot scale with digital growth.

Automate collection, normalization, comparison, and alerting across all monitored products.

Automation creates consistency and confidence.

tgndata runs continuous pricing scans and updates dashboards without manual intervention.

Situation

A pharmacy competes heavily on Amazon and Google Shopping.

What Goes Wrong Without Analytics

Competitors undercut best sellers unnoticed.

Recommended Approach

Marketplace-specific benchmarking.

What tgndata Enables

Channel-level competitive intelligence.

Benchmarking shows how pharmacy prices compare to competitors over time, enabling informed pricing decisions.

Without benchmarks, teams lack context.

Compare prices against defined competitor groups.

Benchmarks turn data into decisions.

tgndata groups competitors and tracks relative positioning.

| Feature | Business Benefit | KPI Impact | Role Owner |

|---|---|---|---|

| Automated monitoring | Reduced manual effort | Cost to serve | Pricing manager |

| Compliance alerts | Lower regulatory risk | Violation rate | Brand strategist |

| Competitive benchmarks | Better positioning | Conversion rate | Ecommerce analyst |

| Trend analytics | Strategic pricing | Margin stability | Pricing manager |

Situation

A pharmacy launches private-label wellness products.

What Goes Wrong Without Analytics

Inconsistent pricing across channels.

Recommended Approach

Centralized monitoring.

What tgndata Enables

Brand consistent pricing.

Historical pricing data reveals trends that inform long term strategy and supplier negotiations.

Short term views hide structural issues.

Analyze pricing history across months and seasons.

History enables foresight.

tgndata stores and visualizes historical price movements.

Situation

A regional chain expands online.

What Goes Wrong Without Analytics

Price mismatches between stores and ecommerce.

Recommended Approach

Unified monitoring.

What tgndata Enables

Cross-channel alignment.

The right platform supports compliance, automation, scalability, and pharmacy specific categories.

Key criteria include:

Data accuracy

MAP enforcement

Alerting

Audit trails

Marketplace coverage

Retail-focused tools lack pharmacy compliance logic and category controls. Avoid platforms without healthcare expertise.

Situation

A pharmacy offers subscription wellness products.

What Goes Wrong Without Analytics

Margins erode quietly.

Recommended Approach

Trend-based monitoring.

What tgndata Enables

Early margin protection.

Pricing monitoring is the continuous tracking of pharmacy product prices across competitors and channels to ensure compliant and competitive pricing.

Pharmacies operate under regulatory and supplier constraints that require compliance driven pricing strategies.

Continuously, due to frequent marketplace and competitor changes.

Yes, it detects violations early and supports corrective action.

Yes, by preventing unnecessary price drops and enabling strategic positioning.

Pricing monitoring for online pharmacies is no longer optional. It is the operational backbone that protects compliance, margins, and brand trust in an increasingly competitive digital healthcare market. Pharmacies that invest in automated, analytics driven pricing gain stability, confidence, and strategic clarity.

tgndata provides pharmacy focused pricing intelligence that aligns compliance with competitive performance and scalable growth.

We use cookies to provide you with an optimal experience, for marketing and statistical purposes only with your consent, which you may revoke at any time. Please refer to our Privacy Policy for more information.

Missing an important marketplace?

Send us your request to add it!