- Product

- Solution for

For Your Industry

- Plans & Pricing

- About us

- Resources

For Your Industry

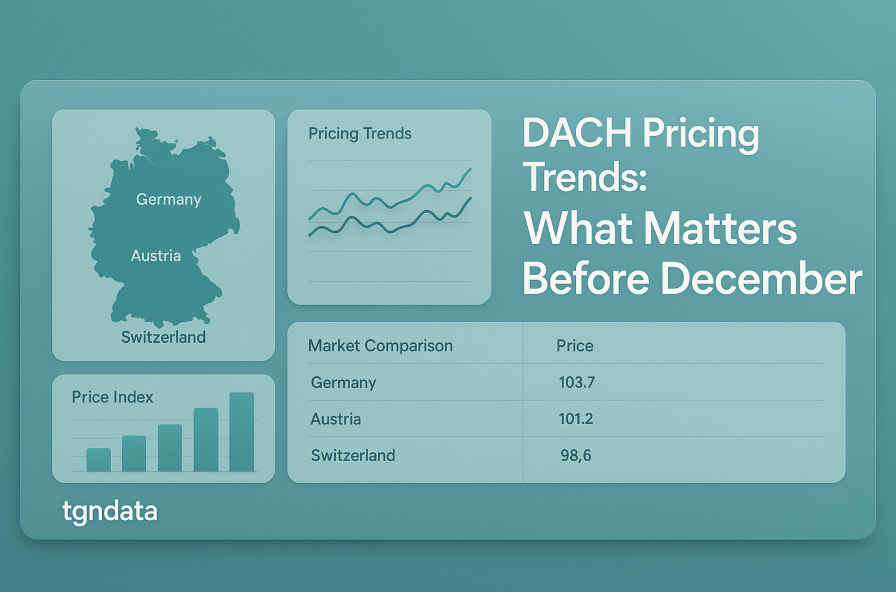

As December approaches, retailers across the DACH region—Germany, Austria, and Switzerland—enter their most competitive pricing cycle of the year. DACH pricing trends reveal that Q4 is no longer defined solely by Black Friday or Cyber Week but by continuous pricing pressure from eCommerce competitors and rising consumer price sensitivity.

The key to profitability lies in anticipating shifts, not reacting to them. tgndata’s pricing intelligence platform empowers DACH retailers to identify market movements, forecast elasticity, and implement dynamic pricing strategies that capture sales while protecting margins during this volatile period.

The DACH retail environment is one of Europe’s most sophisticated, characterized by high online penetration, strong discounting culture, and consumers highly attuned to price transparency.

Germany: Competitive online marketplaces, especially in electronics, apparel, and FMCG.

Austria: Strong omnichannel integration, blending local brand loyalty with cross-border shopping.

Switzerland: Premium pricing segment, but increasingly influenced by Eurozone price benchmarking.

These factors make pricing intelligence essential for maintaining balance between local profitability and international competitiveness.

Historical pricing data from tgndata’s retail analytics across the DACH region shows three distinct patterns in Q4 pricing behavior.

Timing: Late November to early December

Impact: Retailers adjust prices by 10–25% to capture early holiday traffic and clear inventory before major promotions.

Category Leaders: Electronics, home appliances, and personal care items.

After initial discounts, prices stabilize as retailers focus on maintaining margins while monitoring competitor adjustments.

The week before Christmas typically sees price elasticity drop, as convenience outweighs cost. Premium delivery and bundled offers outperform raw discounting.

Understanding these patterns helps brands deploy tactical price adjustments instead of reactive markdowns.

DACH retailers increasingly rely on AI-driven dynamic pricing to align prices with real-time demand.

Electronics retailers in Germany now update pricing 3–5 times per day.

Major Austrian marketplaces use elasticity-based models to automate category-level price shifts.

With shoppers comparing across EU marketplaces, retailers in Switzerland and Austria face pricing pressure from German eCommerce platforms.

Dynamic pricing tools now integrate exchange rate modeling and VAT normalization to maintain price integrity across markets.

Inflation remains above pre-pandemic levels across the DACH region. Consumers are prioritizing value, not just discounts. Retailers must balance price perception and product differentiation to retain loyalty.

tgndata analytics show that “smart price anchoring”—strategically pricing core SKUs to influence perceived fairness—can increase conversion by 8–12%.

Retailers track not just competitor prices but promotion frequency and duration. AI systems identify when competitors are likely to revert to full prices, allowing for timed price rebounds that protect margin without losing competitiveness.

Elasticity measurement has become a cornerstone of DACH pricing strategy. By analyzing how demand reacts to price changes, retailers can set optimal price points before December volatility begins.

| Category | Elasticity Index | Optimal Discount Range | Typical Peak Adjustment |

|---|---|---|---|

| Electronics | -2.8 | 8–12% | 10% |

| Apparel | -1.9 | 10–15% | 12% |

| Home & Living | -1.4 | 6–10% | 8% |

| Beauty | -1.6 | 5–8% | 7% |

Price automation tools dominate, with top retailers deploying real-time APIs to track over 1 million SKUs daily.

Retailers combine digital benchmarking with local customer intelligence, adapting online discounts to in-store promotions.

Given strong brand equity, Swiss retailers use pricing analytics to defend premium positioning while avoiding cross-border cannibalization from EU prices.

A localized yet data-driven approach ensures pricing remains competitive and profitable across the region.

Step 1: Centralize Data Visibility

Consolidate pricing, demand, and competitor insights from all markets into a unified analytics platform.

Step 2: Define Regional Elasticity Models

Adjust pricing rules to reflect market sensitivity, such as higher price tolerance in Switzerland versus discount elasticity in Germany.

Step 3: Automate Dynamic Adjustments

Leverage tgndata’s dynamic pricing automation to execute rules in real time, ensuring every price point reflects true market potential.

Step 4: Monitor Price Perception

Use price index tracking to maintain parity with key competitors while managing consumer trust through stable pricing anchors.

Even data-savvy retailers risk revenue loss if timing and execution falter. Avoid these common pitfalls:

Overreacting to competitor price drops without analyzing elasticity.

Delaying automation setup until promotions are underway.

Ignoring cross-border dynamics between DACH markets.

Focusing solely on discount depth instead of strategic pricing cadence.

Proactive data planning ensures sustainable pricing that supports both volume and profitability.

tgndata provides end-to-end pricing intelligence for retailers operating in complex, multi-market environments like DACH.

Real-time competitor monitoring across EU markets.

Dynamic pricing automation.

Localized benchmarking for currency.

Predictive demand modeling for pre-December optimization.

With tgndata, pricing managers can act on live data instead of assumptions, positioning their brands for success before December’s critical buying window.

In the DACH retail arena, pricing success depends on foresight and precision. Retailers who monitor market signals early, analyze elasticity deeply, and automate dynamic price responses outperform those who rely on static rules.

By integrating tgndata’s pricing intelligence and retail analytics, DACH brands can align strategy with market realities, ensuring competitiveness and profit through December and beyond.

Empower your pricing team with tgndata’s analytics today—because the best December margins are made in November.

We use cookies to provide you with an optimal experience, for marketing and statistical purposes only with your consent, which you may revoke at any time. Please refer to our Privacy Policy for more information.

Missing an important marketplace?

Send us your request to add it!