- Product

- Solution for

For Your Industry

- Plans & Pricing

- About us

- Resources

For Your Industry

November is the ultimate battleground for retail pricing strategy. From Singles’ Day (11.11) to Black Friday and Cyber Monday, these three weeks can generate up to 40% of annual eCommerce revenue for top retailers. Yet with inflationary pressures, volatile demand, and increasingly price-sensitive consumers, the 2025 November retail pricing game plan must be smarter, more agile, and more data-driven than ever.

In this article, we’ll break down how pricing leaders can leverage dynamic pricing automation, real-time competitive intelligence, and AI-driven analytics to capture market share across the month’s biggest shopping events — all while safeguarding margins.

Understanding what makes November unique in 2025 is the first step in shaping your November Retail Pricing Game Plan 2025.

According to EY‑Parthenon, for the November–December 2025 shopping season in the U.S., nominal retail sales are forecast to rise roughly 2.5 %, crossing the $1 trillion mark — but real volume growth is expected to be close to flat. EY

In other words: price increases (inflation, margin recovery) will drive the headline, not big upticks in unit sales.

Retailers are extending the promotional window beyond the classic “Black Friday weekend” into a broader November. For example, extended discounting has turned the “Cyber Five” into the “Cyber Dozen”. EMARKETER+1

This means your pricing game needs to cover a longer runway.

Seasonality specialists show November is a “key inflection” month for retail: a shift from autumn to holiday mode. Solink

Consumers are deal-driven, channel-flexible (online + offline) and sensitive to value. Your pricing must reflect that.

Prioritise value communication, not just steep discounts.

Design pricing that can flex over an extended event window.

Monitor margin viability — since rising cost bases mean discounts erode more than they used to.

Align pricing insights across channels (brick, click, mobile) and geography (holiday campaigns often global).

Use the November period not just for volume but for strategic positioning, loyalty-building, and margin leverage.

A successful November Retail Pricing Game Plan 2025 recognises key events and tailors pricing posture accordingly.

| Event | Timing & Context | Pricing Posture | Key Actions |

|---|---|---|---|

| 11.11 (Singles’ Day) | 11 Nov – heavy in Asia, increasingly global | Lead-in, build excitement | Pre-season pricing signals, early access deals |

| Pre-Black Friday “warm-up” | Mid-Nov – initial promotions begin | Tiered discounting, segmentation | Use early-bird offers, invite-only pricing |

| Black Friday | Late Nov | Deep discount plus dynamic pricing | Hot deals on high-visibility SKUs, clear margin guardrails |

| Cyber Monday | Following Monday | Online-first, cross-channel link-up | Bundle offers, up-sells, dynamic repricing based on live stock |

While traditionally Asian-led, 11.11 increasingly influences global pricing calendars. Use this event to:

Test pricing thresholds for high-interest SKUs

Launch “early access” promotions at premium vs. full discount

Capture data on which segments respond early to deals

Rather than waiting, many retailers signal deals ahead of time—creating urgency and locking in conversions before competitors deepen discounts. Use your pricing game plan to deploy:

Tiered discounts (e.g., -20 % for members, -15 % for general)

Time-limited offers (daily deal countdowns)

Price segmentation (loyal vs. new customers)

This is the core volume and awareness driver in the November calendar. Pricing strategy should emphasise:

Clear “hero” SKUs with standout discounts to attract traffic

Dynamic repricing for trending products: adjust based on stock depletion and competitor activity

Margin floor enforcement: given the muted real-volume growth, reckless discounts undermine long-term profitability

Cyber Monday shifts the focus online — but your pricing game plan must coordinate across channels. Key pricing activities:

Reprice hero SKUs in online channel possibly deeper than in-store

Use bundle offers or add-ons instead of pure discounting (helping margin)

Deploy real-time dynamic pricing and inventory-linked price adjustments (e.g., slipping price as stock depletes or cross-sell as checkout add-on)

Solid execution of your November Retail Pricing Game Plan 2025 rests on using the right levers — underpinned by your analytics, competitive monitoring and automation.

As highlighted by NielsenIQ, many retailers struggle to measure incremental margin impact from promotional pricing. nielseniq.com

Action: Use automated competitor price trackers, segment by SKU-tier and geography, alert when competitive price falls below threshold.

Implement dynamic pricing rules:

Price elasticity models (higher discount only when volume gain justifies margin hit)

Inventory-based triggers (e.g., high stock = deeper discount; low stock = price protection)

Time-sensitive windows (e.g., in final hours of event, deeper markdowns for lesser SKUs)

Retailers with ESL (electronic shelf labels) and dynamic systems are better poised. Wikipedia

Use your first-party data to:

Offer differentiated pricing (e.g., reward members with exclusive early-access discounts)

Layer in cross-sell pricing (e.g., bundled deals at a small discount rather than margin-eroding full discount)

Upsell via pricing (e.g., “buy this at -10% or upgrade +10% for only +€X more”)

Activating smart price architecture:

Use psychological pricing (e.g., €99 vs €100) for high-traffic SKUs

High-low vs everyday-low-price (EDLP) strategy decisions: EDLP may not resonate in an event-driven month; high-low tactics often dominate. Wikipedia+1

Clear “before/after” pricing visibility to reinforce deal value — but ensure transparency, as consumers are increasingly alert to perceived markdown manipulation.

Given the muted volume growth in 2025, margin matters more than ever. Your plan must include:

Discount-to-margin impact worksheets

Scenario modelling: e.g., worst-case (volume flat, cost up 5%), best-case (volume +3 %, cost stable)

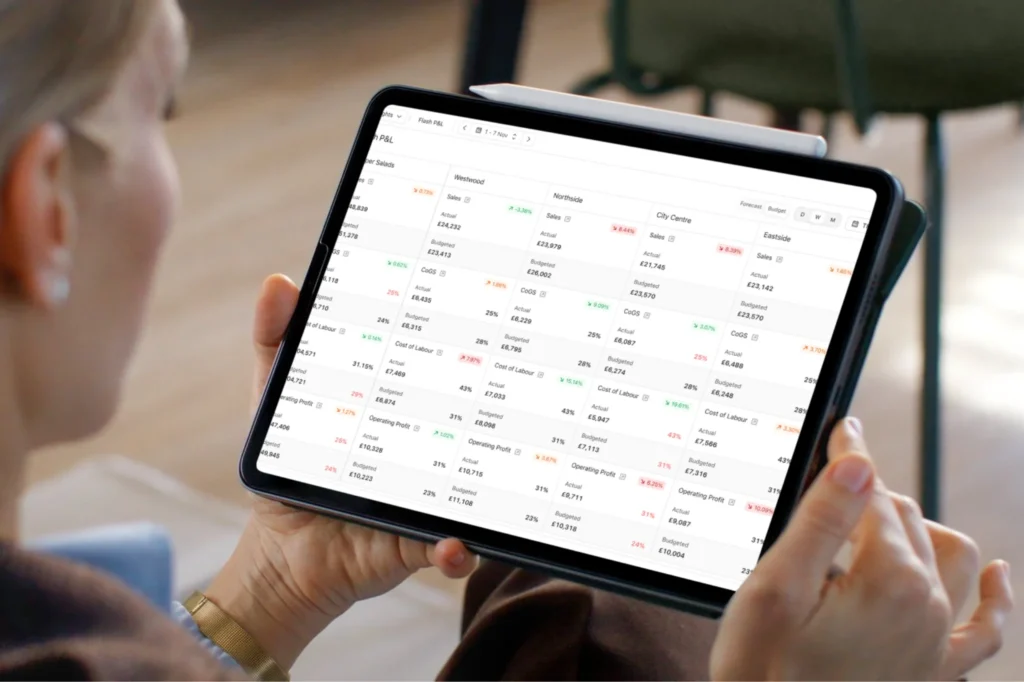

Real-time tracking dashboards so you can stop or pivot deals mid-event if margin erosion exceeds thresholds.

Pricing cannot succeed in isolation — channel synergy and inventory alignment are critical in your November Retail Pricing Game Plan 2025.

Ensure consistency across online, mobile, in-store — or consciously create differentiation:

Online could have deeper discounts for convenience-seekers

In-store could employ “click & collect” pricing advantages

Coordinate timing: Drop online deals first, then in-store or vice-versa depending on operational agility

Pricing needs to reflect inventory reality:

High stock = more aggressive discounting

Low stock = protected pricing or selective discounting to preserve margin

Supply-chain disruptions? Price conservatively and highlight value rather than deep discounting.

November events drive logistics cost spikes (shipping, returns). Embed this in pricing:

Consider bundling shipping or offering free returns only for higher-price tiers

Factor in fulfilment cost increases when calculating margin thresholds for discounts

Use “limited-time/limited inventory” signals to manage consumer expectations and avoid post-sale disappointment.

For international retailers or cross-border sales:

Monitor foreign-exchange impact on landed cost and price positioning

Consider geo-specific pricing events (e.g., localised 11.11 campaigns in Europe, Latin America)

Avoid pricing arbitrage (same product significantly cheaper in one region) which can hurt margin and reputation.

Your November Retail Pricing Game Plan 2025 must include real-time monitoring and adaptive controls to protect profits.

Key metrics to track:

Price vs MAP (Minimum Advertised Price) compliance

Discount magnitude by SKU and category

Volume change vs. baseline (pre-event)

Margin erosion (promotional margin vs. normal margin)

Stock-out and overstock signals

Channel traffic, conversion and average order value (AOV) shifts

Based on dashboard signals:

Pause or throttle discounts if margin < threshold

Alter discount structure mid-event (e.g., move from -30% to -20% but add value bundle)

Reallocate stock/price between channels (move excess online stock to store-pick-up discount)

Trigger loyalty-based pricing offers if general traffic pricing not generating expected yield

Instead of “discount to drive volume”, use “discount to drive profitable volume”. For example:

Set minimum margin floor (e.g., no discount that yields margin below X %)

Use multi-unit promotions (e.g., “buy one get one 50% off”) to move additional units rather than cut list price

Use cross-sell and upsell discounts (bundled value) rather than steep pure price cut

The November Retail Pricing Game Plan 2025 must anticipate risks and build mitigation contingencies.

With cost bases under pressure and volume growth limited, retailers must:

Price for cost increases ahead of event (embed cost pass-through where possible)

Manage consumer perception: communicate value, not just discounting

Use pricing tiers and segmentation to protect margin (premium SKU for value-seekers, basic SKU for deal-seekers)

Delays or stock shortfalls can disrupt discount plans. Mitigation:

Maintain buffer stock for hero SKUs eligible for discount

Have alternative SKUs for promotion if primary stock fails

Price with flexibility: build in script for discount cut-back or hold-back if stock fails

Consumers in 2025 are value-driven, cautious around cost-of-living pressures, and deal-shopping heavily. AP News

Strategies:

Highlight “deal + value” rather than “just low price”

Segment promotions: offer exclusive tiers for loyal customers

Use pricing urgency (limited time, limited inventory) but balance with transparency

Monitor conversion drop-off: if discount doesn’t drive sufficient volume, pivot quickly

As all players ramp up deals, your pricing game plan must account for competitive escalation:

Monitor competitor headlines and adjust your pricing or messaging accordingly

Maintain discipline: just because competitor goes deeper doesn’t mean you must; focus on profitable volume

Use price architecture (bundle, add-on, loyalty) to differentiate beyond mere discount depth

Once the November blitz winds down, your learning engine kicks into high gear — and the November Retail Pricing Game Plan 2025 must include this.

Key post-event metrics:

Actual margin vs planned margin

Incremental volume (units sold during event vs baseline)

Channel-specific performance (online vs in-store vs mobile)

SKU-level discount vs conversion lift

Customer behaviour: acquisition, repeat purchase, loyalty uplift

Inventory & stock-out impact (did too many discounts lead to stock-outs and lost margin?)

Competitive price impact (did you win or react too late?)

Run structured review sessions:

What worked: which SKUs, channels, segments responded to pricing?

What didn’t: where margin drained, where discount had low incremental volume?

What external factors impacted us (cost increases, supply delays, consumer shifts)?

What will we change for 2026? (pricing thresholds, automation, segment definitions)

Document best practices into your pricing playbook for next year.

Use insights to:

Adjust baseline pricing and discount tolerance for 2026 holiday season

Update dynamic-pricing rules and automation parameters

Refine segmentation and loyalty pricing tiers

Align inventory planning with pricing strategy (e.g., fewer markdown dependent SKUs)

Build narrative around value vs discount to protect margin in future seasons

In a year where volume growth is expected to be modest and pricing will carry much of the burden, your November Retail Pricing Game Plan 2025 must be sharply focused, data-driven, and profit-oriented. From early 11.11 activity through the peak Black Friday and Cyber Monday events, you’ll need to balance discounting, value communication, margin protection and inventory coordination.

At tgndata, we specialise in pricing intelligence, retail analytics, and dynamic pricing automation. With real-time competitor monitoring, margin risk modelling and integrated channel dashboards, we help pricing teams turn data into profitable action.

Let’s make this November your most strategic—and most profitable—season yet.

We use cookies to provide you with an optimal experience, for marketing and statistical purposes only with your consent, which you may revoke at any time. Please refer to our Privacy Policy for more information.

Missing an important marketplace?

Send us your request to add it!